What is Customer Churn Rate?

Customer churn rate meaures the proportion of customers who stop engaging with a product or service during a specific timeframe. It is a key indicator of customer attrition. High customer churn is bad for the health of a business. By knowing their customer churn rate, companies can make informed decisions to enhance their overall customer experience, and thus, profitability.

Why is Customer Churn Important?

Understanding customer churn benefits organizations in various ways:

- Revenue impact: Customer churn can lead to significant revenue loss for B2B companies. High churn rates directly affect the bottom line by reducing recurring revenue streams and eroding the customer base that sustains the business.

- Customer Lifetime Value (CLV): Understanding and managing churn is essential for maximizing customer lifetime value. By reducing churn, B2B companies can extend the duration of customer relationships, increasing the overall value generated from each client, and improving the POI of customer acquisition efforts.

- Market reputation: High churn rates can signal underlying issues within a company, and can harm its reputation within the market. Monitoring and addressing churn demonstrates a commitment to customer satisfaction.

- Resource allocation: Churn analysis helps companies allocate resources more effectively. Instead of continually seeking new customers to replace lost ones, efforts can be redirected towards retaining clients, which is often more cost-efficient.

- Data-driven insights: Churn analysis provides insights into customer behavior and preferences. This can inform product improvements, service enhancements, and marketing strategies.

How to Reduce Customer Churn Rate

Businesses can promote customer loyalty and lower their churn rate by adopting these approaches.

1. Enhance Onboarding Experience

Make your initial interactions count. Provide comprehensive onboarding that educates customers about your product’s value and how to use it effectively. A smooth onboarding process can set the stage for a long-lasting customer relationship.

2. Deliver Exceptional Customer Support

Offer responsive and helpful customer support channels. Address issues promptly and go the extra mile to resolve problems. Strong support can foster loyalty and show customers you value their satisfaction.

3. Personalize Communication

Tailor your interactions to each customer’s needs and preferences. Personalized communication, such as relevant product recommendations and targeted content, can demonstrate your understanding of their requirements. Intent data can help you spot customers who may churn and understand their concerns.

4. Regular Engagement and Touchpoints

Maintain consistent engagement through email campaigns, newsletters, webinars, and more. Keeping customers informed about updates, new features, and industry insights can help them see ongoing value in your offerings and improve their overall experience.

5. Collect and Act on Feedback

Provide customers easy ways to share their opinions and concerns. Use their feedback to identify pain points and areas for improvement. A commitment to their input fosters trust and loyalty.

6. Offer Flexible Pricing and Plans

Provide pricing options that accommodate various budgets and usage levels. Offering scalable plans ensures customers can continue using your services as their needs evolve, reducing the likelihood of churn.

7. Measure and Communicate ROI

Regularly demonstrate the value your product or service brings. Show them measurable returns on their investment.

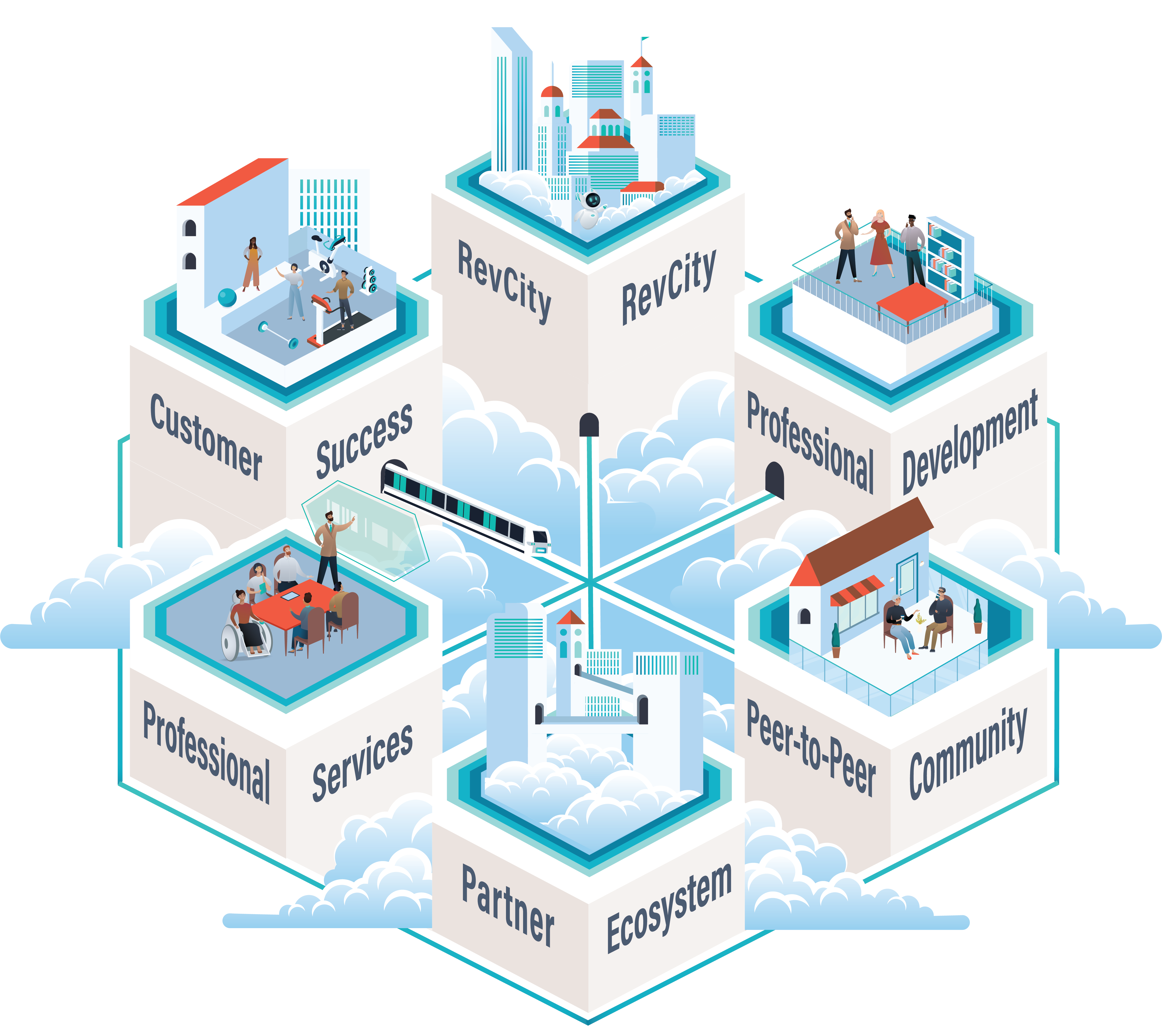

8. Implement Customer Success Programs

Create proactive customer success initiatives that anticipate and address customer needs. Develop strategies that help customers achieve their goals, making them less likely to consider alternatives.

9. Monitor User Activity and Engagement

Use data to track customer behavior and engagement patterns. Identify signs of decreased activity early on and proactively reach out to re-engage before they become disengaged.

How Do You Calculate Customer Churn Rate?

The customer churn rate formula is as follows:

Customer Churn Rate =

(Number of Customers Lost During a Period / Total Number of Customers at the Start of the Period) x 100

Let’s say a company starts the month with 500 customers, and by the end of the month, 20 customers have discontinued their subscriptions. Customer churn rate would be calculated as below:

(20 / 500) x 100

0.04 x 100

Customer Churn Rate = 4%

Customer Churn Rate vs. Revenue Churn Rate

Customer churn rate and revenue churn rate differ in several ways:

- Customer churn rate focuses on the number of customers lost, while revenue churn rate focuses on the financial aspect (how much revenue is lost because of customer churn).

- Revenue churn rate is calculated by dividing the revenue lost from churned customers by the total revenue at the start of the period.

- Customer churn rate is particularly valuable for evaluating customer satisfaction; loyalty programs; and the effectiveness of customer support.

- Revenue churn rate is crucial for understanding the immediate financial impact of churn on the company’s earnings.

| Customer Churn Rate | Revenue Churn Rate | |

| Focus | Number of customers lost | How much revenue is lost |

| Metrics Used | Number of customers lost divided by total number of customers | Revenue lost from churned customers divided by total revenue |

| Use Cases | Evaluating customer satisfaction, loyalty programs, and effectiveness of customer support | Understanding the immediate financial impact of churn on company earnings |

| Insights | Health of customer relationships | Direct impact of churn on company financial performance |