A recent extensive 6sense survey of nearly 1,000 B2B buyers uncovered critical insights about the buying journey. One of the most impactful findings was how the size of a purchase influences the length of the journey.

While it might stand to reason that larger purchases lead to increased scrutiny, longer deal cycles, and larger buying groups, this research reveals exactly how much it influences those variables.

Our research revealed:

- An increase of $100K in purchase price lengthens the buying cycle by 5 to 6 days

- Solutions with a price of $700K or more averaged 5 vendors evaluated

- Deals over $700K average 14 buying group members compared to 10 for smaller deals

- Larger deals (over $700K) see 22 interactions per buying group member; smaller deals see an average of 15

- The average buying journey length for a solution over $700K is 15 months; 25% longer than smaller deals.

Read on for the full story.

The Deep Dive

B2B buying journeys are often long and winding roads that are largely hidden from sellers’ view.

In our recent survey of more than 900 B2B buyers, the typical purchase was between $200,000 to $400,000 in annual value, and these buyers invested more than 11 months in the buying journey, with eight of those months dedicated to conducting independent research before initiating contact with sellers.

These buying journeys are complex, involving numerous decision-makers and thousands of interactions with sellers and other information sources in the course of the selection process.

In our 2023 Buyer Experience Report, we observed that the size of a purchase has a substantial impact on the length of a buying cycle. Not surprisingly, bigger deals take longer. In this report, we examine in depth how buying journeys for the top 10% of purchase sizes in our sample (those over $700,000 in annual value) differ from smaller deal sizes.

The more things change…

In our 2023 Buyer Experience Report, we reported three significant dimensions that nearly all B2B deals share, and which define the arc of B2B buying journeys.

First, we found that the average B2B buying team spends approximately 70% of their buying journey in self-directed research. Indeed, $700k-plus buyers are no different, engaging with sellers at exactly the same point in their buyer journeys – just under 70%.

And, just like buyers of lower-cost solutions, 83% of $700k-plus buyers report that they initiated that first direct engagement with sellers. In other words, whether large or small deals, buyers choose when they engage directly with sellers.

Finally, and most importantly, when buying teams initiate contact with providers, buyers of all deal sizes begin with the provider that ultimately wins the deal 84% of the time. This indicates that at the point of first-contact, buyers at all deal sizes know which provider they expect to buy from, and that choice rarely changes through the last 30% of their journey.

There is one final note of concurrence between the largest purchases and all others. While it might be expected that larger purchases would be rated as more important to the organization than their smaller counterparts, that is not the case. As we shall see, larger companies do tend to make larger purchases. However, even when controlling for company size, larger solutions are not considered more important. Larger purchases are not more important than smaller ones, they simply cost more.

These crucial buying journey parameters are unchanged when deal sizes reach $700k in annual value or more. However, much else about these big-deal buying cycles is meaningfully different.

$700K+ Buying Journeys are Longer and Windier

In our 2023 Buyer Experience Report and further detailed in our Buying Cycle Length Report, we discuss the explicit impact that purchase cost has on the length of the buying cycle.

Each $100,000 increase in purchase cost not only directly lengthens the buying cycle by 5 to 6 days but also indirectly results in an additional 12 to 13 days. This additional time arises from increased interactions between buying team members and vendors, as well as a higher likelihood of expanding the buying team (more vendors and higher costs lead to bigger teams and more interactions).

These trends are precisely what we observed among buyers making purchases of $700,000 or more in annual value.

More Vendors to Evaluate for $700K+ Purchases

As detailed in our 2023 Buyer Experience Report, a single vendor more than the average of four can be expected to add approximately two months to the buying cycle, predominantly through increased interactions and buying team size.

Echoing the broader findings, buyers of $700k-plus solutions evaluate an average of five vendors compared to four evaluated by smaller-deal buyers.

Bigger Buying Groups for $700K+ Purchases

To account for the extra work required to evaluate five vendors rather than four, buying teams are enlarged from an average of just under 10 for smaller deals, to nearly 14 for $700k-plus deals. Over half (53%) of buying groups for deals of this size exceed the overall average of approximately 10 members, and 25% have between 21 and 30 members.

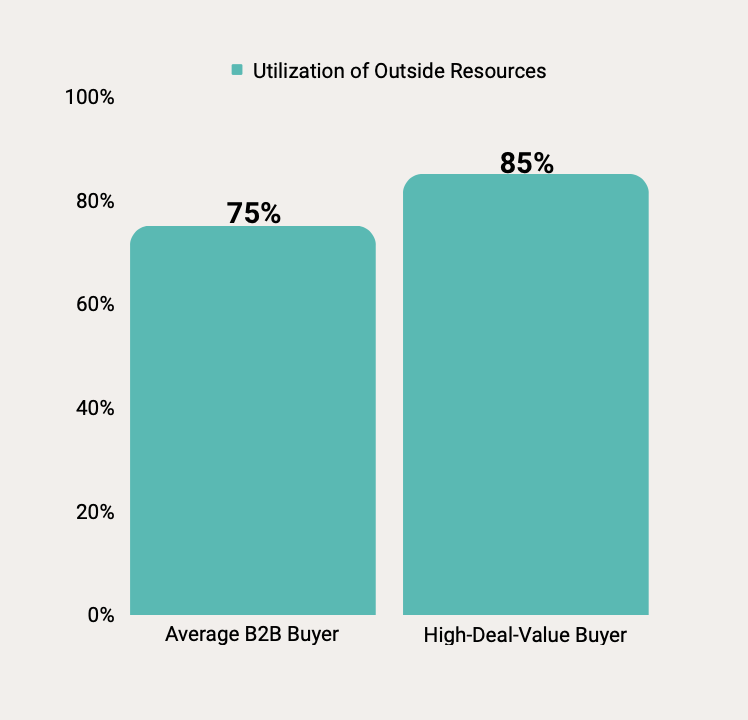

In addition to the buying group itself, our research found that three-quarters of B2B buyers engage consultants or analysts to help in their purchasing process. For $700k-plus purchases, those odds rise to 85% (see chart below).

More Interactions for $700K+ Purchases

Larger buying groups not only contend with the task of achieving consensus among a greater number of individuals, but they also engage in a higher volume of interactions with vendors. Each member of a $700K-plus buying group has an average of 22 interactions per person, per vendor, compared to 15 interactions per person, per vendor for deals under $700k. That is nearly 50% more work for each large-purchase buying group member.

Much Longer Buying Processes for $700K+ Purchases

All together, with more vendors to evaluate, more team members involved in the buying process, and the need to have more interactions with vendors, B2B buying journeys for $700K-plus solutions take an extra four months compared to deals under $700K. Consequently, the average buying journey for $700K-plus deals is approximately 15 months in total, approximately one-third longer than those for smaller purchases.

(Slight) Flexibility in Requirements

Another interesting contrast seen in the $700K-plus buying journey is that these buyers display a slightly higher degree of flexibility in their purchase requirements compared to buyers of deals under $700,000.

While 78% of sub-$700K buyers stated that their purchase requirements were either entirely set or only slightly changed at the time they first engaged directly with selling teams, just 62% of $700K-plus buyers shared the same experience. This leaves around 38% of $700K-plus buyers who reported moderate to substantial changes in their requirements after engaging directly with vendors. That number was just 22% for buyers of deals under $700,000.

In Conclusion…

B2B buying journeys for purchases exceeding $700K are marked by their extended timelines, expanded evaluation lists, and intricate decision-making dynamics. $700K-plus buyers still value their autonomy from sellers, not initiating contact with them until about 70% of the way through the buying journey.

While we found that larger purchases were not necessarily regarded as more important to the business, it does appear as though the additional cost increases the level of scrutiny added to a purchase, resulting in more vendors, bigger buying teams and more information evaluation than for smaller purchases. The additional pressure to ‘get it right’ for these larger purchases may also lead more buying groups to delay finalizing requirements until they have met live with vendors.

Solution providers are not likely to want to lower their deal values to speed up the buying process – certainly not by the hundreds of thousands of dollars it would take to materially impact their length and complexity. However, the findings presented here should provide important input to providers that are considering a move up-market with their solutions. Pursuing larger deal values is often highly desirable, but it comes with trade-offs that organizations should consider carefully and include in their planning and forecasting processes.

Table 1: Statistical Reporting

| Finding | Statistical Test | Statistic | Significance Level | Effect Size | Sample Size |

| The average buying cycle is 11 months for purchases under $700K | Average | n/a | n/a | n/a | 934 |

| B2B buying journeys for $700K-plus solutions take an extra four months compared to deals under $700K. | T-test | -4.189 | p<.001 | .106 | 934 |

| The typical purchase was between $200,000 to $400,000 in annual value for purchases under $700K | Average | n/a | n/a | n/a | 929 |

| Buyers typically make direct contact with vendors around 7.586 months into the buying cycle. | Average | n/a | n/a | n/a | 934 |

| Buyers typically make direct contact with vendors 69% of the way through a buying cycle. | Frequency | n/a | n/a | n/a | 934 |

| $700k-plus buyers engage with sellers at exactly the same point in their buyer journeys – just under 70%. | T-test | .057 | p=.955 | .006 | 934 |

| 83% of $700k-plus buyers report that they initiated the first direct engagement with sellers. This was also seen for sub-$700K buyers. | Chi-square | n/a | p=.737 | .661 | 931 |

| Buyers of all deal sizes begin with the provider that ultimately wins the deal 84% of the time. | Frequency | n/a | n/a | n/a | 931 |

| A single vendor more than the average of four can be expected to add approximately two months to the buying cycle. | Mediation Analysis | z-value=20.181 | p<.001 | estimate=2.221 | 934 |

| Buyers of $700k-plus solutions evaluate an average of five vendors compared to four evaluated by smaller-deal buyers | T-test | -3.836 | p<.001 | -.436 | 934 |

| Buying teams are enlarged from an average of just under 10 for smaller deals to nearly 14 for $700k-plus deals. | T-test | -5.5 | p<.001 | -.635 | 934 |

| Over half (53%) of buying groups for deals of this size exceed the overall average of approximately 10 members, and 25% have between 21 and 30 members | Frequency | n/a | n/a | n/a | 934 |

| Larger buying groups for $700K+ purchases have an average of 22 interactions per person, per vendor, compared to 15 interactions per person, per vendor for deals under $700k | T-test | -4.680 | p<.001 | -.541 | 934 |

| While 78% of sub-$700K buyers stated that their purchase requirements were either entirely set or only slightly changed at the time they first engaged directly with selling teams, just 62% of $700K-plus buyers shared the same experience. Thirty-eight percent of $700K-plus buyers who reported moderate to substantial changes in their requirements after engaging directly with vendors. That number was just 22% for buyers of deals under $700,000. | Chi-square | n/a | p=.001 | 15.581 | 926 |

| three-quarters of B2B buyers engage consultants or analysts to help in their purchasing process. For $700k-plus purchases, those odds rise to 85%. | Chi-square | n/a | p=.028 | 4.8 | 940 |