Zywave, a provider of software for insurance agencies, has long been an innovator in the insurance technology space. But in 2022, Zywave leaders identified a creaky internal blocker that could have weakened their commanding position: a 25-year-old customer database.

Additionally, over the past few years filled with rapid M&A activity, inconsistencies, and obsolete data infested their database — further compounding the common challenges associated with CRM hygiene.

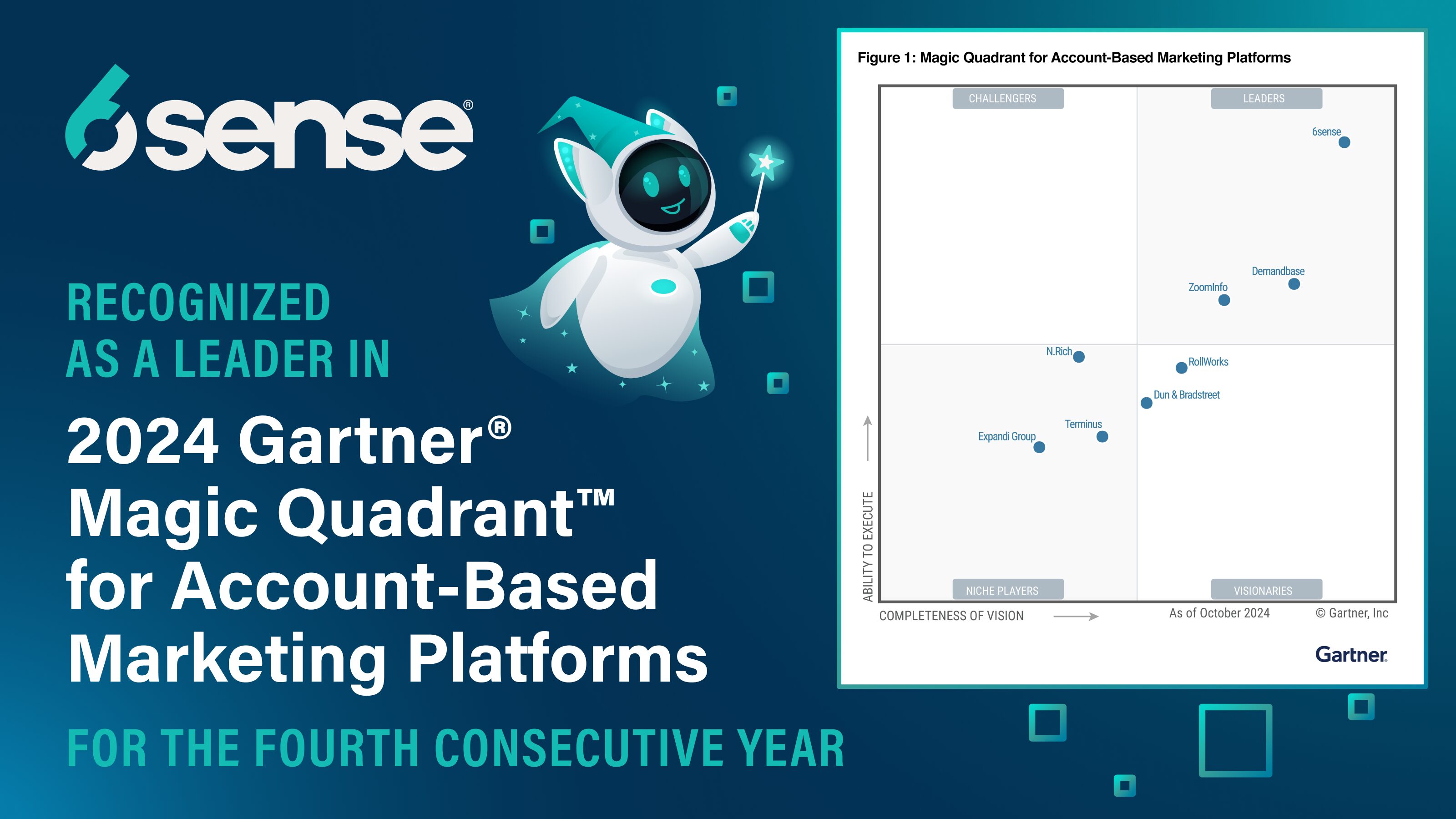

Zywave partnered with 6sense to clean up their data, which led to the improvement of multiple metrics by more than 100%, including average deal value, win rates, and average opportunity value.

The Challenge

Zywave has multiple Ideal Customer Profiles (ICPs) because they sell solutions across an entire industry, from individual brokers to national insurance chains. Historically, the company had struggled to personalize marketing efforts for each profile because, for example, the content that’s relevant for an enterprise account may not be for a smaller insurance broker.

Megan Landisch, the company’s Marketing Operations Team Lead, explains, “The difficult part was coming up with not just one ICP, but six of them, and then developing ABM strategies for each one individually.”

Initially, Zywave engaged 6sense in 2021 to help realize an account-based marketing (ABM) strategy. Zywave needed product-driven strategies that were unique to each sales segment and would drive awareness to top-of-funnel prospects.

But as they implemented this ABM strategy, Zywave’s usage of 6sense also uncovered the dirty database problem. Over 2,000 active accounts were missing website links in Salesforce. These accounts were assigned to sales representatives but didn’t have crucial 6sense intent data.

While the team was excited to use 6sense, their results weren’t as good as they could have been because of Zywave’s outdated database inaccuracies, Megan says.

How Did Zywave’s Data Get Dirty?

Acquiring companies: Zywave acquired 9 companies in four years. While the M&A activity was a huge win for the company and its customers, it also meant the acquisition of nine more databases. This kind of rapid expansion can result in bogged-down databases.

Mismarking opportunities: Members of Zywave’s sales team would both create opportunities and mark them closed-won all on the same day. This made it difficult to decipher the proper buying-journey stages of any given account.

Inaccurately categorizing accounts: Many independent insurance brokers associated with larger insurance agencies use Zywave. Previously, these individual brokers were listed with the larger agencies in Zywave’s database. Even though the independent brokers work with larger agencies, they fall under a different ideal customer profile. This meant Zywave was lacking the insights needed to personalize marketing efforts for the independent brokers.

So, with the help of 6sense Orchestrations and customer success team members, the Zywave team rolled up their sleeves and got cleaning.

The Solution

Zywave updated mismarked opportunities, re-categorized individual insurance brokers, and added missing links to their Salesforce instances.

Using 6sense Orchestrations and segments, Megan’s team then created segments in which individual brokers were listed under national insurance chains. Once Zywave identified accounts lacking website information or were small brokers, they unleashed 6sense’s full targeted advertising potential.

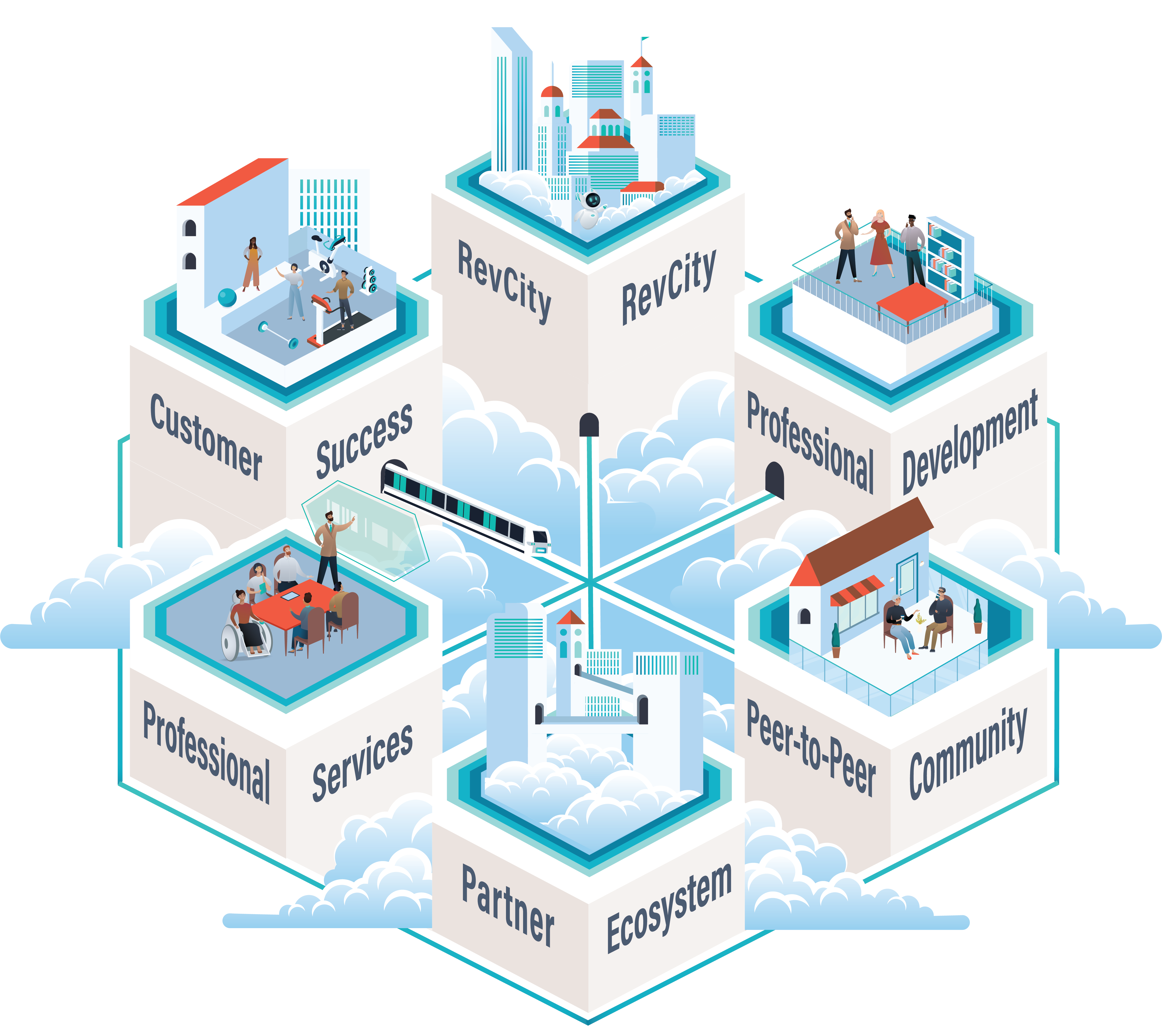

Today, Zywave fully leverages 6sense segments and advertising to understand and develop personalized campaigns for each ICP.

“Knowing which accounts are in-market has allowed us to shift and be more agile in our marketing strategy,” Megan explains. “6sense helps us focus on accounts that will move the needle.”

While 6sense enables marketers to deploy more targeted campaigns, alert capabilities also constantly update sellers on account activity.

These alerts — delivered through channels such as email, Slack messages, and more — tell sales representatives when buyers are engaging with Zywave’s website, filling out forms, or attending webinars. They also indicate when these prospects are researching competitors’ solutions.

These alerts empower sellers to act quickly on prospect accounts with a sales opportunity, or existing customers with an upsell opportunity.

The Results

Thanks to their collaboration with 6sense, Zywave saw a significant increase in annual recurring revenue and deal sizes and a reduction in sales cycle length:

- 157% increase in average opportunity value

- 136% increase in average deal value

- 126% increase in win rates

Zywave’s leadership has also noticed a cultural shift around data hygiene habits and team alignment.

“In cleaning up our database and optimizing 6sense, we now have more buy-in from the team and more opportunities to leverage 6sense in other places,” Megan says.

With the ability to show engagement and funnel movement, marketing and sales team members can work better together.

“6sense has helped us break down silos between sales and marketing and empowered us to become strategic partners,” Megan says.