By Sara Boostani, Marketing Research Analyst

What is your company’s total sales opportunity in any given quarter? And how many of those sales opportunities are being captured in your CRM and other sales intelligence tools?

To answer these questions, 6sense Research surveyed B2B practitioners and referenced customer data to identify gaps that impact sales teams’ ability to reach the right targets and close the most winnable deals.

How Much of Your TAM Is Ready to Buy?

To answer this question, 6sense Research asked 392 B2B marketers and sellers what percentage of their total addressable market (TAM) is ready to buy in any given quarter.

The answer: Between 9% and 11%.

This percentage was consistent across:

- Seventeen unique buyer industries

- Ten unique buying centers

However, the percentage of in-market buyers were reliant upon:

- Solution prices

- A buyer’s company size

Specifically, higher solution prices resulted in fewer in-market buyers, while lower prices had larger pools of active buyers.

Sellers with Higher Solution Prices Have Fewer In-Market Buyers

Note: A statistically reliable negative correlation was found between average solution price (ASP) and the number of in-market accounts. That is, the higher a seller’s solution price is, the fewer ready-to-buy accounts there are likely to be.

When looking at this percentage by segment, smaller buyer organizations were slightly less likely to be in-market than those at the enterprise level. This may be because larger organizations have an increased financial capacity to acquire new tools than smaller organizations.

| Segment | Percent of TAM In-Market |

| Small Medium Companies (51 to 1,000 employees) | 9% |

| Medium Companies (1,000 to 5,000 employees) | 10% |

| Enterprise Companies (5,000 to 20,000 employees) | 11% |

The fact that just 9% to 11% of your TAM is likely in-market at any given time makes the need to identify and reach these accounts even more vital.

A Lot of Sales Opportunities Are NOT in Your CRM

So, how many of those 9% to 11% of accounts would you be able to contact right now? The answer depends in part on how many are in your CRM.

Using our data, we looked across 448 of our customers in Technology and Software to understand how many early and late stage opportunities were organically in their CRM without 6sense.

You probably won’t be fond of what we discovered.

Early Stage Opportunities

Early stage opportunities are the accounts in your addressable market that have shown a bit of interest in the type of solution you sell. They probably aren’t ready to buy, but their early interest makes them ideal targets for marketing messages.

Unfortunately, our research shows that on average only 9% of these early stage opportunities are present in organizations’ CRMs.

This situation is slightly better for larger organizations. Enterprise companies have records for roughly 18% of their early stage opportunities. But small companies only know about 8% of them, on average. This puts smaller companies at a big disadvantage.

Chart 1: Organizations have records for fewer than 20% of their early stage opportunities

| Small-Medium Companies | Medium Companies | Enterprise Companies | |

| Early Stage Opportunities | 8% | 12% | 18% |

Late Stage Opportunities

Late stage opportunities are the accounts that are likely to make a buying decision soon. These accounts are actively engaging in behaviors that signify an interest in the type of solution your organization sells. Thus, it’s much riskier to miss opportunities in this stage.

So, what percentage of these accounts would you be able to reach today?

The average organization has only 22% of these accounts in their CRM.

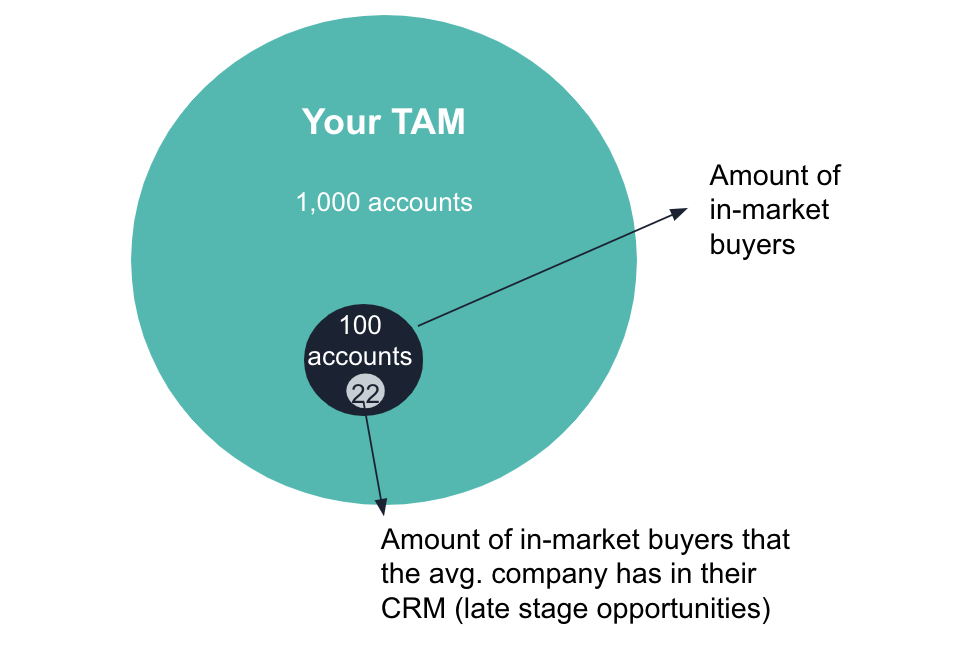

Tying it all together:

- If you had 1,000 accounts in your TAM…

- And just between 9% to 11%, let’s say 10% — or 100 accounts were in-market…

- And you had just 22% of those in your CRM…

… You’d only be able to reach out directly to 22 of the 100 in-market accounts that are in your 1,000 account TAM.

What’s more, while you might have 22 of these accounts in your CRM, you might not know which accounts to go after. You’d need to guess and grind your way through hundreds of other accounts in your CRM to find the 22 that matter.

Meanwhile, 78 other prime opportunities might never cross your radar.

Note: The number of accounts mentioned above are based on a 1,000 account TAM.

This means that companies are at risk of losing 75% of their available late stage opportunities without any attempt to compete for their business. While larger seller organizations have 37% of such opportunities in their CRM, they’re missing out on over 60% with a high likelihood of conversion.

Chart 2: Organizations do not have the vast majority of late stage opportunities in their CRM

| Small Medium Companies | Medium Companies | Enterprise Companies | |

| Late Stage Opportunities | 18% | 25% | 37% |

6sense Qualified Accounts

What are 6sense Qualified Accounts (6QA)? These are accounts 6sense has identified as being in-market, a strong fit for your offering, and highly likely to buy soon from either you or a competitor. In other words, these accounts should be your first priority.

What percentage of these accounts are in your CRM? Without using 6sense, the average company has records for only 27% of these opportunities on their own. These opportunities have the highest potential to convert pipeline to revenue, so any missed opportunity here can be equated to money left behind. Thus, being unaware of even a small percentage of such opportunities poses the greatest risk to your business.

Even the largest tech and software organizations are aware of only 40% of such accounts, on average. They lack visibility into half of the deals on the table, and likely lose them to competitors without ever having the chance to compete.

The situation is significantly worse for smaller companies, with fewer than 30% of potential 6QAs visible in their CRMs.

Chart 3: Tech & software companies miss the majority of in-market buyers when they rely on organic

| Small-Medium Companies | Medium Companies | Enterprise Companies | |

| Early Stage Opportunities | 8% | 12% | 18% |

| Late Stage Opportunities | 18% | 25% | 37% |

| 6QA | 22% | 29% | 40% |

A Path Forward

Companies can fix these gaps by investing in intent data to spot which accounts are in-market, and predictive analytics to help prioritize outreach. To see how 6sense can help you optimize your efforts and close more deals, watch a short video and book a personalized demo.