A KPMG survey of 200 business executives found that 80% believe artificial intelligence will disrupt their industry. However, some expect CFOs to resist the changes.

“The CFO is not typically a shiny object grabber,” Amit Sharan, CIO at LiveRamp, said at a recent Workday conference. “They’re risk averse, but more importantly, that’s their job.”

Understanding the benefits, risks, and costs of any new technology is a key component of a CFO’s job. And while AI is everywhere right now, they’re right to perform due diligence on any tech their company wants to bring on.

But AI can deliver real results across multiple departments that directly affect the CFO, like:

- Automating finance department tasks

- Fast and easy reporting on financial performance

- Detecting hidden buyers to bolster the bottom line for revenue teams

Let’s look at how AI can help with these tasks and the tools that provide those features.

Automate Daily Tasks

Manual tasks can eat up an untold number of hours — and money — in the finance department. One of AI’s greatest assets is its ability to automate those daily tasks, freeing your teams up to focus on higher-level responsibilities.

How AI Helps

AI can automate bookkeeping activities like fixing uncategorized transactions, streamlining client communication, and optimizing accounts payable workflows.

Example: Booke.AI is an automated bookkeeping platform that helps your finance teams by doing all the above. The AI-powered platform can review all of your bank transactions and will continue to get smarter the more you use it.

Quick and Insightful Reporting

CFOs need their fingers on the pulse of the company’s financial performance. Reporting that status to the rest of the C-suite and the board of directors is critical for visibility and quick action.

How AI Helps

Instead of pinging their direct reports, CFOs can leverage AI to quickly analyze their key financial information and present it exactly the way they need it. This makes it much easier to see high-level KPIs and quickly share critical insights with other executives.

Datarails FP&A Genius tool gives users access to a ChatGPT-like input that is connected to your internal systems. It can act as a single source of truth for all questions related to financial performance. The benefits include data security, data visualization, and uncovering important trends.

Find Hidden Buyers that Fit Your Ideal Customer Profile

Revenue teams waste nearly two trillion dollars a year on bad prospecting, missed deals, and inefficient conversion rates. That represents a huge opportunity to boost revenue and the bottom line simply by optimizing GTM motions.

How AI Helps

AI can help your revenue teams spot the accounts that are in-market already and identify which are the right fit for your business.

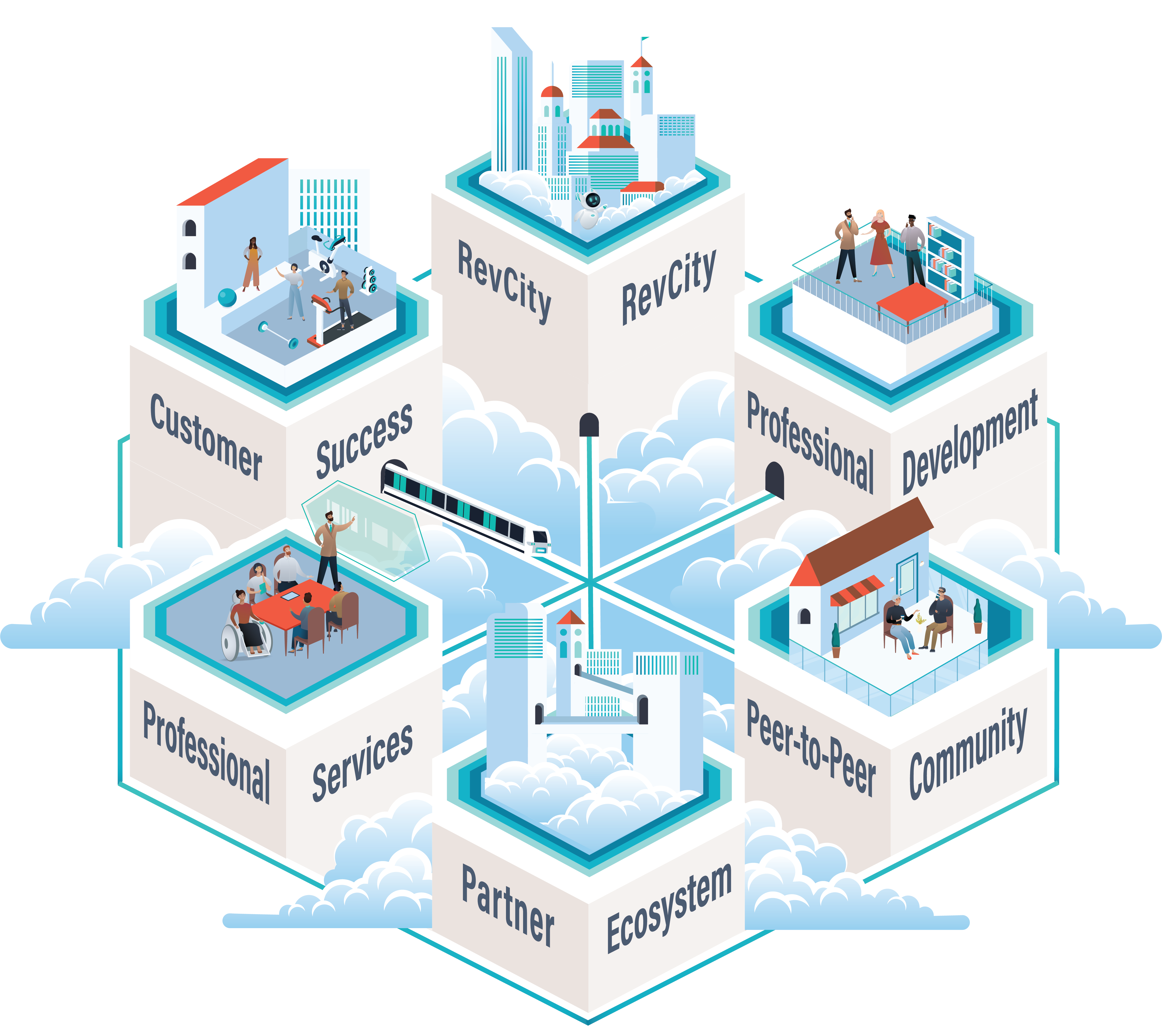

6sense’s ABM platform, powered by Revenue AI, captures buying signals across the entire internet, even the ones that are typically anonymous. By matching these signals to the accounts where they’re happening, the platform can surface companies that are actively researching your products.

Additionally, 6sense’s predictive marketing analytics software uses AI to analyze your existing customers and past opportunities to help you understand which accounts are the best fit for your business.

Conclusion

CFOs that want to improve efficiency across their organization should seriously consider AI-powered solutions. There are numerous platforms that can help automate daily tasks, give high-level financial analysis, and uncover more revenue opportunities.