Expired data in your CRM can cost you millions of dollars in revenue and countless wasted people-hours on dead leads. The cause of this is data decay, or the deterioration of the quality of a database. Research shows that the average monthly B2B contact data decay rate is 2.1%. That doesn’t sound like much, but that translates to an annual rate of 22.5%. Meanwhile, a shocking number of B2B organizations continue to remain ignorant of the impact of data decay.

Don’t let data decay happen to your organization. Read on to learn more about what it is, how it can hurt your bottom line, and what you can do to prevent it.

The Causes Of Data Decay

Data can go bad due to mechanical decay or logical decay.

Mechanical data decay is what happens when data is corrupted or erased. Hard drive failures are the most common cause. Other forms include damaged servers and cyber-attacks. Though it sounds frightening, mechanical decay is easy to prevent with regular data backups and strong cyber security.

Logical data decay is trickier to deal with. It’s what happens when the data in your database becomes outdated or incorrect due to the time-sensitive nature of the data.

Some common forms of logical data decay include:

- Outdated information

- Misspellings

- Duplicate entries

- Inaccuracy/lack of specification

- Misinterpreted data

- Lack of new data, and so on

Of these, outdated information is the most common challenge. People move, switch jobs, change phone numbers, change their names after marriage, and so on. These are all common occurrences, making it inevitable that your database will become outdated over time.

Preventing logical data decay is challenging because outdated data must be first identified and segmented before it can be updated. The process of identifying inaccurate data is time-consuming. By the time you’re done checking each contact’s information, the data could be outdated again already.

The Types of Logical Data Decay and Their Cost

#1 Contact Data Decay

Contact data should be considered “fresh” for no longer than 90 days.

Fresh contact data is critical for preventing your outreach from ending up in a “black hole” inbox — with no way to know whether it has been ignored, or if the address is inactive.

From your perspective, your lead just ignored your email, but they may have been an interested prospect. Not only is this a loss of revenue, but also a loss of your sales team’s time and energy.

Let’s estimate the annual loss in revenue due to contact data decay.

If the average monthly data decay rate for contact info is 2.1%, and you assume that you have 50,000 companies in your database, you can calculate the validity of your database after one quarter.

- Month 1: 50,000 * (100-2.1)% = 48,950

- Month 2: 48,950 * (100-2.1)% = 47,922

- Month 3: 47,922 * (100-2.1)% = 46,915

Within just a quarter, 6.17% of your database has become obsolete. This translates to almost 12% of your database in the half-yearly quarter, and about 22.5% by the end of the year. (Run this calculation with your own database size to understand the cost of contact data decay in your system.)

Of the 50,000 companies in this database, 11,241 of them have become obsolete by the end of the year. Let’s assume that at least 15% of those companies convert, each worth the average B2B ACV value of $1080.

Your total loss in revenue due to contact data decay = $1.82 million.

(Again, use your own conversion rate and ACV to see what a 22.5% shrink in potential pipeline means for you.)

#2 Funding Data Decay

Companies receiving investment funding are typically in the market to buy more technology, so funding info can be critical for discovering high-intent prospects. Due to the time-sensitive nature of funding data, the best time to get funding information is when it’s announced.

Assuming the same conditions as the previous calculations, but this time with 1% of your database receiving funding every month, let’s compound the number of leads you’ve missed out on:

- Month 1: 50,000 * (100-1)% = 49,500

- Month 2: 49,500 * (100-1)% = 49,005

- Month 3: 49,005 * (100-1)% = 48,514

Within a quarter, you’ve missed out on 2.97% of opportunities within your database by not staying updated about their funding info, despite its potential to point out your best active buyers. This translates to almost 5.85% of your database in the half-yearly quarter, and about 11.36% by the end of the year.

With 50,000 companies in your database, you’ve lost 5,681 opportunities throughout the year. Since companies that recently received funding are more likely to buy from you, let’s assume that at least 25% of those companies convert, each worth the average B2B ACV value of $1080.

Your total loss in revenue due to funding data decay = $1.53 million.

#3 Firmographic Data Decay

Firmographics refers to attributes such as company size, industries served, total revenue, market share, acquisitions, and other information that can help you profile companies.

Analyzing the performance of an organization is a crucial step in lead generation. However, this information can change over time and what was once a low-intent lead may have become a high-intent lead, and vice versa.

That’s why it’s important to stay up-to-date on the firmographic data of an organization. While not as time-sensitive as contact details or funding information, any form of data decay has the potential to take away from your revenue, so firmographics data decay cannot be ignored.

Assuming the same conditions as the previous calculations, but this time with 0.4% of your database changing firmographics every month, let’s compound the rate at which your database goes obsolete:

- Month 1: 50,000 * (100-0.4)% = 49,805

- Month 2: 49,805 * (100-0.4)% = 49,611

- Month 3: 49,611 * (100-0.4)% = 49,417

Within a quarter, 1.16% of your database has become partly unreliable. This translates to almost 2.32% of your database by the end of Q2, and about 4.79% by the end of the year.

Of the 50,000 companies in your database, 2,395 of them have become obsolete by the end of the year regarding firmographic data. Once again, let’s assume that at least 15% of those companies convert, each worth the average B2B ACV value of $1080.

Total potential loss in revenue due to firmographic data decay = $387,000

#4 Technographic Data Decay

Technographics is the profiling of organizations based on their current software stack, technology usage behavior, and software adoption/rejection.

Like firmographics, the decay of technographic data plays a less important role in lost revenue. However, this information allows you to infer which accounts are likely to convert into your customers based on knowledge of their current technology stack, past technology stack, and software usage.

Assuming the same conditions as the previous calculations, and a 0.4% monthly technographic data decay rate, your total potential loss in revenue due to technographic data decay can be calculated similar to that of firmographic data decay, which comes to $387,000.

The Total Loss in Revenue Due to Data Decay

Calculating the loss in revenue taking all four types of data decay into account, a company with 50,000 companies in its database, each worth an annual average ACV value of $1080, is subject to a potential average annual loss of $1 million in revenue due to data decay.

This figure is calculated using the lowest possible variables, however. The real cost varies depending on the type of company and the target market. In fact, the actual annual figure that companies estimate as loss in revenue due to bad data is $13 million.

Additional Risks Caused By Data Decay

There’s more than just lost revenue at stake. Data decay also leads to:

- Time and focus taken from sales reps

- Lower conversion rates

- Poor sales performance

- Increased email churn rates

- Damaged domain reputation

- Wasted marketing spend

Data decay impacts sales and marketing teams in ways that chip away at productivity, metrics, spending, and other factors that hurt revenue teams’ bottom lines.

The Remedy to Data Decay

To prevent data decay, your best strategy is to invest in a good data management system. People may move, tech stacks may change, and businesses may merge and get funded, but with a platform like 6sense to back you up, your database is always up to date. 6sense uses automation and AI to remove duplicate data, clean existing data, and acquire new information to keep your database fresh.

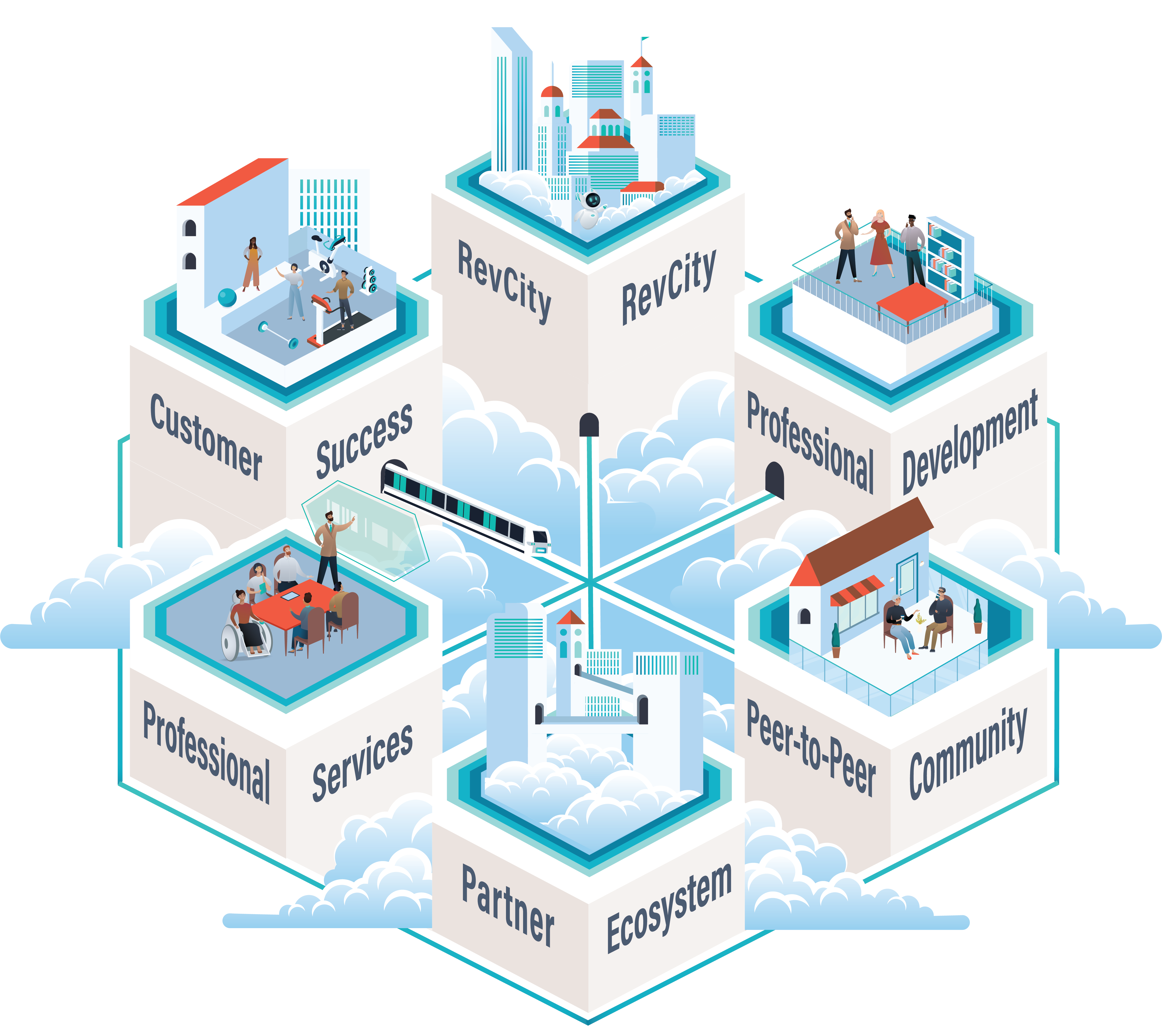

6sense’s data management and enrichment capabilities cleanse and enrich the data that powers your revenue team.

Powered by the most accurate, real-time data in B2B, 6sense aligns sales and marketing with a singular, comprehensive view of your accounts and buying teams.

Better data equals better decisions, and your revenue team will be empowered to make the right decisions when they can trust they’re working with the right data.