• The Big Picture, about 1 minute

• A Closer Look, about 1 minute

• The Deep Dive, about 11 minutes

• Appendix, about 4 minutes

The Big Picture

Reading Time: 278 words; about 1 minute

B2B buyers follow a consistent pattern when making purchase decisions. They spend 70% of their buying journey doing their own research before talking to vendors.

It doesn’t matter how important the purchase is, how expensive, what industry they’re in, the seniority of the people on the buying team … None of it makes much difference.

Why it matters for sellers: If you are waiting for prospects to announce themselves by filling out a form or taking another inbound action, then you aren’t learning about prospects until they’ve already made most of their key decisions. You’ve missed the first 70% of their journey, and our full Buyer Experience Report indicates that you’ve likely already won or lost the deal based on decisions the customer made before speaking with you.

Okay, you may be thinking, we’ll use intent data to call and email sellers earlier in their journey!

Bad idea. Sellers who contact buyers before the 70% mark are less likely to win a deal.

Why?

We suspect it’s because sellers have created a bad experience for buyers, who’d prefer to be left alone until they are good and ready to talk.

Rather than using intent data to inject yourself into too-early conversations, sellers should use intent data to create a better buying experience. If you know who is in-market and what they are interested in, you can deliver marketing messages that educate buyers and influence their research journey so that when they are ready to talk, you’re at the top of their list.

Smart sellers will also parlay this info in ways that reduce the number of vendors being researched by sellers. More on that in the Deep Dive!

A Closer Look

Reading time: 217 words; about 1 minute

Here’s a quick look at key findings from our survey of over 900 buyers:

- Buyers don’t engage with sellers until the buying group has already completed 70% of its buying journey.

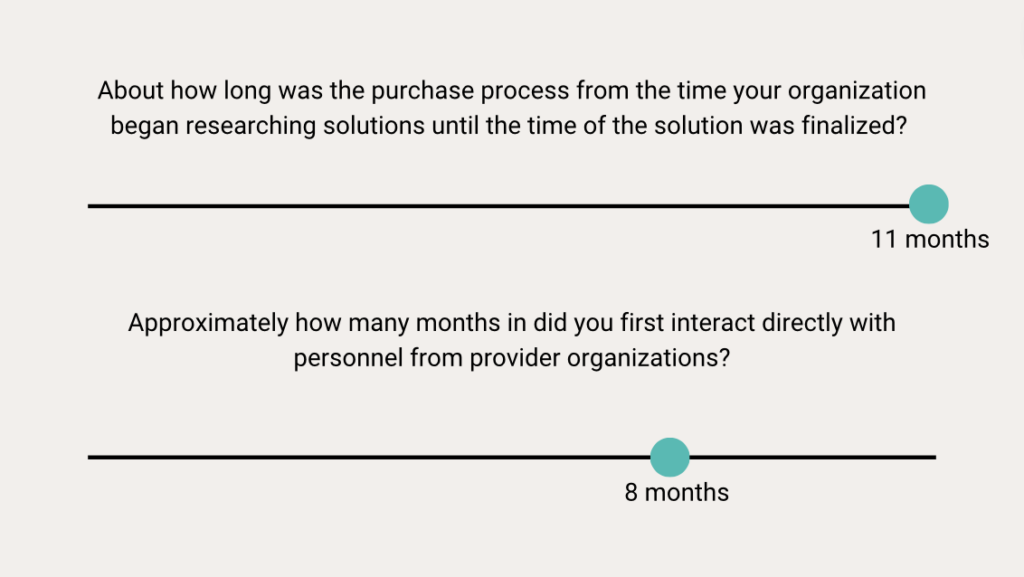

- The average buying journey, from the start of anonymous research to signing a deal, lasted 11 months in 2023. Buyers didn’t speak with sellers, on average, until after 8 months.

- It doesn’t matter whether the buying journey is shorter or longer, the 70% mark is consistent.

- It also doesn’t matter whether buyers are purchasing a new capability or looking to replace a vendor. The 70% figure persists.

- Business purchases that are considered critical to success had shorter buying journeys — but buyers still completed 70% of the journey before talking to sales reps.

- Buyers initiated contact 83% of the time — indicating that many sellers aren’t learning about potential deals until buyers raise their hand.

- Early direct outreach by sales reps made no difference. Buyers didn’t respond until they’d satisfied their independent research needs.

- When contact does occur before the 70% mark, the chance of landing the deal goes down, not up.

- When buyers examine six or more vendors, they tend to spend even more of the buying journey doing independent research..

- As the number of vendors under consideration grows, so does the length of the buying journey, and the amount of time buyers spend on their own before talking to sales.

The Deep Dive

Reading Time: 2,125 words; about 11 minutes

The growth of digital technology and proliferation of online resources has revolutionized the B2B buying process, empowering buyers with unprecedented access to information and transforming their decision-making process. As a result, B2B buyers are now far more self-directed and informed before engaging with provider sales representatives.

Numerous studies from analysts and consulting firms corroborate this trend, highlighting the extent to which B2B buyers are conducting independent research and shaping their purchase decisions prior to direct vendor interaction.

- According to Forrester, a staggering 74% of business buyers conduct more than half of their research online before making an offline purchase.

- Similarly, CEB and Google’s partnered research indicates that the average B2B buyer is 57% through the purchase decision before engaging with a sales representative.

- B2B International’s findings further reinforce this pattern, revealing that B2B audiences typically complete 60% of the purchase process before engaging with the supplier or its sales team.

- McKinsey & Company echoes this sentiment, stating that two-thirds of the buying process is now done digitally.

- This shift towards self-directed research is also reflected in Gartner’s research, which found that 75% of B2B buyers prefer a rep-free sales experience.

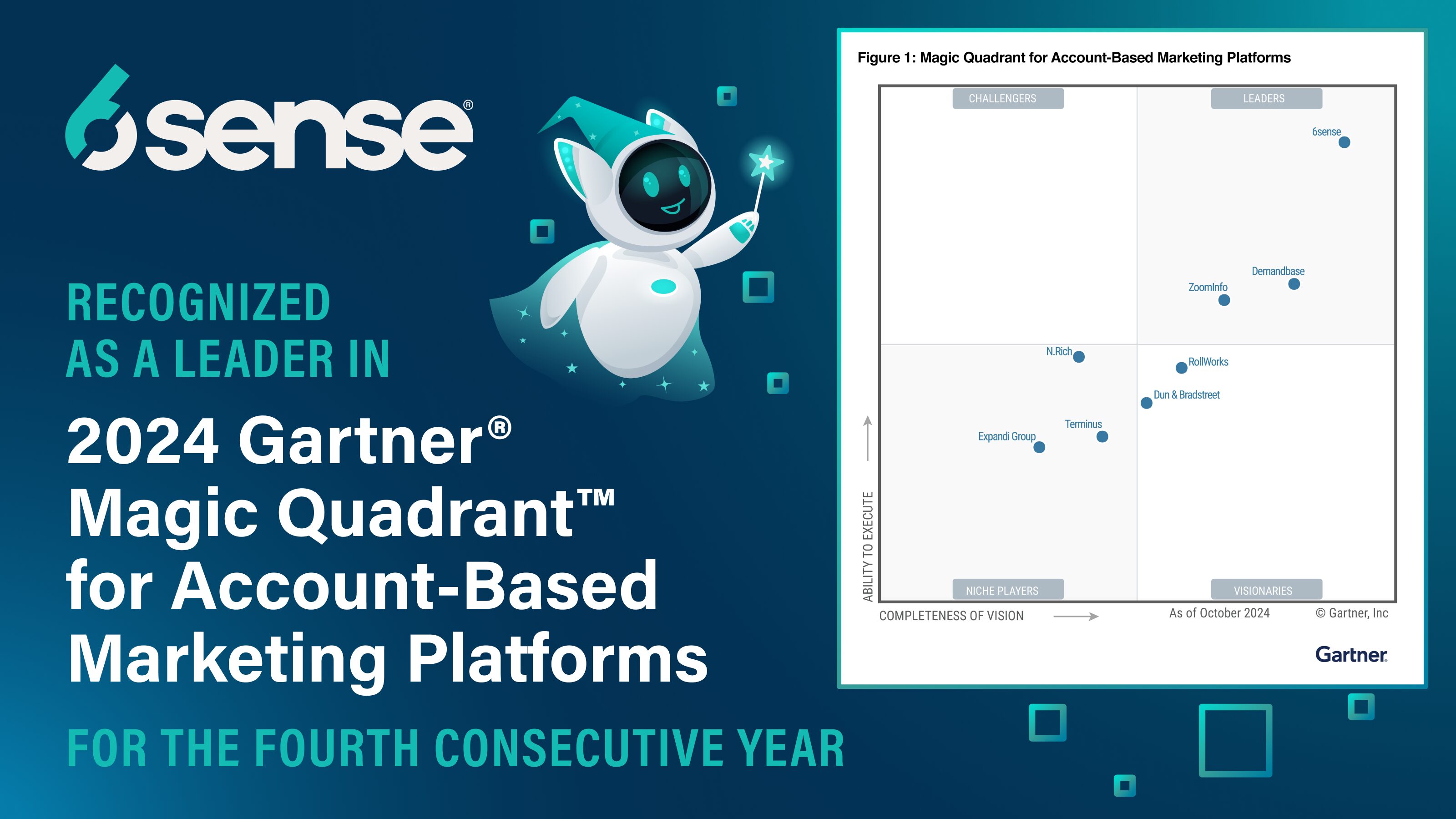

Our own research, based on a survey of over 900 B2B buyers, is consistent with these industry findings. Conducted during the summer of 2023, our study revealed that buyers consistently refrain from engaging directly with selling organizations until they are approximately 70% through their buying process. This point of first contact remains constant regardless of factors such as the buyer’s industry, department, solution and purchase type, purchase price, and even the respondent’s level and role within the organization and the buying process.

In this follow-up to the B2B Buyer Experience Report, we dive into the data to uncover the implications of this “70% Constant” for sellers and explore potential strategies for establishing earlier engagement with buyers.

Our Approach

In our survey, we asked people who had made B2B purchases over $10,000 in the past two years about how long their buying process took and when they first got in touch with the sellers:

To investigate factors affecting the initial interaction between buyers and potential vendors, we gathered data on participants’ company characteristics and purchase procedures. We aimed to determine whether there are circumstances where buyers initiate contact sooner or later in the process. Please refer to the Appendix for a detailed description of the information we collected from respondents.

The Factors That (Surprisingly) Don’t Influence POFC

Firmographic Factors Influence on Point of First Contact (POFC)

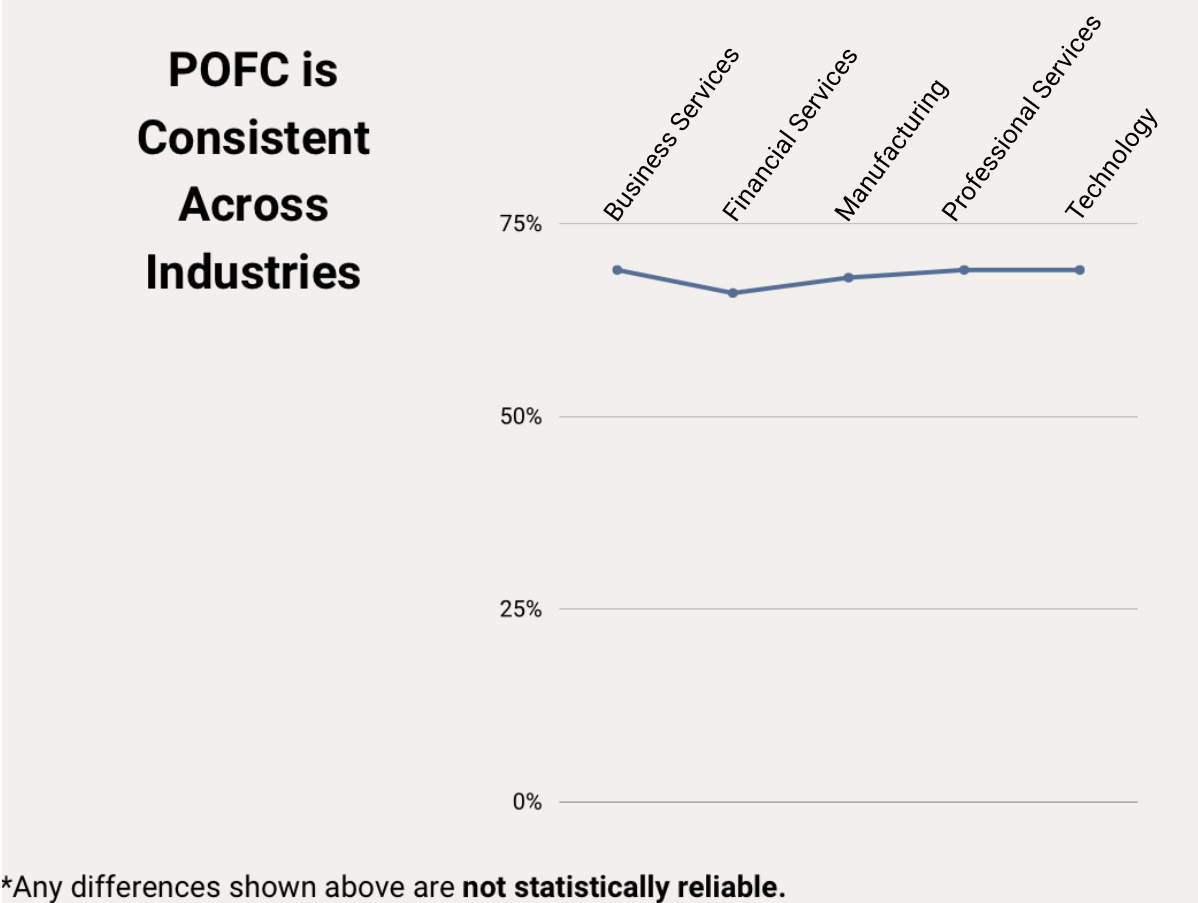

In our analysis, we first examined whether firmographic characteristics of the buyer organization influenced when buyers initiate contact with potential vendors.

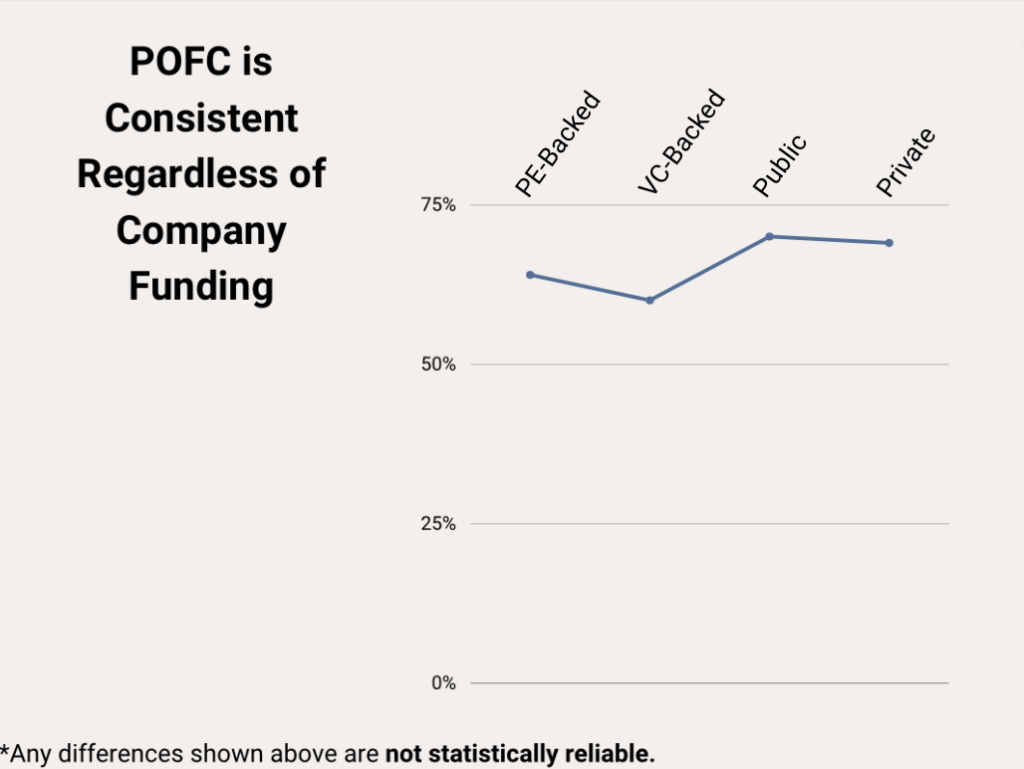

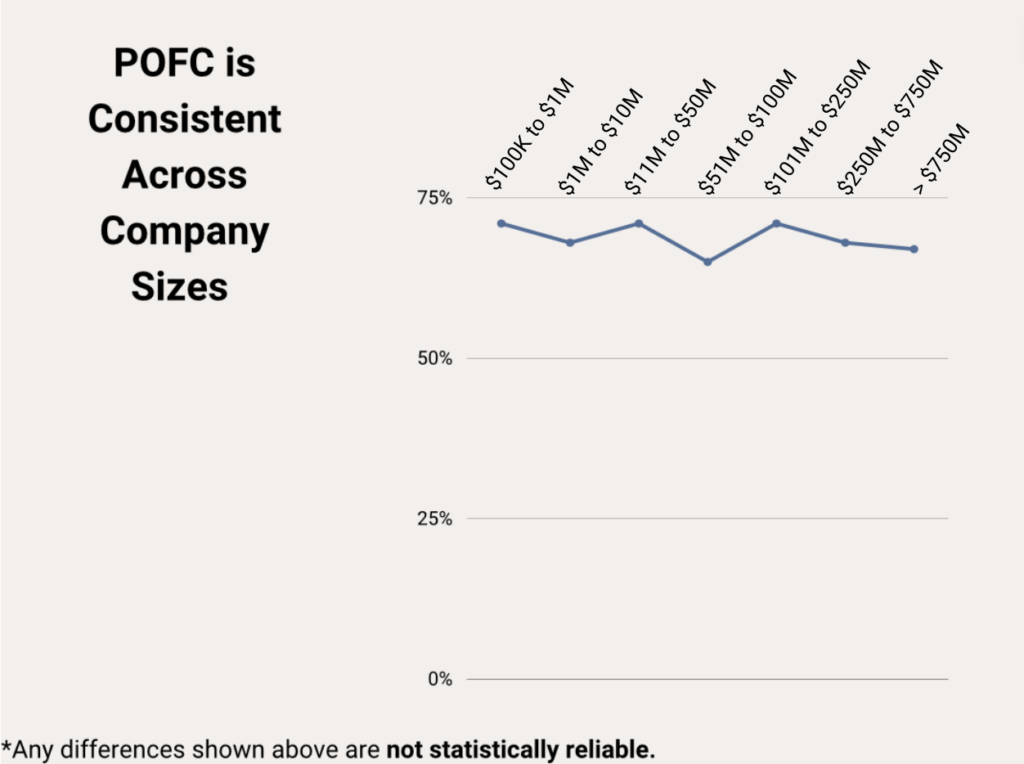

The answer is largely that they do not. Neither the industry in which a buyer operates, the size of their company, nor the type of funding their company receives made any statistically reliable differences in when buyers initiate contact.

It’s important to note that while there may appear to be slight differences in the point of first contact displayed in these graphs, the differences are not statistically reliable. This means that if we were to sample a different but similar group of B2B buyers, these differences would likely not persist.

Buying Process Factors Influence on Point of First Contact (POFC)

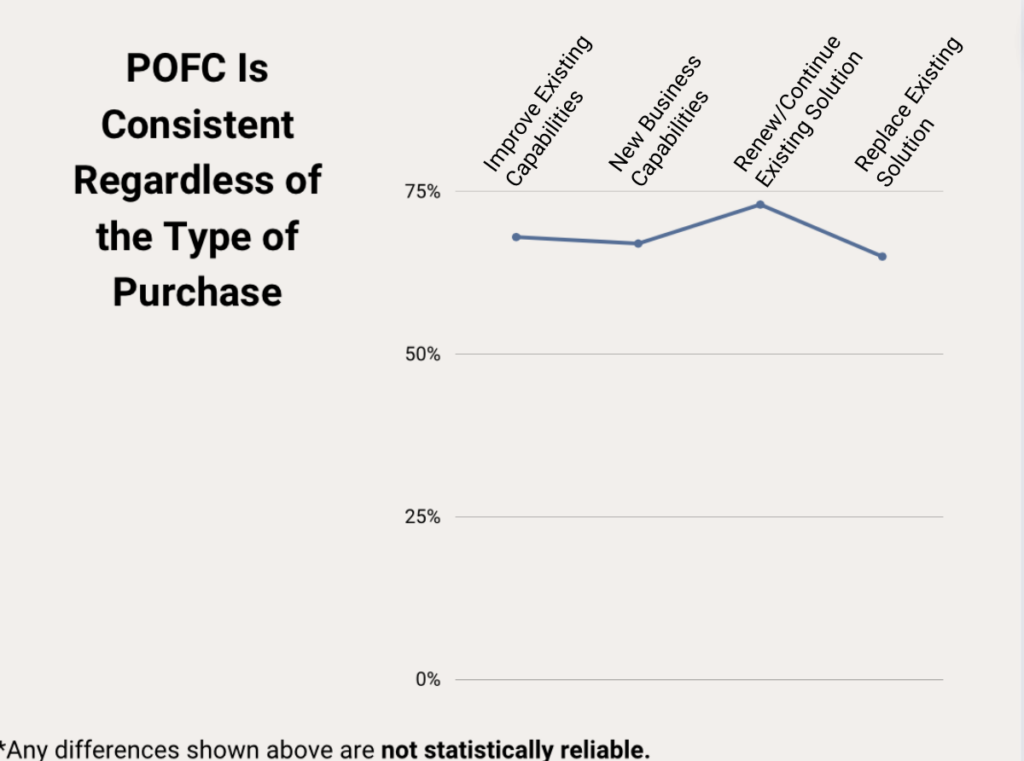

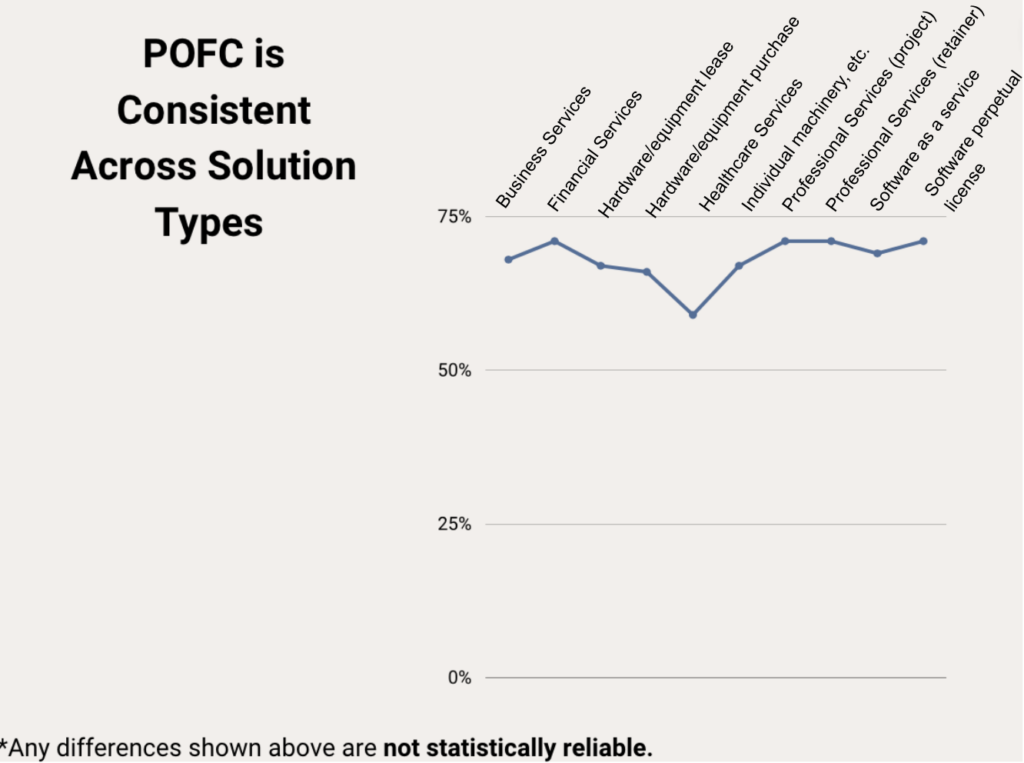

Next, we turned our attention to the nature of the purchase itself. We were curious if the time buyers spent on independent research varied depending on the type of business capability they were after (e.g., new business capabilities, enhancing/replacing existing solutions) and the type of solution they sought (SaaS, machinery, or hardware).To our surprise, these aspects of the purchase had no statistically reliable influence on when buyers reached out to potential suppliers. It is interesting, for example, that buyers spend comparable amounts of time independently researching regardless of whether they are making a purchase that fulfills an entirely new business capability or if they are simply replacing or improving an existing solution. These findings underscore the autonomy and self-reliance of today’s B2B buyers, and that the type of purchase they’re making has little effect on this independent approach.

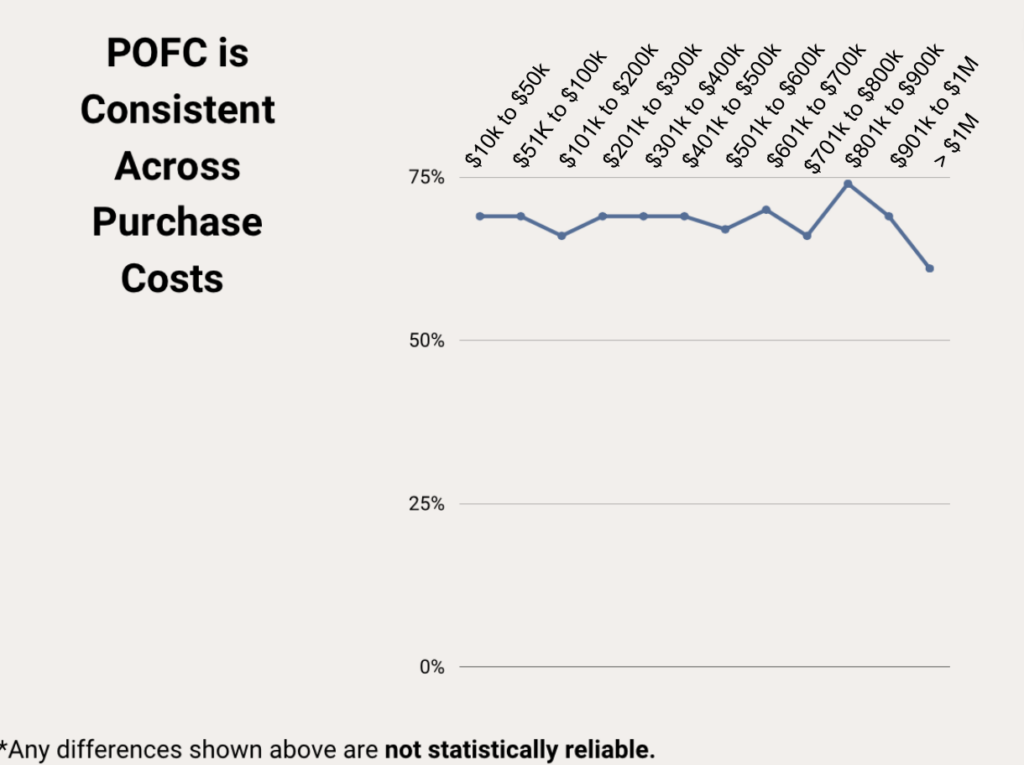

Likewise, the price of the purchase exhibited no statistically reliable impact on when buyers initiated direct contact with sellers.

Whether the purchase was under $50,000 or exceeded one million dollars, buyers consistently invested similar amounts of time in their buyer’s journey before engaging with sellers.

It’s essential to note that although there may seem to be minor variances in the point of first contact shown in the graphs above, these differences lack statistical reliability. In other words, if we were to survey a different but similar group of B2B buyers, these distinctions would probably not hold.

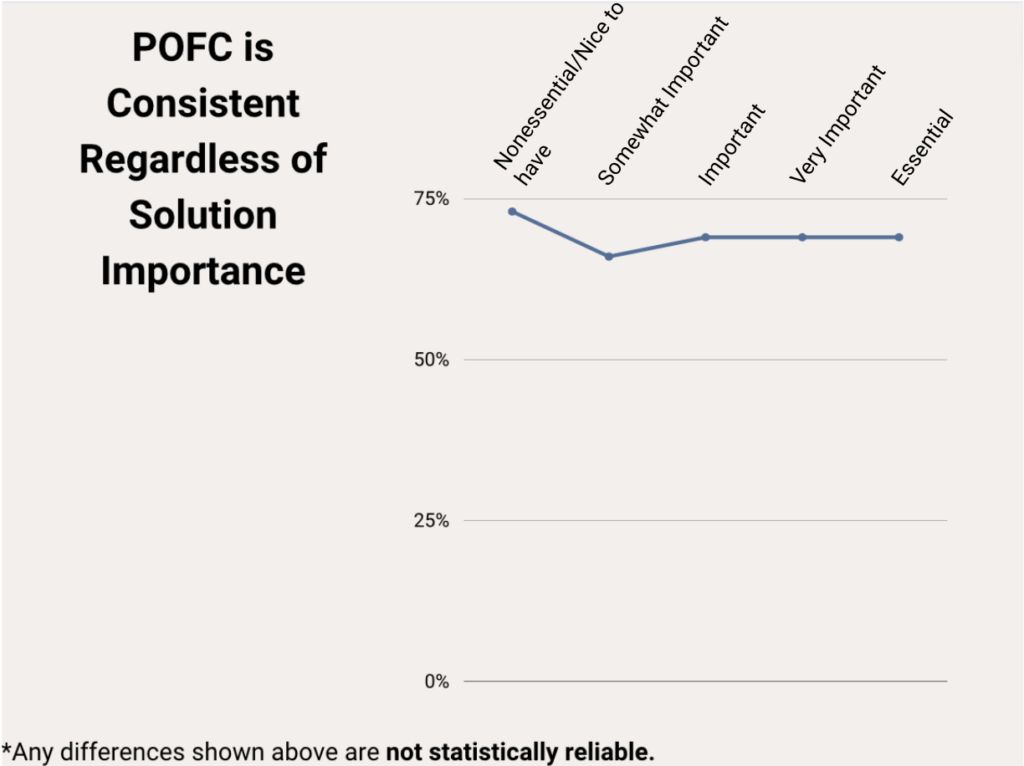

Next, we examined whether the importance of the solution affected how long buyers researched on their own before reaching out to sellers. Again, whether the solution was seen as essential to the organization or simply “nice to have” made no statistically reliable difference in the amount of time spent without seller involvement.

It’s interesting to note that we observed in our comprehensive buyer journey report that more important solutions had slightly shorter buying cycles, but this sense of urgency clearly didn’t translate into a change in the portion of time buyers spend independently researching with their team before connecting with sellers.

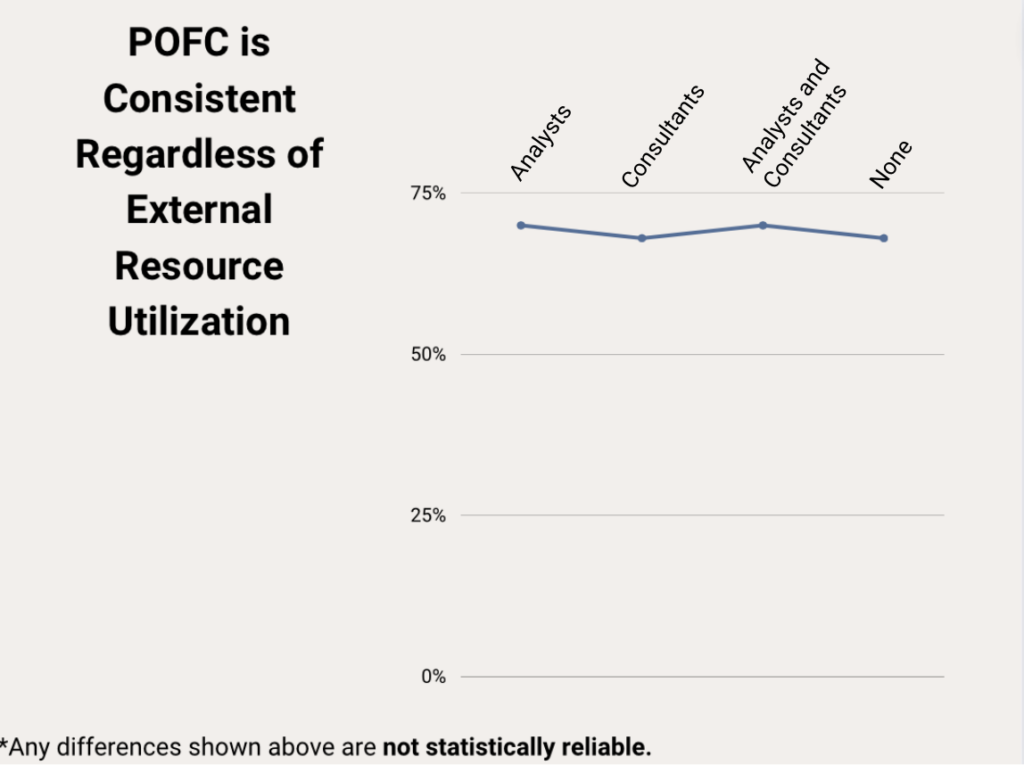

Lastly, we considered whether the utilization of outside resources (such as analysts or consultants) accelerates the initiation of buyer-seller contact. It does not. We observed statistically similar durations spent in the seller-free phase of the buyer’s journey for respondents who employed consultants, analysts, both, and those who did not use any external help.

If the Phone Doesn’t Ring, It’s Me

As we’ve explored, many factors related to the buyer’s organization and their product choices have shown limited influence on the time buyers spend conducting independent research, absent from seller interactions. These findings suggest that buyers remain firmly in control of their purchase process.

What’s more, in our survey, buyers indicated that they were the ones initiating contact 83% of the time. This clearly indicates that sellers are learning about the buying process on the buyer’s terms, further illustrating the buyer’s control in the purchasing process.

Undoubtedly, sellers had in many cases reached out to these buyers prior to that initial contact. However, what our participants’ responses suggest is that whether sellers are reaching out or not, buyers initiate contact when they are ready to engage and rarely before that.

Further cementing the 70% Constant, when we examined the 17% of buyers who said their first contact was initiated by a seller, we found that this interaction also occurred at approximately 70% through the journey.

Whether first contact is buyer- or seller-initiated is not meaningfully influenced by any of the factors we assessed in our study.

I Want Early Access, Please

While virtually nothing we measured impacts when buyers first interact with sellers, one important aspect of the buyer’s journey was shown to move the needle: the number of vendors buyers evaluate.

When buyers increase the number of vendors they evaluate to six or more, buying groups spend approximately 10.5% more time in the buyer’s journey without sales reps. Those who evaluate six or more vendors spent 75% of their time on average researching independently, while those who research the average of four vendors spend an average of 67% of their time in the buyer’s journey in a seller-free experience.

Not only does tacking on vendors extend the length of the buying cycle by over two months, but it also magnifies the proportion of time buyers dedicate to independent research before involving a seller.

This discovery highlights the diligence with which buyers approach their research. It is clear that buyers invest considerable time and attention into evaluating each vendor, even when the list is extended well beyond the average of four. Rather than taking shortcuts on a big to-do list, they put in the effort and allocate additional time to assess each one. This, in turn, extends the duration of their independent research within the buyer’s journey.

In sum, adding an additional vendor to buyers’ shortlists…

- Increases the buyer’s journey by over two months, and

- Extends the amount of time these buyers spend conducting independent research by over 10%.

Is It Everything You Thought It Would Be?

What happens when sellers do earn engagement before the average 70% mark?

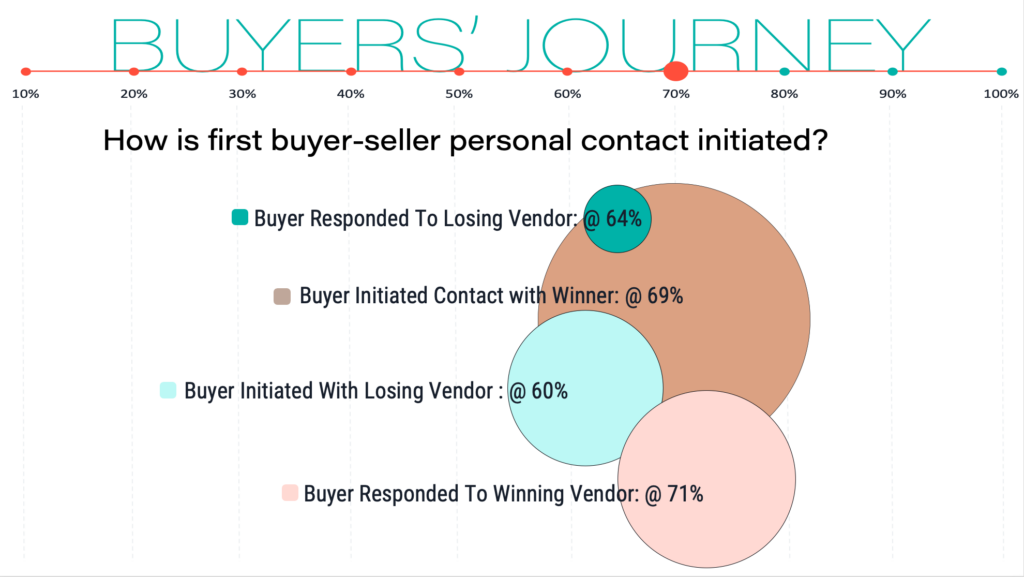

In our analysis, we found that when contact is successfully made before the 70% mark, the result is a lower, not higher likelihood of winning the deal, regardless of whether the initiation comes from the buyer or the seller.

- If buyers initiate contact with losing vendors, it happens substantially earlier, at around 60% through the journey

- If buyers are contacted by the losing vendor and engage, that also happens substantially earlier, at 64% of the way through the buyer’s journey

From this, we learn that initiating direct contact early doesn’t necessarily mean a seller will win. Rather, from what we’ve seen, it reduces, not increases, a seller’s chance of winning. This may indicate that engaging with sellers prior to when they are ready is not a positive experience for the buyer.

Implications

This research underscores the remarkable autonomy and self-reliance of today’s B2B buyers. As we have seen, a wide variety of factors related to their organization’s characteristics, product choices — and even the importance of the solution — exert no influence on when buyers choose to initiate contact with sellers. Buyers consistently refrain from engaging directly with selling organizations until they are approximately 70% through their buying process.

This independence highlights that B2B buyers are firmly in control of their purchase process. Furthermore, a striking 83% of the time, it is the buyers themselves who initiate first contact, solidifying their dominance in the purchasing process.

Interestingly, our study reveals that the one factor that does extend the duration of independent research is the number of vendors evaluated. When buyers expand their evaluation pool from the typical four vendors to more than six, their independent research phase lengthens by about 10.4%. This reflects the thoroughness with which buyers approach their research, showing that additional vendor consideration leads to more time dedicated to independent research in the buyer’s journey.

Our research highlights how rigorous buyers are during their process. Each vendor they evaluate results in a substantial investment of time. It is in the buyer’s; interests to limit their evaluation to providers that can reasonably supply the required business needs effectively and at the right price. The buying team is also best served by not evaluating fringe vendors that have little or no chance of either being selected or performing well if they are selected.

Sellers may wish to be the only provider evaluated, but this is not realistic. The data clearly show that buyers are going to evaluate a list of four competitors on average, giving each a complete evaluation. However, sellers are certainly better served when buyers do not take on the evaluation of fringe competitors that are likely to drag out the evaluation process, delay decisions and reduce the vendor’s likelihood of success.

This suggests that sellers would be well served by providing their prospects clear guidance on which competitors they should be evaluating. While this may seem to risk encouraging buyers to evaluate legitimate contenders for the business, it is highly unlikely that a legitimate competitor would be overlooked. Instead, taking this approach would signal to the buyer which short list of competitors to evaluate, and, by exclusion, which to leave off the evaluation list. It may also help to establish providers that do so as true partners.

However, our research also challenges the conventional notion that getting in early with traditional sales tactics guarantees success. In fact, when BDRs/SDRs make contact before the buyer has completed approximately 70% of their journey, that contact is less likely to result in winning a deal than if that contact happens at 70%. Initiating direct contact early, whether by the buyer or the seller, does not increase the likelihood of a successful outcome.

Instead, during that first 70% of the buying process, sellers should position themselves through education, offering valuable insights and building relationships with buyers in ways that do not involve simply hounding buyers for meetings. Rather than pressuring buyers for a sale when they may not yet be ready, sellers can engage through avenues like social gatherings, strategy sessions, sponsored events, customer references, and other educational initiatives.

This approach allows sellers to develop relationships and become trusted advisors and peers in their communities, thereby nurturing a more meaningful and productive relationship with potential clients. By adopting this educational and relationship-focused strategy, sellers can enhance their chances of being the chosen vendor when buyers finally engage.

Appendix

Reading Time: 819 words, about 4 minutes

Table 1: Statistical Reporting

| Finding | Statistical Test | Statistic | Significance Level | Effect Size | Sample Size |

| The average buying cycle is 11 months. | Average | n/a | n/a | n/a | 934 |

| Buyers typically make direct contact with vendors around 7.586 months into the buying cycle. | Average | n/a | n/a | n/a | 934 |

| Buyers typically make direct contact with vendors 69% of the way through a buying cycle. | Frequency | n/a | n/a | n/a | 934 |

| The point at which buyers first make direct contact with vendors is consistent across industries. | ANOVA | F=1.496 | p=0.189 | 0.008 | 934 |

| The point at which buyers first make direct contact with vendors is consistent across departments. | ANOVA | F=1.660 | p=0.071 | 0.021 | 934 |

| The point at which buyers first make direct contact with vendors is consistent across solution capabilities. | ANOVA | F=2.251 | p=0.081 | 0.007 | 934 |

| The point at which buyers first make direct contact with vendors is consistent across purchase types. | ANOVA | F=0.856 | p=0.574 | 0.009 | 934 |

| The point at which buyers first make direct contact with vendors is consistent across solution price points. | ANOVA | F=0.725 | p=0.728 | 0.009 | 934 |

| B2B buyers indicate that they initiate contact 83% of the time. | Frequency | n/a | n/a | n/a | 931 |

| No matter their industry, buyers indicate they initiate contact with sellers. | Contingency Tables | n/a | p=0.015 | X2=14.086 | 931 |

| No matter their department, buyers indicate they initiate contact with sellers. | Contingency Tables | n/a | p=0.04 | X2=21.441 | 931 |

| Irrespective of the type of capability sought (new, replacement, etc.), buyers indicate that they initiate contact with sellers. | Contingency Tables | n/a | p=.314 | X2=3.553 | 931 |

| Irrespective of the type of purchase (SASS, hardware, etc.), buyers indicate that they initiate contact with sellers. | Contingency Tables | n/a | p<.001 | X2=30.875 | 931 |

| Irrespective of the cost of the purchase, buyers indicate that they initiate contact with sellers. | Contingency Tables | n/a | p=0.691 | 0.001 | 927 |

| If buyers initiate contact with losing vendors, it happens substantially earlier, at around 60% through the journey. | ANOVA | F=9.106 | p<.001 | n2=.009 | 878 |

| If buyers are contacted by the losing vendor and engage, that also happens substantially earlier, at 64% of the way through the buyer’s journey. | ANOVA | F=5.422 | p=.02 | n2=.006 | 840 |

| When we examined the 17% of buyers who said their first contact was initiated by a seller, we found that this interaction also occurred at approximately 70% through the journey. | Independent Samples T-Test | Welch’s=-1.01 | p=.272 | Cohen’s d=-0.106 | 840 |

| Those who evaluate six or more vendors spent 75% of their time on average researching independently, while those who research the average of four vendors spend an average of 67% of their time in the buyer’s journey in a seller-free experience. | ANOVA | F=3.628 | p=.006 | n2=.017 | 840 |

| When the number of vendors exceeds the average of four, each additional vendor extends the buying cycle by over two months (2.21 months). | Mediation Analysis | z-value=20.181 | p<.001 | estimate=2.221 |

Table 2

| Factor | Factor Values |

| Firmographic Factors | |

| Industry – What industry is the buying organization a part of? | Business ServicesConstructionEducationEnergy/Oil & GasFinancial servicesHealthcareInformation technologyLeisure and entertainment ManufacturingManufacturingReal estate RetailSales Transportation UtilitiesWholesale |

| Company Size – What is the size of the buying company measured in revenue? | Measured by employee count on a 10-point scale ranging from less than 50 to more than 10K |

| Company Funding – What type of funding does the buying company have? | Private-Equity (PE) BackedVenture-Capital (VC) BackedPublic Private |

| Buying Process Factors | |

| Purchase Cost – How much did the purchase cost? (minimum $10,000 annual value) | The annualized value of the purchase measured on a 12-point scale ranging from $10k to over $1 million |

| Buying group size – How many people were part of the solution evaluation team? | Numeric response |

| Solution Importance – How critical to the functioning of your organization is that solution? | Rate the importance of a solution to the organization on a scale from Non-essential/nice to have (1) to Essential (5) |

| Vendor Count – How many vendors were evaluated as part of the buying process? | Numeric response |

| Utilization of Outside Resources – Did the buying company utilize external resources to assist them with the purchase, such as analysts or consultants? | AnalystsConsultantsBoth analysts and consultantsNone |

| Purchase Type – What kinds of capabilities did the purchase bring? | Improve existing capabilitiesNew business capabilitiesRenew/ Continue Existing SolutionReplace existing capabilities |

| Solution Type – What type of solution was the purchase? | Business ServicesFinancial ServicesHardware or equipment leaseHardware or equipment purchaseHealthcare ServicesIndividual machinery/heavy equipmentOther – Please specifyProfessional Services – Project-basedProfessional Services – retainer or contract termSoftware as a serviceSoftware perpetual license |

Skip to content

Skip to content