B2B buyers generally find that the contracting phase of their buying process makes them more inclined to make future purchases from the same vendor. This last mile of the buying journey contributes positively to a buyer’s purchasing experience.

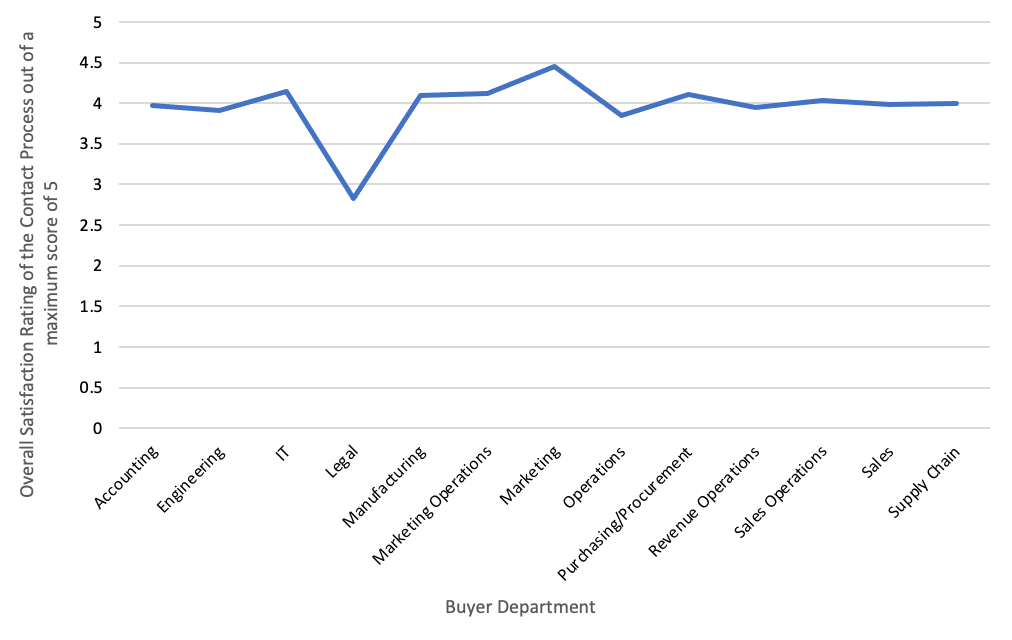

However, the perspectives of legal department members within buying teams differ: They find the contracting process has no meaningful impact on their inclinations or sentiment.

At a Glance

- The contracting process has a reliably positive impact on buyers’ overall perception of the entire buying process.

- The positive afterglow from the contracting process reaches all parts of the buying team, except the legal department. For Legal, the psychological impact of the contracting process is a solid “meh.”

- When the contracting process is positive, buyers start the customer relationship happier.

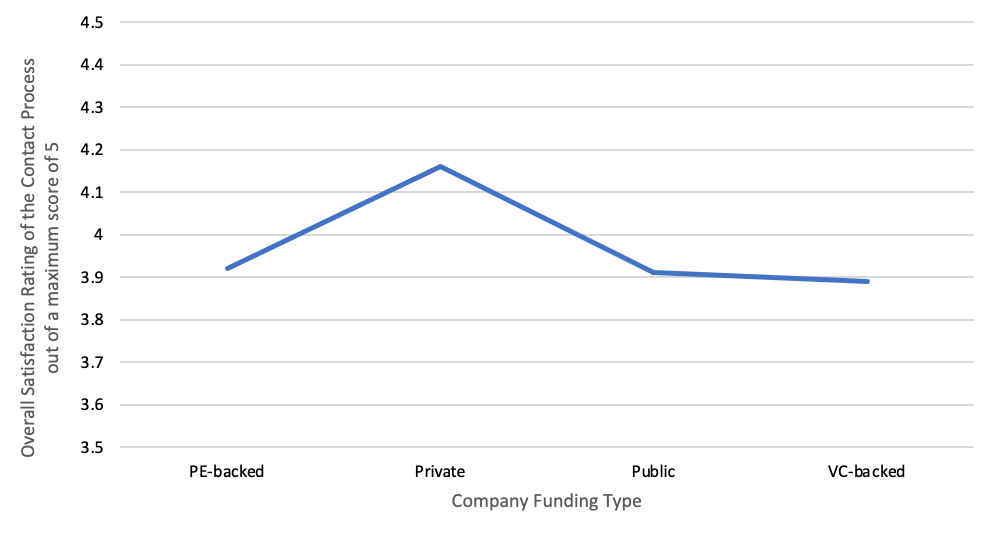

- Buyers at privately-owned companies were happier with the contracting experience compared to companies with other ownership structures.

- The more important the solution, the higher buyers tended to rate the contracting process.

- Companies that have enjoyed strong financial performance in the past year are happier with contracting processes.

The Deep Dive

All’s Well That Ends Well … If It Does

The “peak-end” rule in human psychology holds that our lasting impression of an experience tends to be most strongly influenced by how we are feeling at the most intense moments of the process and by the final moments of the process. The peak-end rule has been applied to improve how people perceive everything from medical procedures to dining experiences.

In B2B, the final part of most buying processes involves negotiating and finalizing a contract. Because it is the last part of the buying process, we hypothesized that it might have an important role in shaping how buying processes are remembered.

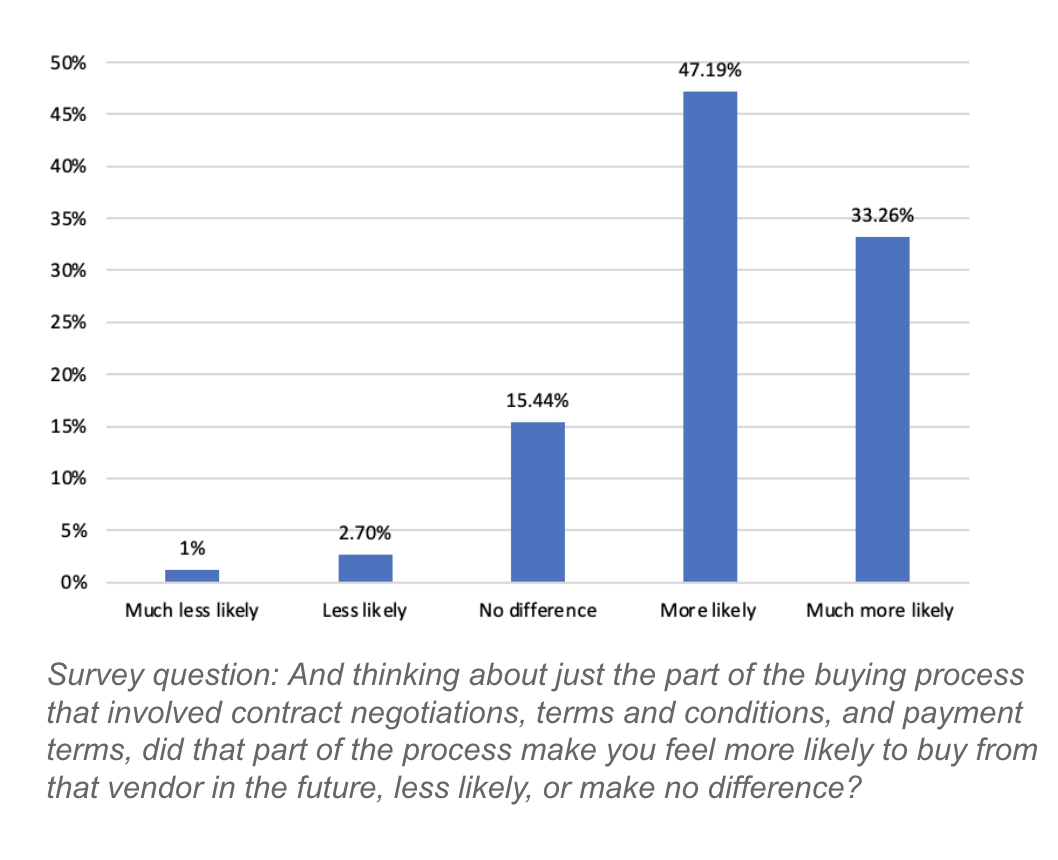

To explore the impact of contract negotiations on buyer-seller relationships, we asked participants to tell us whether the contracting process itself made them more or less likely to want to do business with the selling organization in the future. Buyers responded using a 5-point scale from Much Less Likely to do business with the selling organization again (1) to Much More Likely (5).

Buyers reported that the contracting process exerted a positive influence on future buying. The contracting process scored an average of 4.1 out of 5, suggesting that buyers would be likely to work with the supplier again based on the contracting process.

Source: 6sense

To examine relationships with other factors, a correlation analysis was conducted (See the table in the Appendix.). In this examination, only a company’s financial performance and the importance of the solution being purchased were related to their view of the contracting process, with better-performing companies and the purchase of more important solutions being reliably associated with more satisfaction with the contracting process.

We also tested a wide variety of other factors, such as a respondent’s industry, funding type, and department, as well as the solution and purchase type.

Of these, only two statistically reliable relationships appeared. Private company respondents tended to have a slightly rosier view of the contracting process than others, while Legal department respondents took a substantially dimmer view of the process, rating it just 2.8 out of 5 compared to the overall average of 4.1. For Legal department respondents, the contracting process neither increased nor decreased the likelihood of future purchases from the same company.

Private Organizations Think Most Favorably of The Contracting Process

Source: 6sense

Legal Department Respondents Are Not Influenced by The Contracting Process

Source: 6sense

Overall Buying Process Rating

Our main interest in examining the contracting process, though, was to understand what kind of impact it might have on the buyer’s overall view of the buying process. Here, we found that buyers who rated the contracting process higher reliably gave the overall buying process higher. This suggests that as a capstone of the buying journey, the contracting process plays an important role in shaping how buyers think about the overall buying process.

Two other factors were found to be associated with a rosier perception of the buying process. Solutions rated more important by buyers tended to be associated with more satisfying purchasing processes. And, respondents who reported that their companies had performed better financially over the past year also had a rosier view of the buying process.

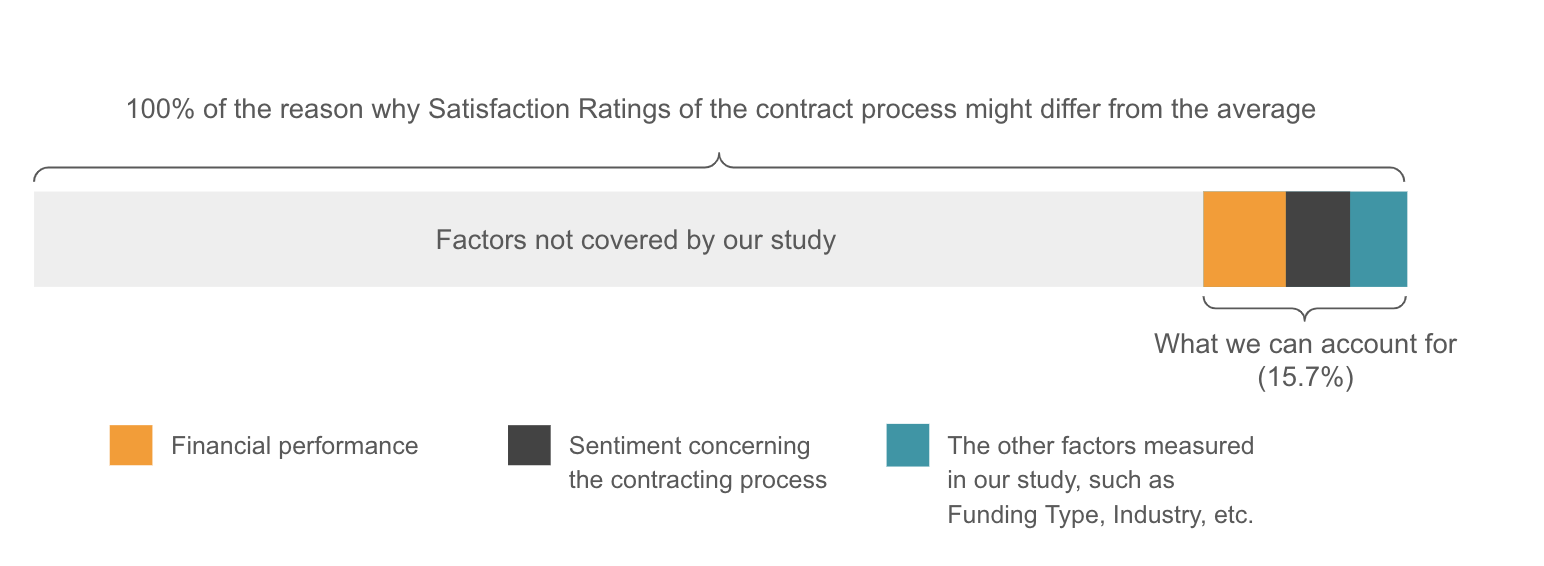

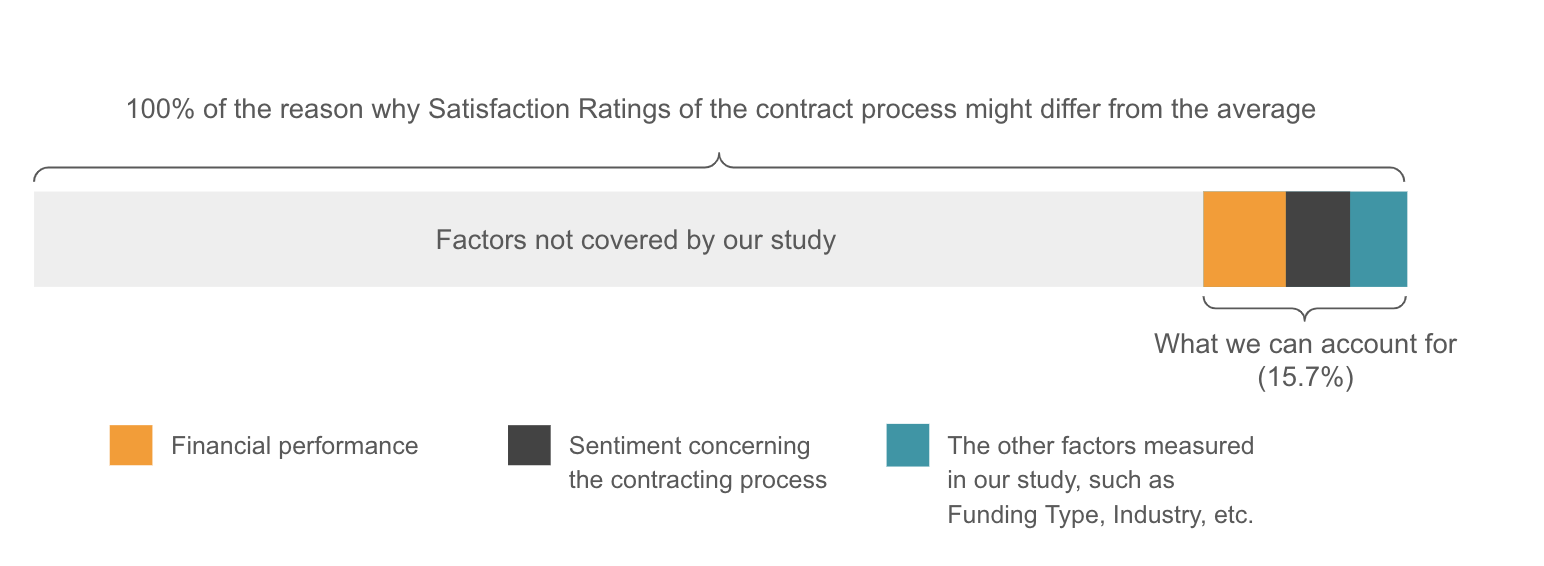

To test the impact of the contracting process on the overall purchase satisfaction rating, we entered the contracting sentiment variable along with others that we have considered in this research into a multiple regression model predicting overall satisfaction with the buying process. The resulting model accounted for just 15.7% of the reasons that buyers varied in how satisfied they felt with the buying process. In the model, a buyer organization’s financial performance over the past year was the strongest predictor of satisfaction with the buying process, accounting for a third of the total variability accounted for by the model. Companies that are doing well tend to enjoy the process of acquiring new solutions. Sentiment concerning the contracting process accounted for nearly as much (31.7%) of the model’s predictive power.

The Role of Contract Process Satisfaction in Determining Purchase Satisfaction

Source: 6sense

While not as robust as other models we have considered in this buying experience research, it is clear that the contracting process can have a meaningful impact on whether buyers are likely to become repeat customers.

Appendix

Table 1: Statistical Reporting

| Finding | Statistical Test | Statistic | Significance Level | Effect Size | Sample Size |

| The contracting process scored an average of 4.1 out of 5. | Average | N/A | N/A | N/A | 926 |

| Private company respondents tended to have a slightly rosier view of the contracting process than others. | Average | N/A | N/A | N/A | 926 |

| Legal department respondents took a substantially dimmer view of the process, rating it just 2.8 out of 5 compared to the overall average of 4.1. | Average | N/A | N/A | N/A | 926 |

| A higher rating of the contracting process was associated with a reliably higher rating of the overall buying process. | Correlation | r=.177 | p<.001 | Fishers=.18 | 926 |

| More important solutions were associated with more satisfying purchasing processes. | Correlation | r=.315 | p<.001 | Fishers=.33 | 926 |

| Respondents from companies reporting better financial performance had a more positive view of the buying process. | Correlation | r=.297 | p<.001 | Fishers=.31 | 926 |

| The resulting model accounted for just 15.7% of the variability in the overall satisfaction rating. In the model, a buyer organization’s financial performance over the past year was the strongest predictor of satisfaction with the buying process, accounting for a third of the total variability accounted for by the model. Sentiment concerning the contracting process accounted for nearly as much (31.7%) of the model’s predictive power. | Multiple Regression | F=28.49 | p<.001 | R2=.157 | 926 |

Definition of correlation analysis: Correlations measure whether changes in one factor are reliably associated with changes in another. The easiest correlations to think about are those where one measurement increases, and then a second one also consistently increases. For example, in our research on B2B buying processes, we found that when buyer’s increase the number of vendors they evaluate, their buying process takes longer. That is a positive correlation. In contrast, we found a weak but reliable negative correlation between how important a buyer rates a solution and the length of the buying cycle. More important solutions have reliably shorter buying cycles. Return to article.