Three years of research across nearly 10,000 B2B buyers has shown us that the B2B buyer is a highly experienced group of individuals that has, in many cases, “been there, done that” many times. The average buying group member in our study is around 40 years old and has been through 8 to 9 purchase cycles in the solution category they reported on in our study.

Armed with extensive experience, buying groups place four out of five vendors they will evaluate on the shortlist from day one of their journey, and buy from one of those four 95% of the time.

Brand familiarity and prior experience clearly matter. But what else gets the buying group to say “yes”? In this report, we look at the top reasons buyers give for choosing a vendor and the activities they find most helpful in bringing their teams to consensus on a preferred choice.

Prior Brand Experience as a Baseline Requirement

Our years of research furnish ample evidence that buyers make consequential decisions from the outset of their buying journeys. In fact, much of what guides them to the final “yes” is determined at the outset of the journey (see table below). And the foundation for those early decisions is built long before the current buying cycle even begins (see our deep dive report, In It (Multiple Times) To Win It: Prior Evaluations Precede Most B2B Wins).

| 2025 | Prior Years | |

|---|---|---|

| Vendors Shortlisted on Day One | 4/5 | 4/5 |

| Percentage of Shortlisted Vendors Buyer Has Prior Experience With | 75% | 69% |

| Winning Vendor on Day-One Shortlist | 95% | 85% |

| Prior Experience with Winning Vendor | 85.5% | 84.7% |

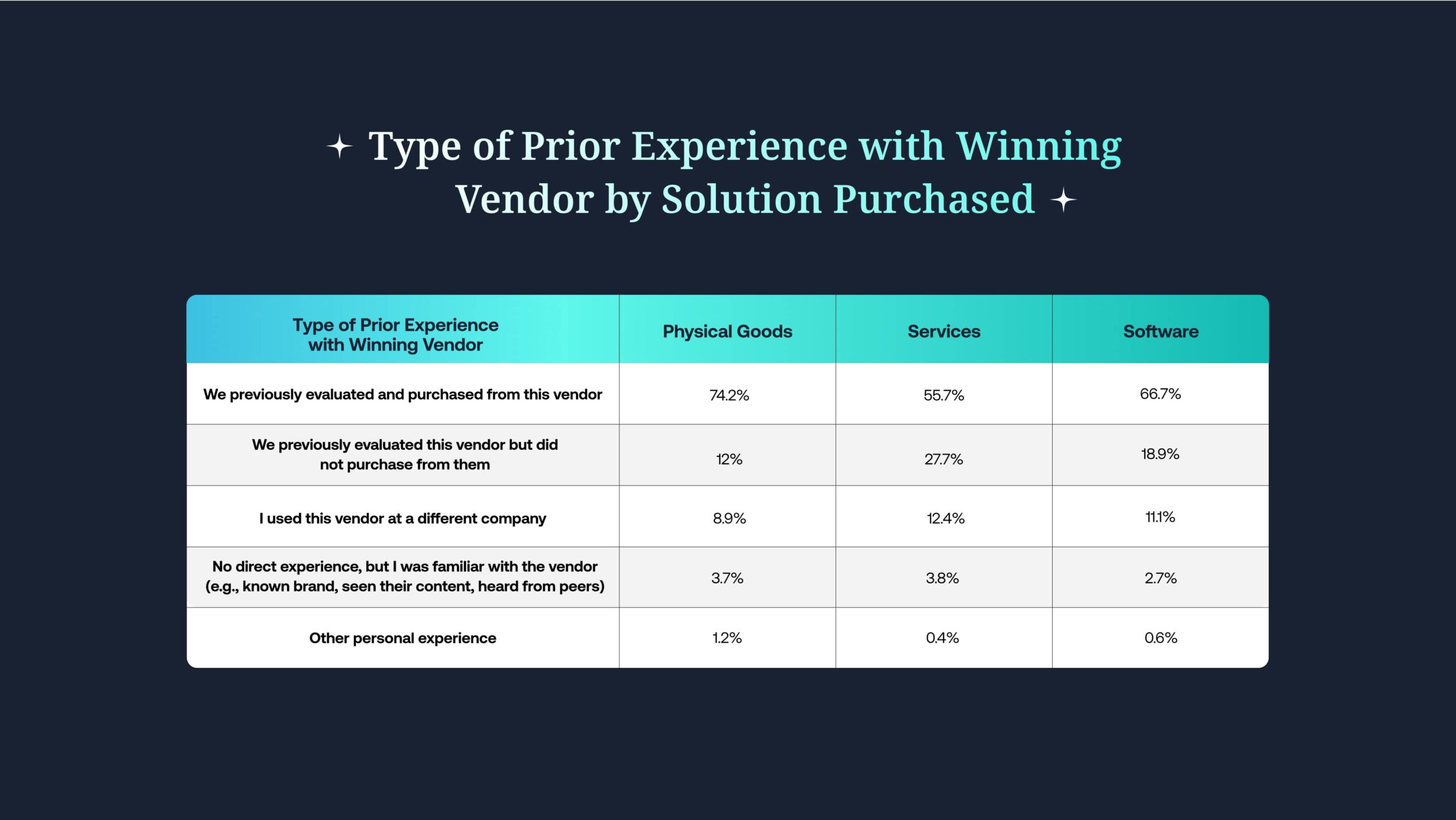

In our 2024 study, we established that buyers purchase from vendors they’ve had prior experience with roughly 85% of the time. So this year, we set out to understand what type of prior experience that was.

Inside Buyers’ Prior Experience with Vendors

Buyers are not simply familiar with the brands they’ll evaluate next — they have personal experience from prior evaluations of the vendor. And this was true across solution types, industries, whether the purchase was for new business capabilities, upgrades, renewals, and the like.

It’s interesting, then, that when buyers are asked directly about the drivers that led them to select the winning vendor (see a list of Key Purchase Drivers in the next section), prior experience is chosen about as often as others.

Given the overwhelming likelihood that buyers will choose a vendor with which they have prior experience, this suggests that prior experience may function more as a baseline expectation — a “given” — rather than a differentiator buyers consciously point to.

| Type of Capability Purchased | % of Deals Where the Winner Was Previously Evaluated |

|---|---|

| Improve existing capabilities | 86% |

| New business capabilities | 81% |

| Renew/Continue Existing Solution | 89% |

| Replace existing capabilities | 85% |

Beyond Familiarity: Key Purchase Drivers

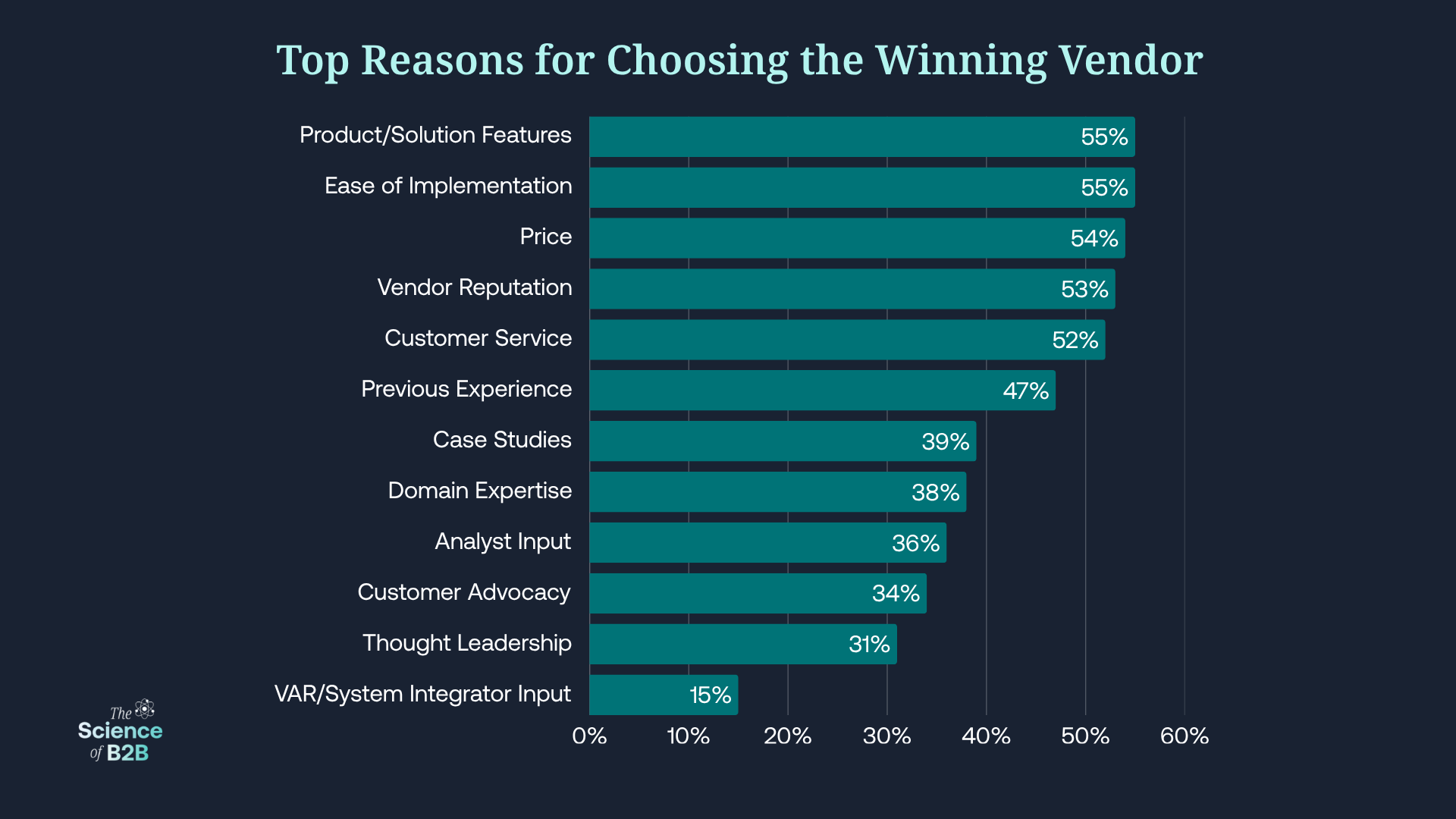

Beyond having prior experience with a brand, buyers most often point to product and solution features, ease of implementation, and price as the top reasons for selecting the ultimate winner. These factors are chosen at statistically equivalent rates and can be thought of as the leading “package” of purchase drivers.

The next rung down includes vendor reputation and customer service — again statistically equivalent to one another but ahead of “previous experience,” which follows. This suggests that once the baseline of familiarity is in place, buyers focus on practical considerations around the solution itself and the support they expect to receive, with prior experience shaping who makes it to the table rather than what breaks the tie.

It is also worth noting that one highly regarded source of influence, customer advocacy, ranked among the least influential reasons for choosing a vendor. Other forms of third-party external influence also ranked near the bottom: analyst input, thought leadership, and VAR/system integrator input.

Shared Priorities in Vendor Selection

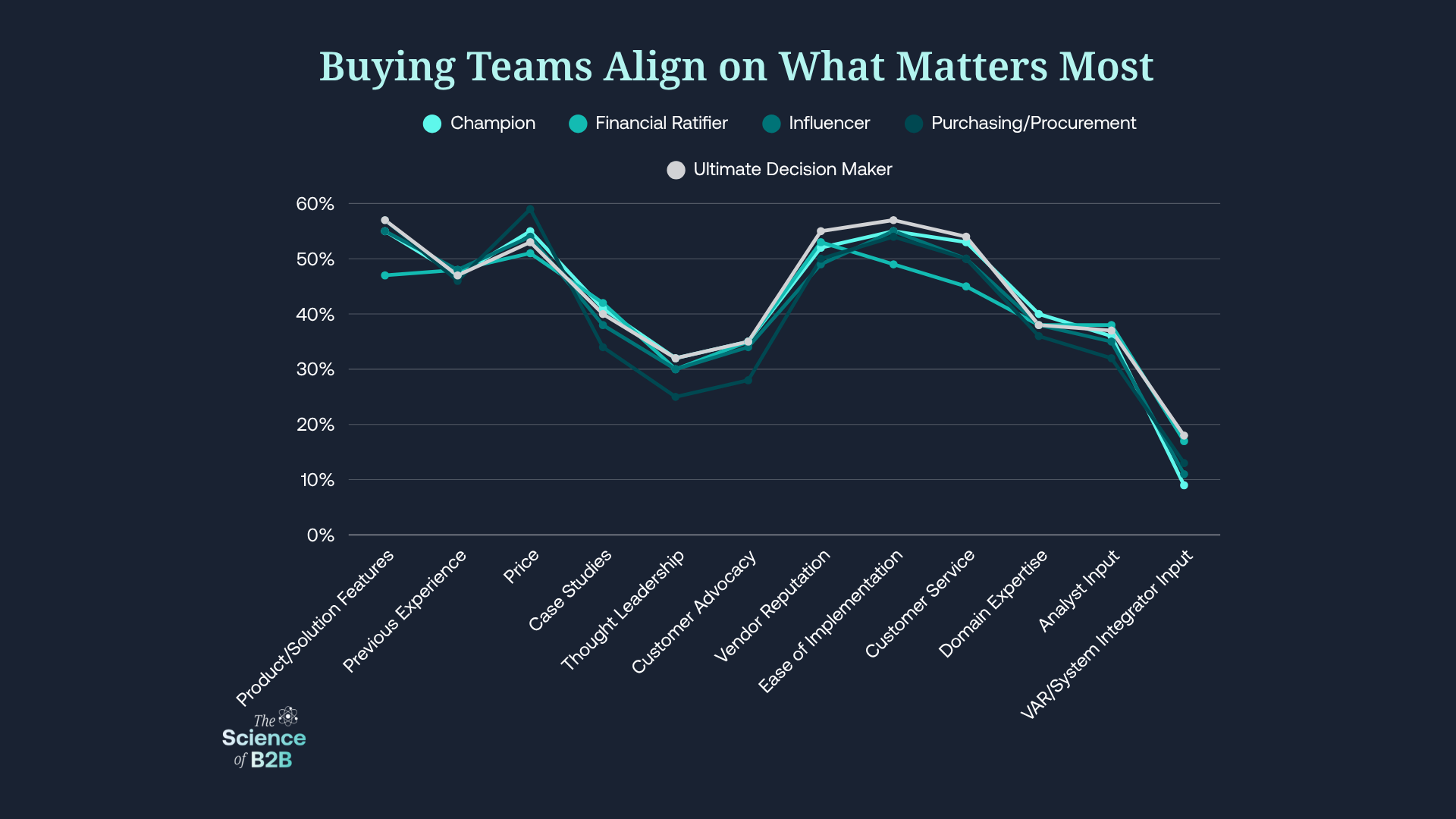

The reasons buyers cite as most important in choosing the ultimate winner are remarkably consistent across purchase roles (see figure below), suggesting that members of the buying group are generally aligned on what matters most in a winning vendor. Rather than debating whether price matters more than features or service, the real question becomes which vendor delivers best on their collective priorities.

What Helps Buying Groups Reach Agreement

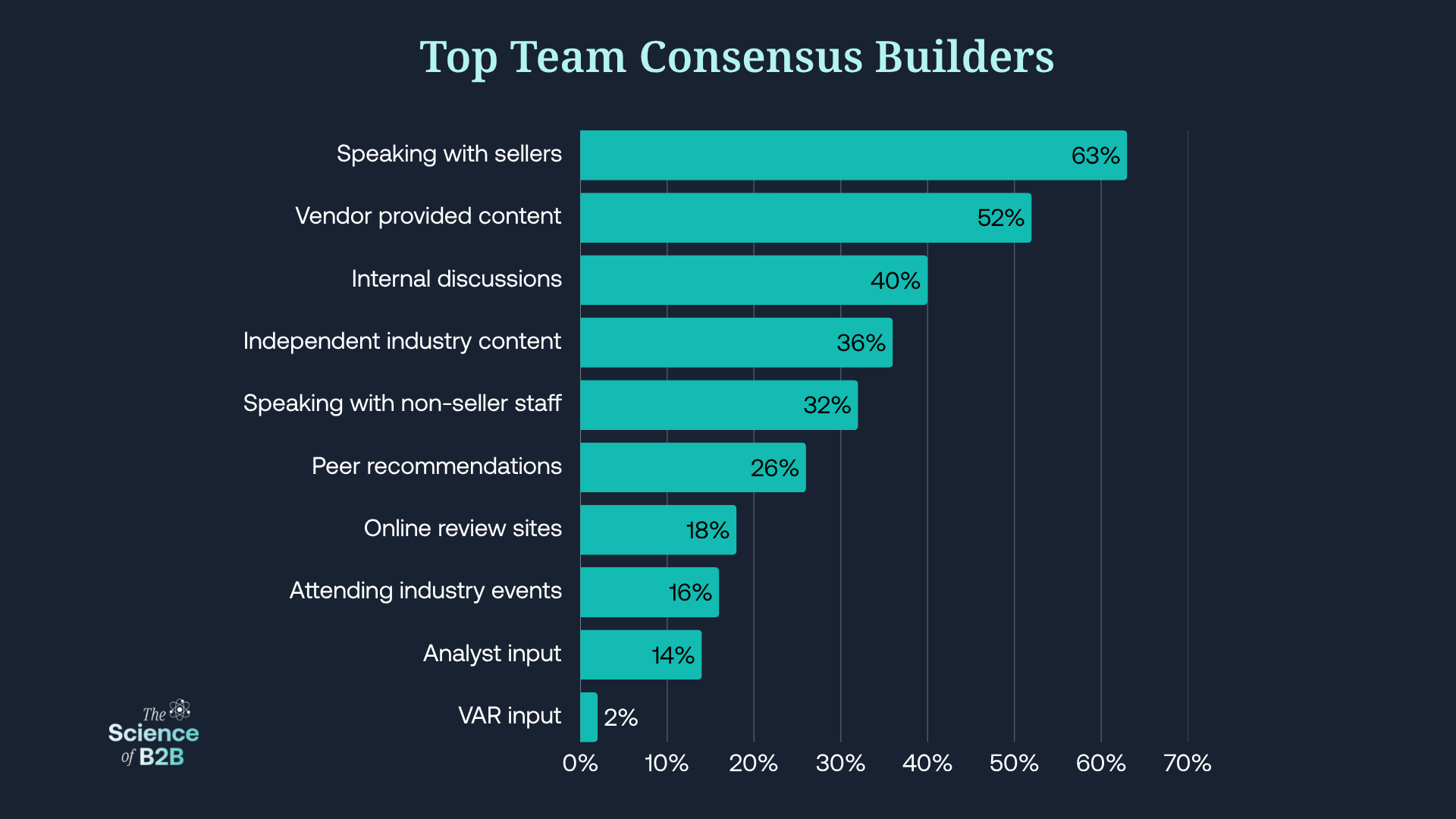

We also asked buyers to identify the three activities in their journey that were most helpful in reaching consensus within their internal buying committee. The figure below shows the percentage of buyers who included each activity among their top three. Each item is statistically different from the others, meaning the list represents a true rank order of how often the activities were selected.

How Sellers Help Buyers Reconfirm Consensus

Speaking with sellers tops the list of activities buyers say helped their teams reach consensus. This finding may seem at odds with what we know from the past three years of research. In both 2023 and 2024, buyers reported not speaking with sellers until roughly 70% of the way through their journey. While that figure has shifted to around 60% in 2025, buyers still report establishing a preferred vendor before seller contact — and purchasing from that early favorite nearly 80% of the time.

At first glance, these findings appear to conflict. How can sellers be the top consensus-building activity if most buyers already agree on a preferred vendor before speaking to them? In the sections below, we unpack two distinct points of consensus that clarify this paradox.

Two Points of Consensus

The First, Defining-But-Hard-Won Consensus

The resolution of this seeming contradiction lies in recognizing that there are two points of consensus in the buying journey. The first comes before seller contact but after many months of internal deliberation. This first consensus establishes a preferred vendor, and it is a difficult consensus to achieve. Research suggests that between 40% to 60% of buying journeys that end without making a purchase do so because the buying group fails to come to consensus. The lived experience of readers of this report will also testify that coming to consensus on an important purchase for the enterprise can be difficult.

Once this initial consensus is reached, buying groups are reluctant to re-litigate, and the numbers show us clearly that they rarely do, even when their preference changes during the Validation Phase.

When Preference and Consensus Part Company

Although B2B buyers often revisit their assumptions during the buying journey, the data show that early choices are remarkably durable. In our study, buyers ultimately purchased from the vendor they preferred at the end of their Selection Phase 77% of the time. Yet when asked whether their vendor preference changed after speaking with sellers, 42% said yes. In other words, nearly half experienced some shift in perception during seller interactions, but only about one in four buying groups actually changed their final choice.

This suggests that while sales conversations often influence perceptions and reinforce or erode confidence, this only leads to a change in buying group choice about half the time. This underscores the underscoring the critical importance of being the preferred vendor before formal engagement begins.

Dissent from the Group Decision Is Handled In the Selection Phase

Even more, when asked what could cause them to move off their preferred vendor once discussions with sellers began, only 2.6% of buying group members cited, “internal pushback from stakeholders” as a reason. This suggests that buyers are extremely confident that they have arrived at a clear consensus choice within the buying group prior to talking to sellers. Buyers assign very close to zero likelihood that a member of the buying group is going to push back on the consensus choice once that consensus has been achieved. This is a remarkable statement of unity on the part of B2B buying group members, again underscoring the importance of being in first place at the end of the Selection phase.

The Second Consensus: Driven by Confirmation Bias, but Not Just A Rubber Stamp

And yet, buyers must still validate their initial consensus. This requires formally evaluating vendors through demonstrations, conversations with sellers, and the other formal methods for evaluating capabilities.

In this phase, seller interactions are not about objectively weighing information they encounter through seller interactions. Instead, it is largely about validating the initial choice — reassuring the buying group that their initial decision was sound and that they will not have to relitigate the hard-won agreement.

Sellers are the source of this second validation point. Buyers told us that if the preliminary consensus choice were to be beaten on price or competitive features, they were open to changing their choice. The fact that this rarely happens suggests both that sellers do an excellent job of finding common ground with buyers in those areas, and that buyers are motivated to assess their favorite’s price and capabilities favorably.

Where sellers execute demonstrations and negotiate terms effectively, initial choices are validated. This what buyers describe as most helpful, because it allows them to move forward confidently without revisiting months of internal alignment.

AI & the Second Consensus

As discussed at length in our global Buyer Experience Report, buyers are engaging with sellers earlier now than in prior years. Our investigation into why the point of first contact is moving earlier helps clarify the role of these two points of consensus.

Eighty-nine percent of buyers said they purchased something with AI features. However, there is a great deal about how AI is implemented in solutions that buyers have needed to clarify before making their final choice. The information they need to make that final choice is not available on vendor websites, and even buyers who have been through multiple previous buying journeys in a category cannot answer these questions from their experience. This has caused buyers to reach out and start seller conversations earlier in their journeys.

Buyers still order their shortlists before engaging sellers (94% of buying groups do), and that consensus is hard-won but solid, as we saw above. Buyers do not want to change their choice, and nearly 80% ultimately stick with their original favorite. However, more than in recent years, they have needed seller help to validate those choices. When sellers are able to successfully overcome roadblocks on the way to confirming the original selection, buyers are appreciative.

What This Means for Marketers and Sellers

Our findings point to two truths that marketers and sellers must reckon with simultaneously.

First, the shortlist is largely set before sellers ever enter the picture, and it is heavily influenced by prior brand experience. That means the work of marketing is not just about lead generation in the current cycle, but about ensuring the brand has visibility and credibility. Even more, marketing must help facilitate the personal connection between brand and buyer that buyers rely on when they enter the market for solutions. The fact that prior evaluations carry so much weight suggests that even when a cycle doesn’t end in a win, those experiences shape future consideration.

Second, while buying groups enter the Validation Phase (sales cycle) tightly aligned on their decision criteria, speaking with sellers remains the single most helpful activity for reaching final consensus. Sellers play a pivotal role in answering new questions — especially as AI and other emerging technologies introduce unfamiliar considerations. But because the shortlist is already in place, these interactions serve more to confirm and reinforce the choice than to change it.

For marketers, this underscores the importance of building brand memory and driving early engagement long before a purchase is in motion. For sellers, it emphasizes the value of being prepared with expertise that addresses buyers’ emerging questions and helps them validate the decision they are already inclined to make. Together, marketing and sales can shape both the early familiarity that earns a spot on the shortlist and the later interactions that bring the buying group to a confident “yes”.

Keep Reading

- “AI Inside” Is Catalyzing an Earlier Point of First Contact (POFC) for B2B Buyers and Sellers

- In It (Multiple Times) To Win It: Prior Evaluations Precede Most B2B Wins

- How Buyer Experience Offsets LLM-Induced Traffic Loss

- B2B Buyers Are Even Less of a Blank Slate Than We Thought

- Meet the B2B Buying Group: Who’s at the Table and What They Do

- B2B Buying Under Economic Pressure in 2025