In high-stakes situations—whether in diplomacy, corporate negotiations, or even personal matters—backchannels are informal, behind-the-scenes lines of communication that help move decisions forward. For example, in diplomacy, discreet discussions between trusted intermediaries often take place before or even during formal negotiations, allowing parties to clarify terms, address concerns, and build trust away from public scrutiny.

These backchannels aren’t about secrecy for its own sake. Instead, they create opportunities for candid conversations that resolve doubts, test ideas, and set the stage for more formal engagements.

In B2B buying, we’ve discovered a similar dynamic. Buyers frequently engage with non-sales personnel—such as subject-matter experts or executives—through informal interactions that help them answer questions, validate decisions, and refine their purchase requirements long before they speak with a sales team.

The B2B Backchannel

Over the past two years of our research on B2B buying, we’ve heard from over 3,500 buyers that they spend more than two-thirds of the entire buying journey—from initial research to final purchase—without engaging with a sales representative.

Our data also indicate that buyers are holding off on seller engagement until they have reached consensus on a preferred vendor and fully or mostly defined their purchase requirements. It’s a substantial amount to accomplish independently, yet buyers manage to do so in over 80% of purchases.

This independence challenges common marketing and sales assumptions — that buyers begin their journeys as essentially blank slates, unfamiliar with providers or their competitors. In reality, buyers are far from uninformed when they start their journeys. Our research shows that over 90% of buyers have prior experience with at least one vendor they evaluate, and that 4 out of the 5 vendors they will evaluate are on their shortlist from Day 1 of their buying journey.

Given this level of familiarity, and the fact that buyers are able to progress so deeply in their buying processes without talking to sellers, we wondered whether buyers might use their own backchannels to further their buying processes?

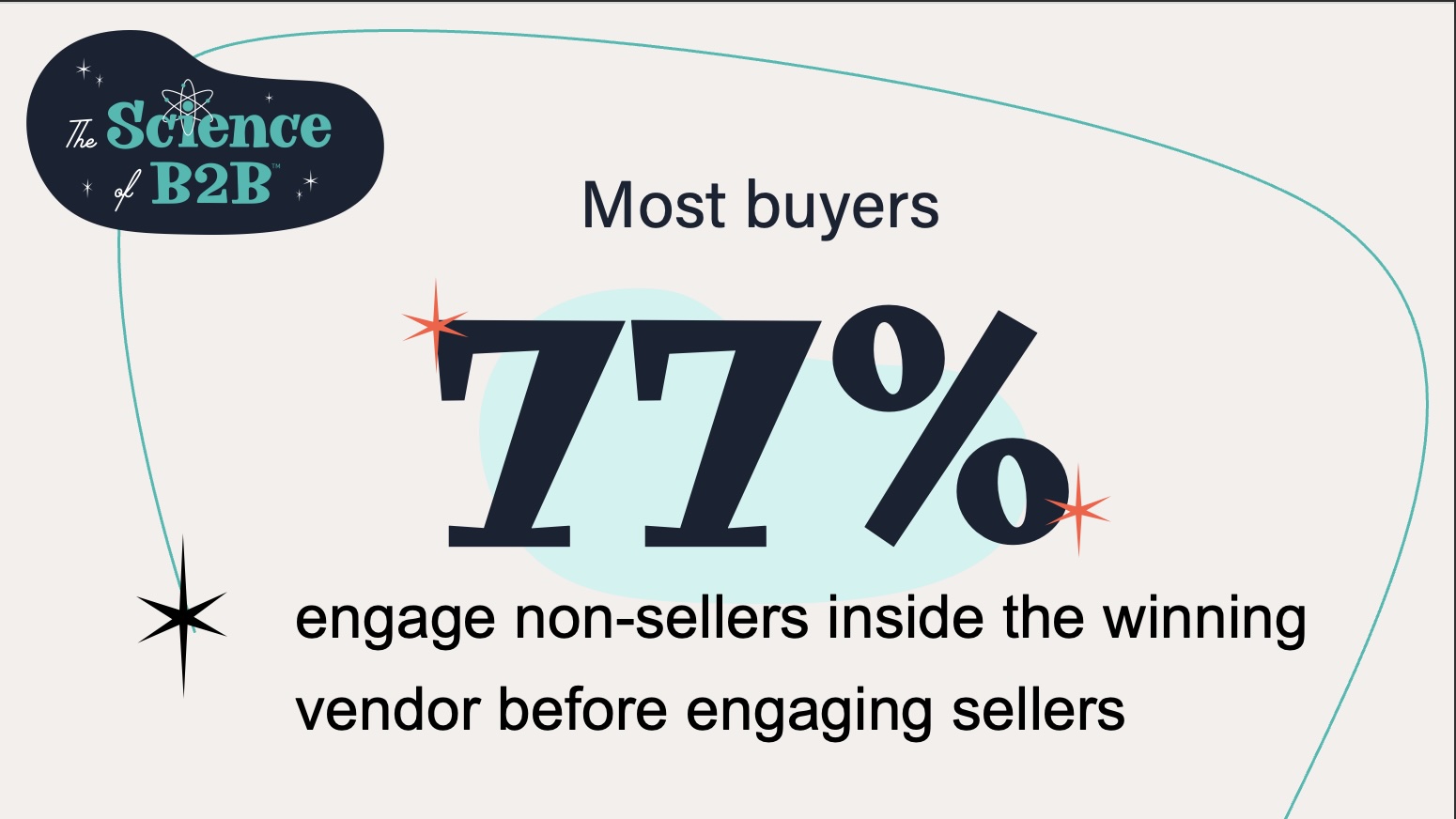

Indeed, in our most recent survey of buyers, we were surprised to find that although most buyers do not engage with sellers until 69% of the buying cycle has passed, many do connect with vendor organizations earlier—but with individuals outside of sales roles.

An astounding 77% of buyers reported having conversations with non-sales personnel, such as subject-matter experts or C-suite executives, from the vendor they ultimately purchased from. Meanwhile, 70.4% of buyers had these conversations with vendors they did not ultimately choose. Thus, most buyers (70% or more) connect with multiple vendors on their shortlist, if not all, before turning to sellers.

While buyers rely on a broad array of resources during their decision process (we surveyed them on over 20 options, and each were leveraged by 68% to 83% of buyers), these conversations with non-sales personnel appear to serve as a vital catalyst in shaping buyers’ purchase requirements and narrowing down their preferred vendor.

In this article, we take a closer look at this 70%+ of buyers to understand who is most likely to seek these conversations.

Isolating What Drives Backchanneling

For this analysis, we used logistic regression to measure how much each factor in a buyer’s purchase contributes to the likelihood of backchanneling. Logistic regression allows this by holding all other factors in the model constant—essentially applying the principle of “all else being equal”—to pinpoint the individual effect of each factor.

Software Purchases Trigger Nearly Double the Backchanneling

Among all the factors analyzed, the type of solution—specifically, software—was the strongest predictor of engaging in these conversations. All else being equal, buyers of software are nearly twice as likely to engage in backchanneling compared to buyers of other types of solutions.

If a hypothetical company were buying two products, one software and one of another type, for the same price, evaluating the same number of vendors, and with other factors also being the same, we would expect the individuals buying the software to backchannel twice as often as the buyers of the other product.

All Roles Backchannel, but Senior Roles Backchannel Less Often

Next, our regression analysis showed that each role in the buying group—Champions, Ultimate Decision Makers, Financial Ratifiers, Influencers, and Purchasing/Procurement—has an equal likelihood of backchanneling.

Interestingly, the regression model indicated that, all else being equal, senior members of buying groups are less likely to engage in backchanneling than those in junior positions.

How Real-World Context Shapes Backchanneling

While logistic regression helps isolate how individual aspects of a purchase influence a buyer’s likelihood to backchannel, real-world buying decisions are far more complex. In practice, all else is rarely equal. Buying processes are shaped by many overlapping factors.

In this section, we’ll explore how common factors in the buying journey overlap and shape backchanneling behavior in the real world, helping us see why actual behaviors sometimes look different than what the models predict.

The Trifecta – Price, Vendors Evaluated, & Buying Group Size

Throughout our research on B2B buying, three factors – the price of the solution being purchased, the number of vendors evaluated, and the size of the buying group – have consistently played a pivotal role in shaping key aspects of the buying journey. For example, each of these factors influences buying cycle length more than the buyer’s company size or industry.

It follows then, that these same factors also influence backchanneling behavior. Buyers making larger investments, evaluating more vendors, and working within larger buying teams face higher stakes, more options to weigh, and more opinions to reconcile. Backchanneling appears to be a valuable tool in these complex purchases, enabling buyers to validate their decisions, gain different perspectives, and build confidence before formally engaging with sellers.

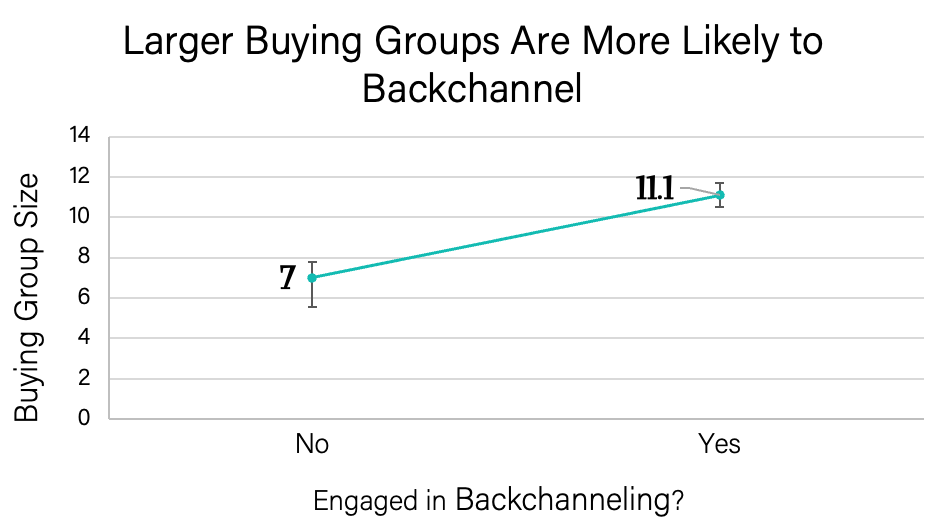

There is a statistically reliable difference in group size between those who backchannel and those who don’t. On average, those who backchannel have internal buying groups of 11 people, compared to 7 people for those who don’t.

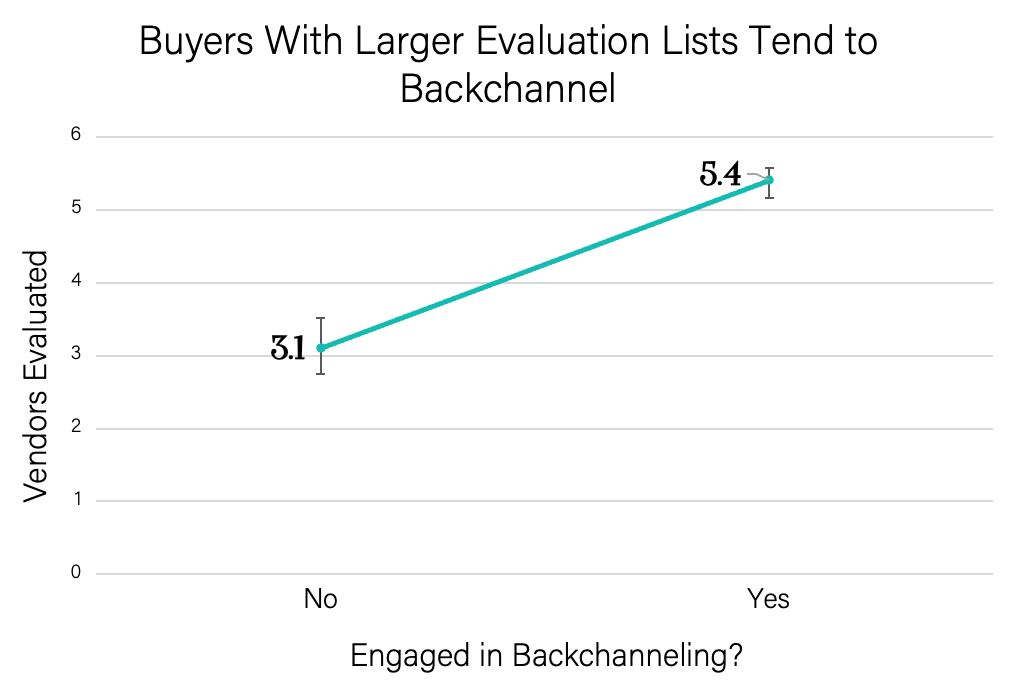

Buyers who backchannel evaluate an average of 5.4 vendors, compared to 3.1 for those who don’t—a statistically reliable difference.

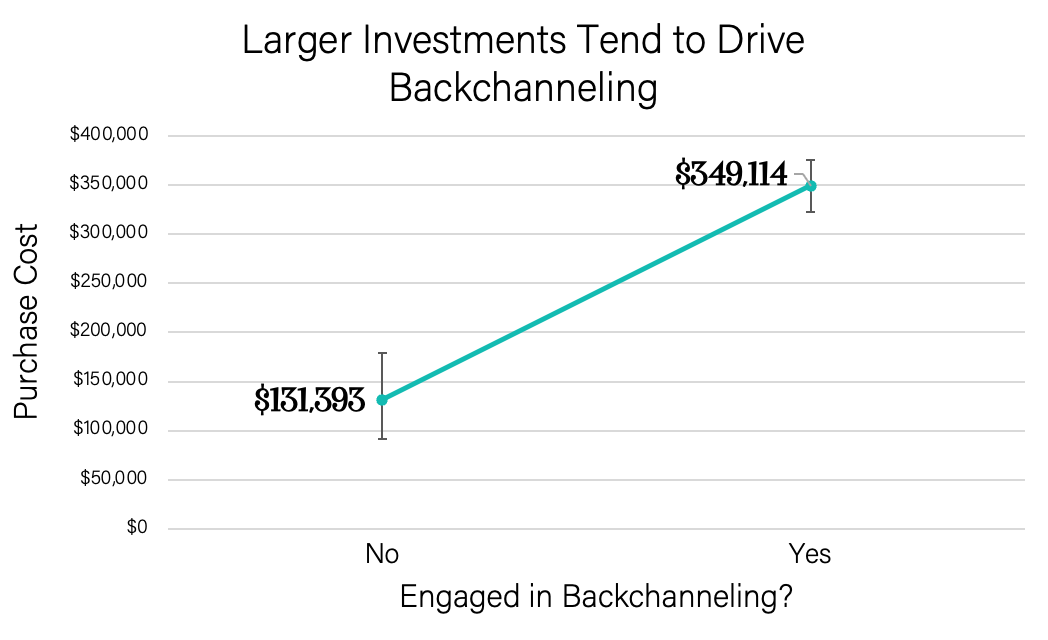

Those who backchannel tend to make bigger purchases, around $350,000, while those who don’t backchannel tend to make smaller purchases, around $130,000—a statistically reliable difference.

Throughout our research, we have also observed that certain types of solutions tend to push these factors—price, number of vendors evaluated, and buying group size—to the higher end of the scale. Services and software purchases often involve more costly investments, driving buyers to evaluate more options and involve larger teams in their decision-making process. In contrast, hardware and machinery purchases typically fall on the lower end of those scales, requiring smaller investments, fewer team members, and the evaluation of fewer vendors to reach a decision.

As noted earlier, while software alone nearly doubles a buyer’s likelihood of backchanneling, the natural distribution of our sample—where many aspects of the buying journey overlap—shows that services and software buyers have nearly identical rates of backchanneling. This reflects the fact that services purchases in our survey tended to be more expensive, and to have larger buying teams and longer vendor shortlists that software purchases—which amplified backchanneling activity among services buyers compared to that of software buyers.

We see similar patterns when examining buyer roles and seniority. Earlier, the logistic regression showed that every buying team role—Champions, Ultimate Decision Makers, Financial Ratifiers, Influencers, and Purchasing/Procurement—has an equal likelihood of backchanneling. It also showed that senior-level individuals are less likely to backchannel when all else is equal.

However, in our sample where all else is not equal, Financial Ratifiers are statistically more likely to backchannel than Ultimate Decision Makers (see below).

In the chart above, the only statistically reliable difference in backchanneling rates is between Financial Ratifiers and Ultimate Decision Makers. Differences between other groups are not statistically reliable. This means that any differences across these other groups could be due to chance, so we cannot confidently conclude that they reflect real patterns in the broader population.

However, this is only because Financial Ratifiers are more likely to be involved in the type of deals where backchanneling is more common. For example, Financial Ratifiers are more likely to be involved in Software and Services deals, which frequently focus on acquiring or improving capabilities—situations that lead to more backchanneling. Thus, the higher backchanneling rates for Financial Ratifiers are a result of the contexts they operate in rather than an inherent tendency to engage in backchanneling more frequently than Ultimate Decision Makers. If both roles were involved in the same types of deals at the same frequency, they would backchannel at comparable rates.

Financial Ratifiers in our sample were more likely to be reporting on software or services (higher-complexity) purchases than the Ultimate Decision Makers we surveyed.

Financial Ratifiers tend to be involved and to backchannel when their organization makes a purchase for new business capabilities or to improve existing capabilities.

Most of the software and services purchases Financial Ratifiers were apart of involved acquiring new business capabilities or improving existing capabilities.

Next, the regression model showed that, if all else were equal, senior buying group members would be less likely to backchannel. However, as solution prices increase, those senior-level individuals become more likely to get involved. Naturally, larger investments often demand higher-level oversight to mitigate risks and ensure alignment with organizational priorities.

In our sample, purchase prices were distributed across a range that resulted in individuals at all organizational levels being equally likely to engage in these conversations. But in typical real-world scenarios, higher-level individuals are more likely to participate when larger investments are at stake. If price weren’t a factor, we would see less involvement from senior-level members overall, as suggested by our logistic regression.

In Summary

Throughout this paper, we have examined factors that make backchanneling more or less likely.

Software Buyers Are Naturally More Inclined to Engage Early

All else being equal, buyers of software are nearly twice as likely to engage in early conversations with non-sales personnel compared to buyers of other solution types.

Complex Purchases Drive Backchanneling

Complex purchases—with higher price tags, evaluation of more vendors, and larger buying teams—create a compounding effect that increases buyers’ likelihood of backchanneling, as seen with services buyers.

Role and Context Matter

Financial Ratifiers engage more often in backchannel conversations because they are more likely to be involved (90%) in purchases where these conversations happen frequently—such as services and software. In contrast, Ultimate Decision Makers participate in these types of purchases less often (70%), which helps explain their lower rates of backchanneling. If all else were equal, every role on the buying team would have an equal likelihood of backchanneling.

Does Participation Decline as Seniority Rises? It Depends on the Context.

If all else were equal, higher-level individuals would be less likely to participate in pre-sales conversations. However, in the real world, things like price are not held constant – in buying journeys that involve larger investments, senior-level individuals are more likely to be involved, and therefore more likely to engage in pre-sales conversations.

Implications

In roughly 80% of B2B buying processes, buying groups don’t talk to sellers until they have chosen a favored vendor. But nearly three-quarters of buyers are backchanneling, making the backchannel a potent source of information for buyers and a powerful selling tool for vendor organizations.

Unseen and unmanaged, however, organizations cannot anticipate, manage, or optimize the buyer backchannel. It appears that much of the backchanneling that occurs likely happens between buying group members and individuals inside vendor organizations that the buyers have met during previous buying processes. These buying processes may happen between individuals who have been involved in prior buying processes for the companies they are with today, but may often have occurred while both parties were working in other organizations.

Given the size of B2B buying groups, predicting where potential backchannels may occur may not be possible. However, we do know that software vendors are more likely to experience backchanneling, and we know that as purchases become more costly, backchanneling becomes more likely.

This suggests that organizations should do two things:

- In future research, we will examine which members of a vendor organization are likely to be backchannels. In the meantime, it seems wise for vendor organizations to establish training for all personnel on how to handle backchannel communications effectively.

For example, all personnel who are likely to become a backchannel should be trained on which backchannel communications should be surfaced to the marketing and selling teams? This would include any roles that are typically involved in sales process, plus subject-matter experts that have a public personas and so are easily identified by buyers. These individuals could also be trained on how to tactfully ask whether it might be appropriate to involve a seller or other resource to handle questions.

Marketers and sellers should be trained on how to respond effectively to backchannel communications that are reported. While buyers would probably not welcome outreach from sellers in response to their backchannel communication, there may be situations in which it is appropriate. There may also be a role for marketing to deliver appropriate messaging in response to a backchannel communication. - Create simple processes for backchannel individuals to record these communications. Recording these conversations to account or opportunity records in CRM would be ideal. Where that is not feasible, something as simple as an email box or internal chat channel that could receive brief messages from backchannels might suffice. These repositories can be monitored by human or AI resources and attached to CRM records to inform future marketing and selling efforts.

Skip to content

Skip to content