The blank slate theory of human nature held that:

- People were born without inherent differences in mental and emotional capabilities.

- Lived experience was responsible for virtually all differences in personality, behavior, and outcomes later in life.

This view pervaded the thinking of philosophers and social scientists from the 17th Century to the middle of the 20th Century.

The blank slate theory was well-meaning, but its bedrock assumption – that we are each born with identical capabilities – was a fallacy. We are all born with a unique set of capabilities. A more enlightened view sees these individual differences as our greatest strength and maintains that all people should have the opportunity to optimize their well-being and their contributions to society because of, not in spite of, those differences.

For the past two decades, the Blank Slate Fallacy of B2B Buying has pervaded B2B marketing and sales processes.

In this report, we describe how the Blank Slate Fallacy of B2B Buying shapes B2B revenue generation practices. We will show how we know it is a fallacy, describe what modern B2B buying is really like, and briefly discuss what must change in light of this new understanding.

The Blank Slate Fallacy of B2B Buying

The Blank Slate Fallacy of B2B Buying can be summarized as the belief that when organizations reach buyers, either digitally or in person, the buyer is essentially a blank slate — lacking knowledge of or experience with the provider or its competitors.

Both marketers and sellers fall prey to this fallacy:

- Marketers assume that when buyers begin their journey, they are unfamiliar with the provider and its solutions, thus experiencing the brand solely through current offerings, messaging, and campaigns.

- Sellers believe that the job of creating preference and winning deals begins at the moment they begin interacting directly with buyers (during the traditional sales process).

Buyers Are Not Blank Slates for Marketing

Most B2B Purchases Are for Existing Capabilities by Experienced Buyers

Traditional conceptions of B2B buying journeys imagine buyers as individuals seeking solutions they aren’t familiar with from companies they don’t know. Best practice demand marketers create content for various stages of the buyer journey, starting with “top of funnel” content like white papers that introduce the brand, the business problem, and the solution. Less advanced marketers create lead nurture campaigns that deliver content in a sequence, assuming buyers’ knowledge evolves progressively.

However, research indicates that this view of the buyer journey is deeply flawed. Most B2B purchases are made by buying groups, not individuals, and these groups consist of members with varying levels of knowledge about the business problem, available solutions, and providers. Critically, all buying group members do substantial independent research.

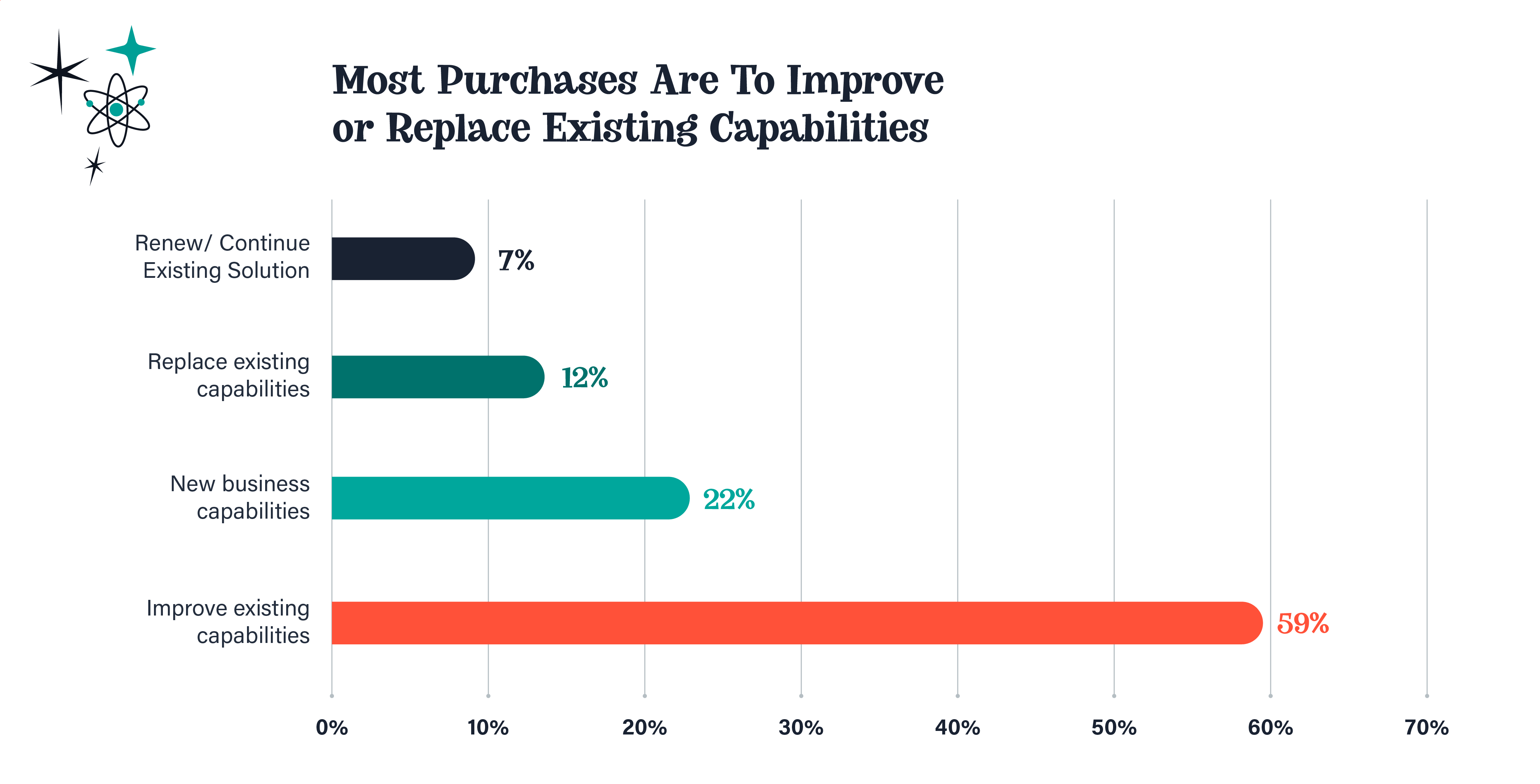

Our research shows that 78% of B2B purchases involve renewing, replacing, or enhancing existing solutions, rather than acquiring new capabilities. Therefore, most purchases are not about acquiring, for example, an enterprise resource planning system for the first time. Rather, they are about upgrading or replacing an existing one. Further, Bain’s research, published in the Harvard Business Review, supports the finding that buyers often purchase from providers that were on their list from day one.

By itself, this understanding challenges the blank slate assumption. Knowing this, it is unsurprising that 90% of buying group members say that they have prior experience with one or more of the vendors they evaluate.

As the chart below shows, more than 90% of buyers are likely to have experience with at least one of the vendors being evaluated. Even when buyers are acquiring solutions that offer completely new business capabilities, they are still more than 90% likely to have experience with one or more of the vendors being evaluated, and roughly half will have experience with the ultimate winner and at least one of the eventual non-winning vendors.

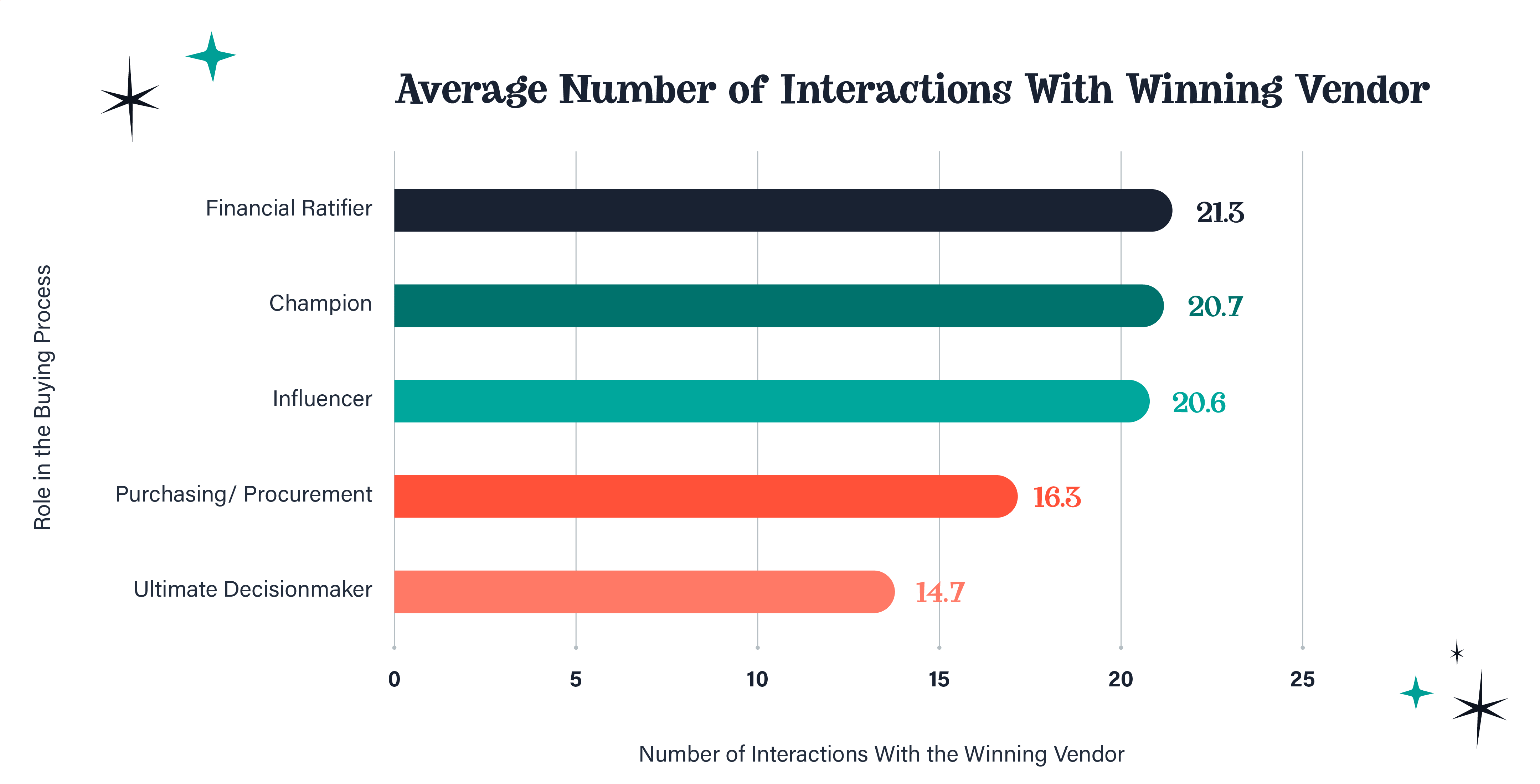

As depicted in the chart below, all buying group roles tend to have experience with the vendors to be evaluated. Buying group members in Financial Ratifier and Purchasing/ Procurement roles are just as likely to have experience with vendors being evaluated as Champion and Ultimate Decision-maker roles. Surprisingly, the buying group champion role is marginally less likely than the Financial Ratifier role to have experience with the vendors.

Why We See Buyers as Blank Slates

The Blank Slate Fallacy of B2B Buying has its roots in B2B history. Prior to the widespread use of the internet in B2B, buyers relied almost entirely on information they received directly from vendors. Most information buyers received from vendors came only through direct interactions with sellers. While this may seem like ancient history, buyers only gained reliable access to substantial product information in the late-2000s. Sellers were the guardians of product information during the early careers of many if not most of today’s B2B leaders.

This view of the buyer may persist in large part because most B2B buyers that are delivered to sellers from marketing are delivered as leads – as individuals whose only known interactions are the few actions they have taken place after filling in a form on the vendor website. Leads do not reflect most of the activity of those form-fillers, let alone their buying group teammates who did not fill in forms during their journey.

Buyers Are Not Blank Slates for Sales

The data from two years of our research across North America, EMEA and APAC clearly show that dialogues with buyers typically do not occur until two-thirds of the way through the buying journey (see the 2024 Buyer Experience Report for more detail). Prior to engaging with sellers, the average buying group member has been researching solutions for eight months and has had a dozen or more content interactions with each vendor they are evaluating. Our data also show that buyers talk with peers, consult a wide variety of non-vendor information sources, and that more than 70% of buyers engage third-party experts (analysts and/or consultants).

Far from being blank slates when they first engage with providers, by the point of first contact with sellers, more than 80% of buying groups have fully or mostly established their requirements. Buyers are so well informed by the time of that first interaction that they have been able to come to a consensus as a buying group about which vendors are on the evaluation short list, and which of the short-listed vendors is on the top of that list. That pre-contact favorite wins the deal more than 80% of the time.

And yet, B2B sales processes still treat the beginning of their interactions with buyers as the beginning of the buying journey. First-call sales decks reiterate marketing content by introducing buying group members to the company, the value propositions for relevant solutions, and introduce competitive differentiators.

There may be nothing wrong with ensuring that buyers experience a vendor’s tightly curated messaging and value proposition in a first live dialogue, but these engagements would undoubtedly be more productive were sellers to incorporate this new understanding of their buyers. For instance, by simply asking if they were the first vendor contacted, sellers would be able to realistically gauge their competitive position. Even more, hearing that they were not the first vendor contacted, sellers could immediately probe buying groups to get to the heart of where they stand competitively and how they might overcome a losing position on the shortlist.

The Blank Slate Yields to A Radical New View

This new understanding of the B2B buying process demands a radical rethink of B2B marketing and sales resourcing.

In a world where decision-making only begins after buyers and sellers start a dialogue, marketing can be seen as a junior partner in revenue production. This outdated view is reflected in how sales and marketing budgets are managed during downturns — marketing budgets are often the first to be cut, under the assumption that sellers can generate more conversations and close more deals without marketing support, often simply by trying harder.

However, this view is dangerously obsolete. During the first two-thirds of their buying journey, buyers create and rank a shortlist. They pick a favorite prior to talking to sellers and rarely change their pre-contact preferences. Even more, Bain’s work cited earlier, together with as-yet unpublished data of our own, make clear that buyers settle their evaluation lists very early in their buying journeys.

Given this, cutting brand and reputation marketing budgets may reduce near-term expenses, but will almost certainly reduce mid- and long-term revenue opportunities. Instead, organizations should amplify both brand and demand investments to maximize revenue from early-stage buying processes. Additional selling resources might be necessary to capture maturing pipelines, but this should be seen as expanding capacity, not merely preventing shortfalls.

The death of the Blank Slate Fallacy of B2B brings to the fore the importance of brand and reputation in B2B. The evidence is clear that buyers largely know the vendors they will be evaluating on day one of their buying journey. What buyers know and think of your brand on day one and even pre-journey is likely to make or break your chances to compete.

Finally, it is imperative that marketing organizations invest in tools, data, and processes to identify in-market buying groups as early in their journeys as possible. Getting on the day one list is but the first hurdle. Maneuvering to the top of it requires not only pre-journey reputation, but within-journey nurturing. Knowing which organizations are in-market allows providers to focus demand marketing efforts toward maximizing their yield from in-flight buying groups, and to build intelligence to contextualize future sales interactions.