Since last summer, the economic news around B2B has been dominated by tech industry layoffs, inflation challenges, the failure of Silicon Valley Bank — and a general sense that a broad U.S. recession was on the horizon.

Yet when we surveyed nearly 1,900 sales and marketing leaders and asked how they felt about their company’s performance, a different story emerged. Results suggest folks are meeting — or beating — expectations.

Let’s take a deeper look.

What We Asked

At 6sense Research, we’re curious about how people perceive their company’s financial performance. We’re especially curious about how the financial performance of an organization is related to its revenue generation practices.

So, about a year ago we started asking people who take our surveys, “How has your company performed financially over the past 12 months?” Respondents could choose from a range of answers from Well Below Expectations (1) to Well Above Expectations (5).

Back then, we immediately found that people whose companies leverage an ABM or target-account practice report 8% better financial performance than peers that don’t. Account- and opportunity-centric — rather than lead-centric practices — are simply better for B2B organizations.

(Since participants were asked to make a subjective evaluation, and two people in the same company could answer it differently, there’s a lot of room for “noise” in this data. That kind of noise makes it less likely, not more likely, that we would find a robust, statistically significant relationship between having an ABM program and financial performance.)

Now, a year later, it’s clear that what our survey respondents are saying doesn’t quite match what all those LinkedIn layoff posts have been saying:

Table 1: Survey demographics

| Time Period | Participants |

|---|---|

| Q2-2022 | 60 |

| Q3-2022 | 354 |

| Q1-2023 | 136 |

| Q2-2023 | 1298 |

| Region | Participants |

|---|---|

| APAC | 15 |

| Asia-Pacific | 5 |

| EMEA | 40 |

| Latin America | 16 |

| North America | 1764 |

Note: We collected data through three different surveys across a period of approximately 12 months, from Q2 2022 to Q2 2023. Participants were primarily from North America (1,764 of the 1,876). Total responses vary per question as not all participants answered every question every time.

Mixed Macroeconomic Signals

As the past year unfolded, we became increasingly interested in how our survey results compared to the state of the economy.

Economic slowdowns were pretty well underway by the time we first asked people our question in July 2022. The U.S. Federal Reserve raised interest rates in March 2022 to combat inflation. By July 2022, the Consumer Price Index (CPI) rose 9.1% year-over-year, the highest rate of inflation in 40 years.

Since then, user posts from LinkedIn and other social networks indicate that layoffs have been happening non-stop. And yet, overall unemployment rates remain essentially unchanged.

Traditionally, a 4% unemployment rate was considered to be “essentially zero.” Many U.S. states and the UK are at or below that level, and the average across Europe is around 6%, despite some countries, such as Spain, being around 13%.

So, the signals from the global economy were certainly mixed.

Factors Impacting Perceived Company Performance

In analyzing the survey results, we also decided to take a look at how survey responses differed by:

- Geography

- Fiscal Quarter in which the response was submitted

- Industry

- Company Financing

- Company Size

Performance by Geographic Region

Our sample was largely drawn from North America, so we wanted to understand whether geography played a role in how respondents perceived the performance of their companies.

As Chart 1 below shows, there was a small but reliable difference, such that respondents from North American companies reported slightly better performance than peers elsewhere.

Respondents said their companies were doing about as well financially as they expected them to do. And while a question about meeting expectations doesn’t give us real insight into whether sales forecasts were made or missed, it does strongly suggest that the bottom hasn’t fallen out.

Chart 1: North America vs. world

Performance by Quarter

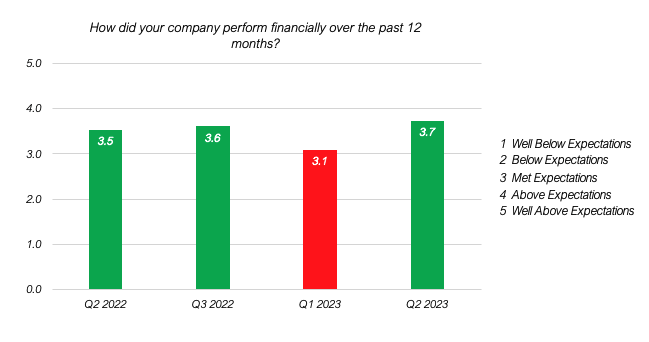

When we break down responses by calendar quarter, we do see a statistically meaningful drop in performance in Q1 2023, but that wasn’t when the economy supposedly took its first dip, and this drop didn’t last. By Q2 2023, results were back to prior levels.

In fact, it would be reasonable to read Chart 2 as saying that folks are reporting their companies have exceeded expectations, if only just by a bit, in all but Q1 of 2023.

Chart 2: Financial performance over time

Note: In Chart 2, only Q1 2023 is statistically distinct from the other quarters.

Performance by Industry

Chart 3 offers further insight, parsing responses by the industry of the participant. The important takeaway here is that Tech & Software companies were underperforming compared to other industries. It also explains why professionals in the tech industry might feel differently about the economy than everyone else.

Chart 3: Financial performance by industry

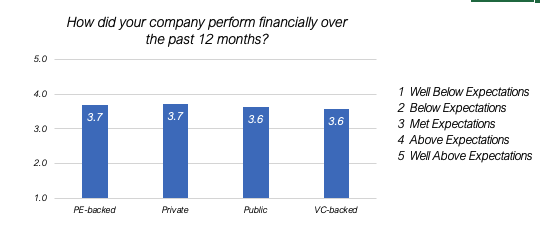

Performance by Company Financing

6sense Research had certainly heard reports of venture capital and private-equity funding becoming more difficult to obtain, so we examined whether a company’s primary source of funding was a factor in how they were performing. The answer is no.

This doesn’t speak to whether funding became hard to find — by all accounts, it was. But those who were financed through venture capital or private equity haven’t fared differently than their publicly-traded or private company peers.

Chart 4: Financial performance by company funding

Note: None of these differences were statistically different from one another.

Performance by Company Size

Next, we wondered whether company size might have something to do with how companies performed. Here, we did find two differences, in that the largest companies (greater than $250M) performed somewhat better than those in other categories. Also, companies in the $1M to $10M range underperformed their peers in the largest two categories. These differences were small, but reliable.

Chart 5: Financial performance by company size

Note: Companies greater than $250M in revenue report better performance than any of the other categories. Companies in the $1M to $10M range performed below the two larger ranges.

How’s Your Company Doing?

The survey results we’ve received so far indicate that:

- If you’re in tech, performance is okay, if only barely.

- If you’re in other industries, performance has actually been pretty good.

The survey is still active, and we’d like your input. We’ll continue to track the responses and report on the results.