In the early months of 2022, the labor market was seen as a professionals’ paradise. Remote positions hung around even as COVID-19 restrictions began to lift, creating the opportunity for professionals to take a step up in their careers without location constraints while organizations competed for borderless talent. This period of time was coined the “Great Resignation.” Now, however, with talk of a possible recession, what does it mean for those who quit their jobs and for the companies that were fighting so vigorously to hire and retain employees?

According to economists at Monster, the need for new hiring is still here, but employers are likely approaching their limits on compensation spend as wages have gone up 5.6% in the last twelve months.

Met by a 7.9% increase in consumer prices, employees are left looking for ways to fill in the gaps between this difference. A recent survey from Branch and Marqeta showed that 85% of workers have plans to take on more gig work. Similarly, Monster economists predict that organizations will shift toward filling these types of roles (i.e., contract/gig work) rather than hiring full-time to cut costs.

As these labor trends tend to be discussed at the macro level (the “Great Resignation” and the current economic climate), 2X and 6sense collaborated to understand what it means specifically for B2B marketing functions.

Research Finds Notable Skill Gaps in the B2B Marketing Labor Supply

At the beginning of the year, “talent/labor issues” were cited as the number one CMO headwind to growth by Chief Outsiders. Furthermore, Gartner’s 2022 State of Marketing Budget and Strategy Report showed that 58% of CMOs believe their teams lack the in-house capabilities needed to execute on their marketing strategy.

2X and 6sense partnered together to gain a better understanding of the B2B marketing talent supply issue, how candidates and organizations may be responding to the current economic climate, and explore strategies that marketing leaders can leverage.

We first set out to better understand a real-time view of B2B marketing talent supply and demand. Most labor trend reports tend to be backward looking, some up to 12 months. Given the dynamic situation, we needed a different approach from analyzing backward-looking reports. We also set out to understand what kind of B2B marketing skills were facing the biggest shortages.

To avoid drawing conclusions based on backward-looking data, we analyzed real-time job postings within the US. This information provided deep insight into demand across marketing positions and skills.

Then we looked at the supply side and reviewed, in aggregate, marketing professional profiles across LinkedIn and Indeed.

By analyzing these sources together, we obtained a real-time supply and demand comparison — we could see what positions were being sought in the market relative to personnel that were qualified for these positions. We could also trend these over time to see how supply and demand volumes have changed from when the Great Resignation was in full swing to today’s uncertain economic climate.

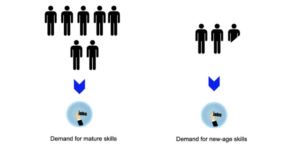

To analyze labor trends as it relates to certain qualifications, we examined supply and demand by two skill sets: new-age skills and mature skills. We defined new age skills as those relating to modern practices and technology, such as account-based marketing, artificial intelligence, and 6sense, to name a few examples. Mature skills were defined as table stakes skills in the B2B industry, such as demand generation, email marketing, Salesforce, SEO, etc. We then used keyword searches for these terms when looking at job postings and candidate profiles to differentiate the supply and demand for each skill set.

Demand for both new-age skills and mature skills in marketing has gone down since May

Our first round of data was collected in May (pre-economic uncertainty) and showed a healthy amount of overall demand for marketing talent across both types of skill sets. Fast-forward to our second round of collection which happened at the end of July, amid the shifting economy, and the amount of job listings fell by 14.5%.

When separating out demand by type of skills required for the job, openings for ‘mature’ marketing functions decreased by 13.5% while openings for marketing functions that require new-age skills fell by 17.6%. While we cannot say for certain what’s behind the reason for this drop in demand — factors such as jobs being filled, businesses slowing for summer months, financial austerity, and more may play a role — a sizable 15% overall drop amid economically uncertain times is suspected to be a reflection of employers taking precautionary measures against the possibility of a recession.

Overall LinkedIn Demand Across Two Skill Sets for Marketing Roles from May to July 2022

Source: 6sense and 2X

Note: These numbers are based on real-time job listings found on LinkedIn and are subject to change but reflect the dates on which they were collected.

Only 1-2 qualified professionals existed for every 1 open marketing position requiring new-age skills in May 2022

Data captured in May revealed healthy levels of supply relative to demand for mature marketing skills — an overall ratio of around five skilled professionals in the market for every one open position. When we looked at the advanced, new-age skill sets, we saw a very different picture with ratios of one-to-two qualified professionals for every one open position, with some functional areas being negative, meaning less people existed in the market (nearly all of whom were also currently employed) versus the demand for those positions.

Chart: Demand/Supply in May 2022 by Skill-Set (LinkedIn)

Source: 6sense and 2X

Note: These numbers are based on real-time job listings and candidate profiles found on LinkedIn and are subject to change but reflect the dates on which they were collected.

The ratio of supply to demand for new-age skills is still lacking compared to this ratio for mature skills

While demand has decreased from May to July, supply for both new-age skills and mature skills has increased. Supply for new-age skills has gone up 7.8% on LinkedIn while professionals with mature skills has gone up 5.6% over the same period. This increase, coupled with decreases in demand, represents a slight widening in selection for employers and an increase in competition amongst candidates.

However, the amount of qualified professionals to fill the roles that require new-age skills is still very much lacking compared to the ratio of supply to demand for mature skills. As of now, there are 2.5 qualified professionals for every one job opening that requires new-age skills whereas there is an average seven professionals for every one job opening that requires mature skills.

Chart: LinkedIn Demand/Supply by Skill-Set in July 2022 (LinkedIn)

Source: 6sense and 2X

Note: These numbers are based on real-time job listings found on LinkedIn and are subject to change but reflect the dates on which they were collected.

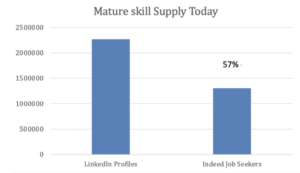

When accounting for professionals actively looking for work, the amount of supply is even less

Because LinkedIn hosts an array of professionals, some of whom are employed and not looking for work and some who may be looking for work, the ratios described above are a good indication of what’s technically true for supply but not probable given that some of these professionals are not looking to change employment.

To gain a better understanding of the number of individuals with either type of skill set who are actively looking for work, we turned to Indeed. Although the following proportions should be considered with caution as they involve comparing data from two separate sources in which there might be overlap (i.e., the same candidate may be on LinkedIn and Indeed), the amount of professionals with mature skills that are looking for work on Indeed is 43% lower than the supply with these skills found on LinkedIn.

Furthermore, the amount of professionals with new-age skills who are looking for work on Indeed is 69% lower than the amount of professionals with these skills found on LinkedIn. While we can’t know for certain what proportion of professionals on LinkedIn are looking for work, Indeed offers a better view of this number. Our findings point to a likelihood that the pool of available candidates is even smaller than what LinkedIn may suggest.

The Talent Supply with New-Age Skills Falls by 69% When Accounting for Professionals Who are Actively Looking for Work on Indeed.

Source: 6sense and 2X

Description: 31% of the amount of “potential” supply with new-age skills found on LinkedIn is actively looking for work on Indeed.

Note: These numbers are based on real-time candidate profiles found on LinkedIn and Indeed Employer and are subject to change but reflect the dates on which they were collected.

The Talent Supply with Mature Skills Falls by 43% When Accounting for Professionals Who are Actively Looking for Work on Indeed.

Source: 6sense and 2X

Description: 57% of the amount of “potential” supply with mature skills found on LinkedIn is actively looking for work on Indeed.

Note: These numbers are based on real-time candidate profiles found on LinkedIn and Indeed Employer and are subject to change but reflect the dates on which they were collected.

This analysis shows that for new age B2B marketing skills, there are not only less marketing professionals in aggregate, they are significantly less likely to be looking for new opportunities.

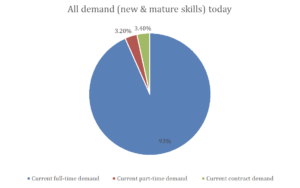

Demand is largely still full-time, at least for now

As mentioned previously, Monster economists predict that employers will begin hiring more part-time and contract positions than full-time roles to cut costs during economic hardship. We wanted to understand if these predicted trends can already be reflected in today’s labor market. At this point in time, it does not appear that these trends have come into play (or, if they ever will).

Today’s LinkedIn’s Talent Demand is Still Largely Full-Time

Source 6sense and 2X

Note: These numbers are based on real-time job listings found on LinkedIn and are subject to change but reflect the dates on which they were collected.

Implications for Marketing Leaders

This analysis provided insight to a concerning labor trend that is under the radar for many CMOs. Marketing leaders are already struggling to retain their teams while they compete in the most difficult recruiting market of their careers. Alongside talk of a recession — they are also hunting for roles that are incredibly scarce and, in many cases, may not even exist in the available talent pool.

The center of many CMO strategies includes transformation, implementation of advanced technology, and evolution of marketing capability. Recognizing the importance of the human elements of marketing, along with the technology elements that enable and elevate that work, this research identifies a need for better visibility to the labor supply constraints that risk achieving marketing transformation.

The shortages in qualified professionals found for roles requiring new-age skills also points to an opportunity for professionals with mature B2B marketing skills to expand their competency into the new-age areas.

This research also creates a conversation about how marketing leaders are addressing these challenges, how they are building and managing their own skilled workforces, how they acquire talent in non-traditional ways, and how some are innovating as much in talent/labor supply in the same way they innovate in their strategy, technology stack, and marketing program investments.

And that’s exactly what we will discuss in our next article!