Imagine walking into a department store, intent on purchasing a specific item or just exploring your options. As soon as you step through the door, a flurry of sales associates descends on you, eager to assist. While you might appreciate their enthusiasm, it can feel overwhelming, even intrusive. Most of us decline the offer of help. We prefer to take our time, explore the aisles, and make decisions on our own terms. Then, when we’re ready for help, we want it promptly — not too soon and not after we’ve been left waiting.

It’s remarkably similar for buyers in B2B today. Before widespread internet use, B2B buyers relied almost entirely on information they received directly from vendors — they had to ask for help when they walked into the store. Now, 89% of B2B buyers rely on the internet to collect information about their potential purchases and 75% prefer a rep-free experience. Much like consumers who prefer to explore their options on their own, B2B buyers now have the freedom to “roam the aisles” researching their purchases online.

Data show that today’s B2B buyers resist early outreach from sales teams — they are defensive. Despite the best efforts of revenue teams, many buyers prefer to shield themselves from unsolicited contact, carefully guarding their buying process until they’re ready to engage.

Yet, many revenue teams continue to push for premature interactions, flooding potential buyers with outreach before they’re ready. The result? Marketers and sellers waste their efforts knocking on the doors of buyers who had already drawn the blinds and retreated to their safe rooms to deliberate in peace.

In this report, we dive into the data behind what we call Defensive Buyer Syndrome — the tendency of B2B buyers to avoid sellers until they’ve defined their requirements and reached a consensus on their preferred vendor.

Buyers Don’t Want to Raise Their Hands

The first piece of evidence signaling a buyer’s preference to stay anonymous is B2B’s infamously low form-fill rates. Past research has consistently benchmarked the rate under 5% of total unique website visitors. Unbounce reports 3%, Search Engine Land reports 3% to 5%, and WordStream reports 2.4%. Our own data, tracking nearly 1,000 B2B organizations over two years, shows form-fill rates under 4% both this year and last. These low rates hold across industries, product offerings, company sizes, buyer segments, and more (see 2024 Buyer Identification Benchmark).

There is still more critical context to consider: research from PathFactory shows that when visitors come from accounts that can be identified through de-anonymization techniques, only 15% to 20% of them fill out forms. Additionally, our own Buyer Experience Research over the past two years found that half or fewer buyers fill out forms on the websites of vendors they eventually buy from. Buyers want to browse anonymously.

The Buyer-Led Purchase Journey

Perhaps the most compelling evidence that buyers are defensive comes from the past two years of our research on the B2B buying journey, drawn from the experiences of over 3,500 B2B buyers worldwide.

In both years, buyers have told us that over two-thirds of their buying journey is complete by the time they directly engage sellers — regardless of the type of solution being purchased, the cost of the solution, the size of the buyer organization, the industry of the buyer and much else. Buyers of every purchase role (Champion, Financial Ratifier, Ultimate Decisionmaker, etc.) also report nearly identical points of first contact with sellers, indicating that the Defensive Buyer is not just one or a few people on the buying team, it is the buying team, collectively. This finding is so consistent that we have dubbed it the Point of First Contact Constant.

Buyers, working in teams of 10 to 11 internal stakeholders, spend over two-thirds of their purchase journey without sales reps. But, during this time, buyers are not only researching solutions and potential providers — they’re deciding. Over 80% of buyers say that their purchase requirements are mostly or fully defined before contacting sellers. They also rank their shortlist with their preferred vendor at the top, reaching out to the ultimate winner first over 80% of the time.

Only after buying groups have worked out their purchase requirements and reached consensus on a preferred vendor do they engage directly with providers. More than 80% of the time, buyers initiate that first contact with sellers. Only if sellers happen to reach out to buyers at around the time buyers are ready to engage will buyers respond to emails or calls.

Point of First Contact | |||

|---|---|---|---|

North America | EMEA | APAC | |

Buyer Initiated First Contact | 67.4% | 66.5% | 71% |

Seller-Initiated First Contact | 72.3% | 70.6% | 78.5% |

Buyers simply don’t respond until they are ready, and if they do respond prior to about 70% of the way through their journey, the data suggest it is bad news for the organization that reaches them early. Buyers who begin their contact with a losing vendor typically do so before the 70% mark.

Revenue Teams Make a Significant Investment to Reach Buyers That Are Not Ready

To be clear, buyers resist engaging, despite heroic efforts by BDR teams to reach them. In our 2024 State of the BDR research, BDRs reported making an average of 17 attempts to reach a prospect before giving up and moving on, while reaching out to six individuals at each account they attempt. These attempts are distributed across social media, calls, and emails — coming at buyers from all angles.

The trouble is that most of these contact attempts are simply an effort to secure a meeting with the prospect. BDRs report requesting meetings in about 70% of their contact attempts. By now, however, we know that these attempts are largely doomed to failure.

How to Succeed with Defensive Buyers

We have seen so far that B2B buying groups are defensive. They do not fill in forms on vendor websites and do not engage with sellers until they have done their research, come to consensus as a team about their requirements, and picked a frontrunner for the business. Meanwhile, B2B revenue teams are exerting substantial effort to reach buyers who are largely either too early in their buying journeys or not in market at all. Below, we describe a different approach — one that is aligned to the buyer’s journey and their expectations.

Journey-Aligned Marketing: Not a Future Goal, But a Present Necessity

Journey-aligned marketing starts with the understanding that most potential buyers are not presently in market. Our In-Market Buyers Study found that only 5% to 11% of buyers are typically ready to buy in any given quarter. The now-famous 95-5 Rule from the Ehrenberg-Bass Institute refers to the most common in-market percentage – five – and provides a formula for calculating the in-market percentage.

Instead of luring curious, out-of-market buyers to fill out web forms, only to hound them with sales calls before they’re ready, teams should leverage intent signals to pinpoint which accounts and buying groups are actively in the market. Doing so allows marketers to focus higher cost, low-scale tactics and offers on the tiny fraction of accounts that are in market, while reserving enough budget to effectively build brand preference in the accounts that are not yet in market.

Then, by making relevant content easy to find and consume, marketers position their brands as trusted, value-adding partners, boosting preference for their brand and solutions. This approach is not only more efficient, it aligns with expectations buyers import to B2B purchases from their consumer experiences. Buyers expect to be able to shop anonymously, educate themselves and form opinions on their own. The B2B organizations that empower buyers to engage on their own terms will have a substantial advantage.

The Great Gate Debate Is Over: Don’t Gate

We have already seen that B2B buyers are reluctant to fill in forms. As a result, gating content not only restricts access but also undermines the buyer’s autonomy, while pushing them toward competitors who allow them to self-educate without barriers.

Buyers form strong opinions about you and your competitors based on the information they gather before engaging with your team. This means it’s crucial to provide all the content they need to make an informed decision before they even consider reaching out. Providers who excel at offering open, ungated access to valuable content — addressing the specific needs and questions buyers have throughout their journey — will gain a significant competitive advantage, all else being equal.

The data are in. Buyers are defensive and want to make decisions on their own. They also feel empowered to do so. The solution to operating effectively in this reality is simple: remove the gates, respect the buyer’s journey, and position your company as a trusted resource long before direct engagement happens.

A Modern Strategy for BDR Teams

Instead of pushing for a demo or discovery call before buyers are ready, BDRs and sellers should shift their focus to enabling buyers through education, insights, and experiences that support them at each stage of their buying journey. This approach respects the buyer’s autonomy while providing the resources they need to progress naturally through their decision-making process.

Providers lose nothing by adopting this approach — buyers won’t engage until they’re ready anyway. But by consistently offering value through non-intrusive means, providers can position themselves as trusted partners and set the stage for a more meaningful engagement when the time is right.

Encouragingly, sellers are starting to adapt. While BDRs still ask for meetings in about 70% of contact attempts, relationship-building activities — like sharing educational content and inviting prospects to strategy sessions with subject-matter experts — are becoming more common. Our 2024 State of the BDR Report shows that these value-driven interactions now happen in slightly more than half of their calls.

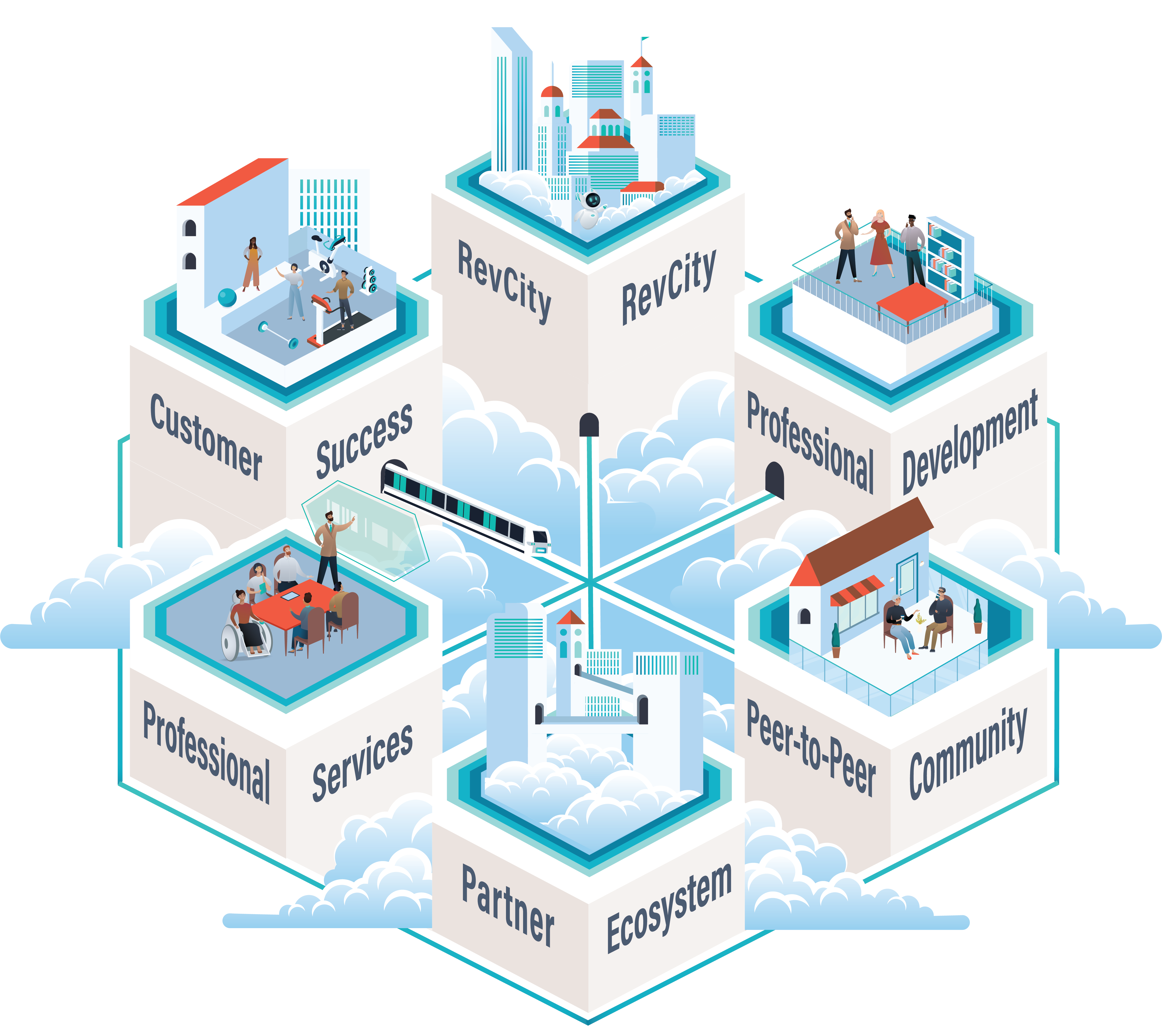

Affinity Communities

Online affinity communities can be relatively inexpensive to develop and maintain but may require a substantial investment of time. Online communities centered around the common interests of the buying audience, such as functional leadership (e.g., IT leaders, chief marketing officers, office managers), provide a venue for networking, sharing ideas, and giving members a sense of belonging.

Through sponsoring such communities, provider companies establish themselves as valued members of the communities they serve apart from simply being vendors. Even more, such communities establish relationships between the members of the community, the brand, and even individuals inside the brand. All of this may play a crucial role in establishing brand preference in the minds of key decision makers in prospect accounts.

Care must be taken to ensure that affinity-based communities are perceived as genuine and not as marketing or sales tactics. A clear distinction must be maintained between the vendor, its solutions, and the communities it sponsors.

Customer Communities

Many B2B companies establish customer communities. Customer communities do not require a divide between the community and the brand. Instead, they should offer existing customers the same type of opportunities that affinity communities offer, while also building a connection between customers and the brand.

As with affinity communities, customer should prioritize opportunities for customers to connect with each other as much as with the brand itself.

When prospects are invited to attend customer community meetings, they get a preview of the experience of being a customers. When executed well, these experiences can generate brand preference and spark relationships between customer, prospects, and provider teams.

Many companies employ known industry experts to create and publish thought leadership content, speak at industry events, and engage directly with buyers who would not otherwise engage with provider representatives. For example, former industry analysts with a history of providing thought leadership on topics relevant to a company’s customers and prospects may be engaged by prospects and customers alike for high-value strategy discussions, even in situations where provider sales representatives are not welcome.

These subject matter experts can be engaged to speak at industry events and publish content in independent industry publications and online forums, furthering the reach of the brand and continuing to deliver value to prospective customers beyond the confines of an active buying process.

As with affinity communities, it is important that SMEs and thought leadership content not be perceived as overly partisan. Ideally, both SMEs and published thought leadership will provide value to the buying audience on topics that are not strictly related to the use of a company’s product but will also provide more general guidance to assist the buying audience in their jobs and careers.

Where decision makers that are engaged in the earlier stages of a buying process would decline an invitation to a sales conversation, they are often much more inclined to attend an event such as a dinner, wine-tasting, or educational event that allows them to interact with peers, learn, and have pleasant, memorable experiences. Whether employed by the vendor directly or brought in as needed, subject-matter experts may be engaged to speak to audiences at these events, reinforcing the association of the brand with value.

Events that are more geared to current customers may provide similar opportunities for prospects to engage. Early-stage prospects that would not agree to sales meetings also frequently welcome the opportunity to meet peers, network, and learn more about solutions in a group environment.

Industry events, long a staple of B2B revenue team tactics, whether sponsored by associations, publications, or analyst firms, provide an excellent venue for bringing early-stage buyers together with vendor personnel and current customers

Another powerful resource companies can provide their buying audience is to make customers available to them. Providers may establish a network of customers who are willing to share their time and experience as a customer with potential buyers. Key to providing this resource is establishing a low-friction mechanism for potential buyers to identify customers to speak with. Ideally, buyers will be able to identify contacts without first speaking with sellers.

Take-Aways

Across two surveys spanning three global regions and nearly 3,500 participants, B2B buyers have made it clear: they want to navigate their buying journeys on their own. Even when they are part of active buying groups, they are highly unlikely to fill out forms on vendor websites. And though BDRs blanket those that do fill in forms with countless calls and emails, more than 80% of buyers ignore their entreaties until they have already established their requirements and picked a favored vendor.

The only sensible interpretation of these findings is that buyers do not want to be influenced by sellers until they have reviewed the available information about the potential solutions, engaged trusted advisors, and negotiated a consensus among buying group members. Buyers guard this process, defending it from outside influences that might have an agenda that is not aligned to their own.

But, provider organizations are not helpless. The winning formula is clear.

- Create content that helps buyers understand the brand and solution differentiators.

- Make that content freely available to whomever might be interested.

- Identify which accounts are in market.

- Focus compelling, high-value demand capture tactics and offers on those accounts and buying groups.