A global financial services provider with a diverse product portfolio needed to scale up their digital marketing efforts to continue on their revenue growth trajectory.

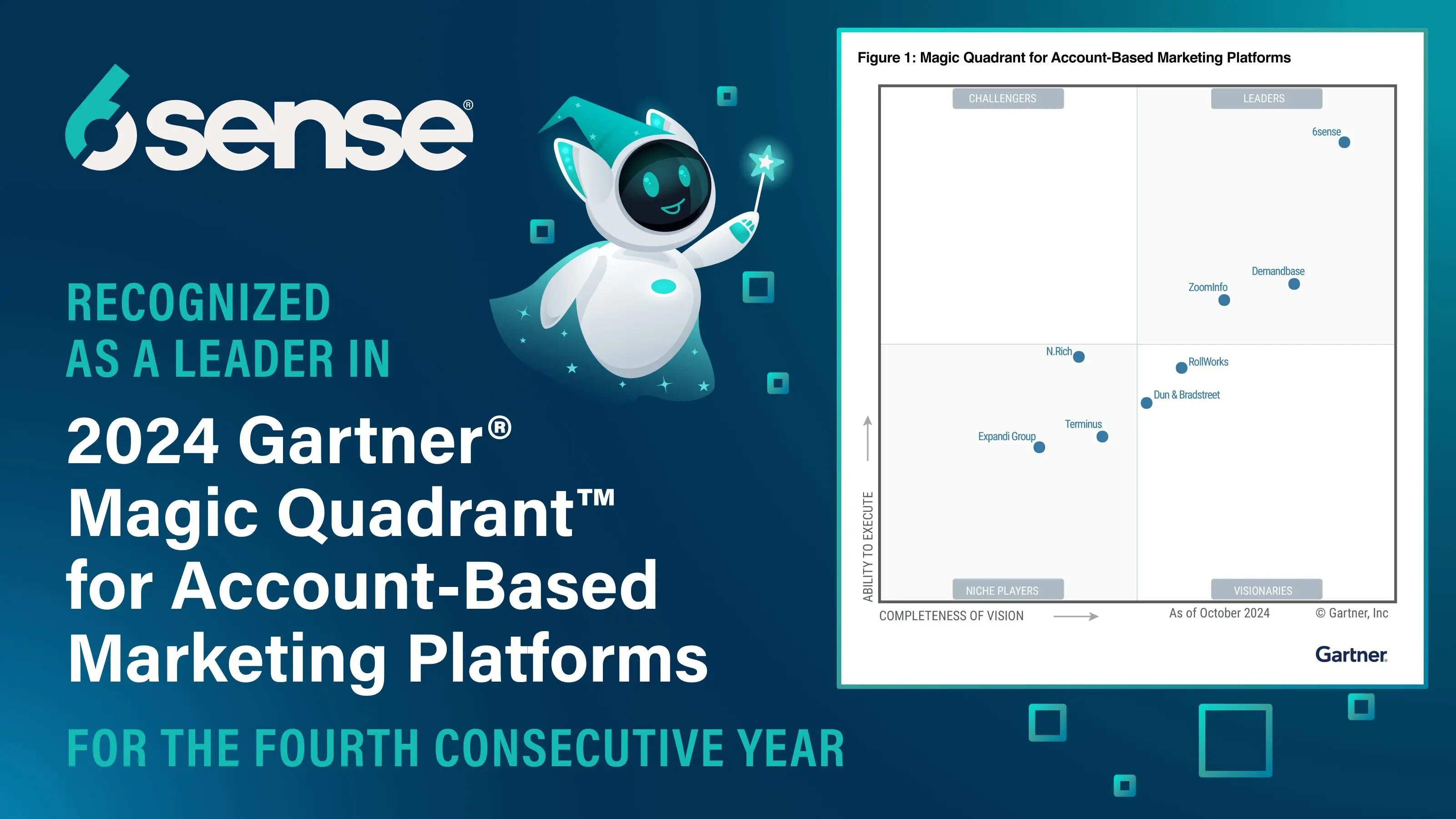

The company’s CMO spearheaded the search for an ABM platform to modernize their go-to-market strategy and drive their sales and marketing tactics with data, not guesswork.

The following explains how this financial giant generated a 262% increase in sales by launching an account-based initiative and eliminating revenue team silos with 6sense.

The Challenge: Operating in Silos

As this company’s stakeholders researched potential solutions, they soon realized their existing technology stack couldn’t support an account-based approach. This company had a fragmented process, different tools for different purposes, and relied too heavily on traditional channels rather than data.

At the time, the company’s marketing and sales teams weren’t communicating effectively. Additionally, the revenue team didn’t personalize or customize their sales and marketing engagement since they didn’t have deep data about their accounts (and those accounts’ concerns).

As their need for a modernized tech stack with intent data grew, they turned to 6sense. The concept of the Dark Funnel™ resonated with the marketing team. The Dark Funnel™is anonymized buyer intent data that revenue teams are typically unable to access on their own, such as what accounts are visiting their website or researching competitors. These account-level intent signals, when de-anonymized by 6sense, are made even more powerful with 6sense Revenue AI™, which streamlines workflows, uncovers hidden sales opportunities, and prioritizes accounts ready to buy.

Steps to Activation

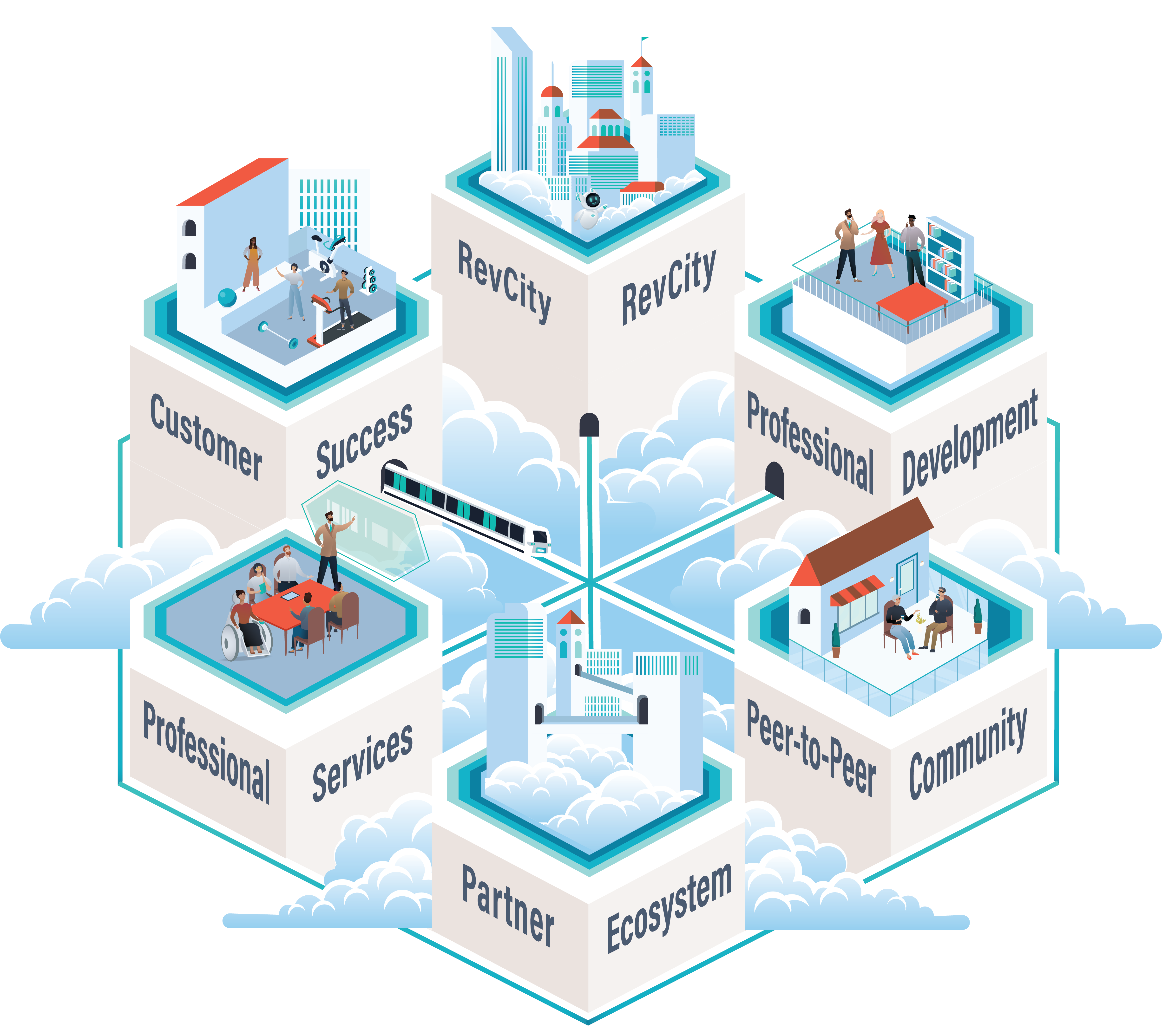

The company’s total addressable market (TAM) covers a wide span of companies of many sizes, across many industries. 6sense enables marketers to create highly-personalized, relevant go-to-market strategies for all opportunities within their TAM.

When targeting larger, enterprise-sized companies, 6sense intent data helps marketers narrow down opportunities to accounts that are in-market and actively searching for a financial service solution. With 6sense, marketers then build segments to target accounts that have visited the company’s website to launch digital ads and personalized marketing campaigns.

With smaller, commercial-sized companies, they don’t need to narrow opportunities, but instead use 6sense intent signals to deliver the right message at the right time to the right people.

This company leverages 6sense in many industry-specific use cases, but one of the most impactful is with custodians.

Achieving Personalization at Scale

The company works with custodians, financial institutions that hold and action customer securities when an individual trades assets. A change in custodian can cause potential disruptions for advisors and end clients. Using 6sense, they proactively seek out custodian changes to target the firms in a time of need and provide the appropriate solutions.

They then receive a notification when a custodian changes. This triggers the company’s revenue team to build a segment within 6sense to target those specific to this audience through an omnichannel — personalized digital ads coupled with direct mail, an approach that’s led to great success.

The marketing team has a library of evergreen-targeted ads that respond to a multitude of scenarios, such as changes in the market. With ready-made and legally approved content in their ad library, they can launch a campaign that responds to any quick market change — for example, if the market drops suddenly — within a day. This is typically accompanied by targeted outreach from a sales representative.

“Taking action real-time is critical for us, so 6sense empowers every marketer to successfully go to market within their segment,” the CMO explains.

Focused sales outreach coupled with timely messaging is the perfect example of the company’s revenue organization operating as one united team with a single goal: targeting the right people at the right time with the right message.

“We’ve found real success with a hands-on-keyboard approach, using 6sense, to go to market,” the CMO says.

The Results: A Unified Revenue Organization

The financial giant used a pilot team to build a new business model with sales and marketing. After six months in a new segment, the pilot team experienced:

- 262% increase in sales

- 528% increase in client lifetime value of assets under management

These results were entirely driven through digital channels — 6sense intent signals coupled with Salesforce to aggregate other data sets, and Tableau as their business intelligence tool. Once leads were qualified, one sales representative supported and drove the sales cycle.

The company’s entire revenue organization moved from one suffering from fragmented processes to a team aligned on intent data, fueling targeted marketing campaigns coupled with focused, personalized sales efforts.

The shift to a unified revenue organization challenged the company’s traditional marketing tactics, empowering them to operate with a modernized approach. The result: accelerated revenue growth.

The CMO advises organizations preparing for a big transformation, “Don’t be afraid of taking the risk. Challenge the status quo to change the way people think…That’s where you’ll see results.”

Skip to content

Skip to content