Introduction

Over the past year, the promise of AI and specter of economic uncertainty have dominated business discussions. Our 2025 study of buyer behavior comprises two surveys totaling more than 4,000 responses, and it captured a marketplace in a state of flux, buffeted by these powerful forces.

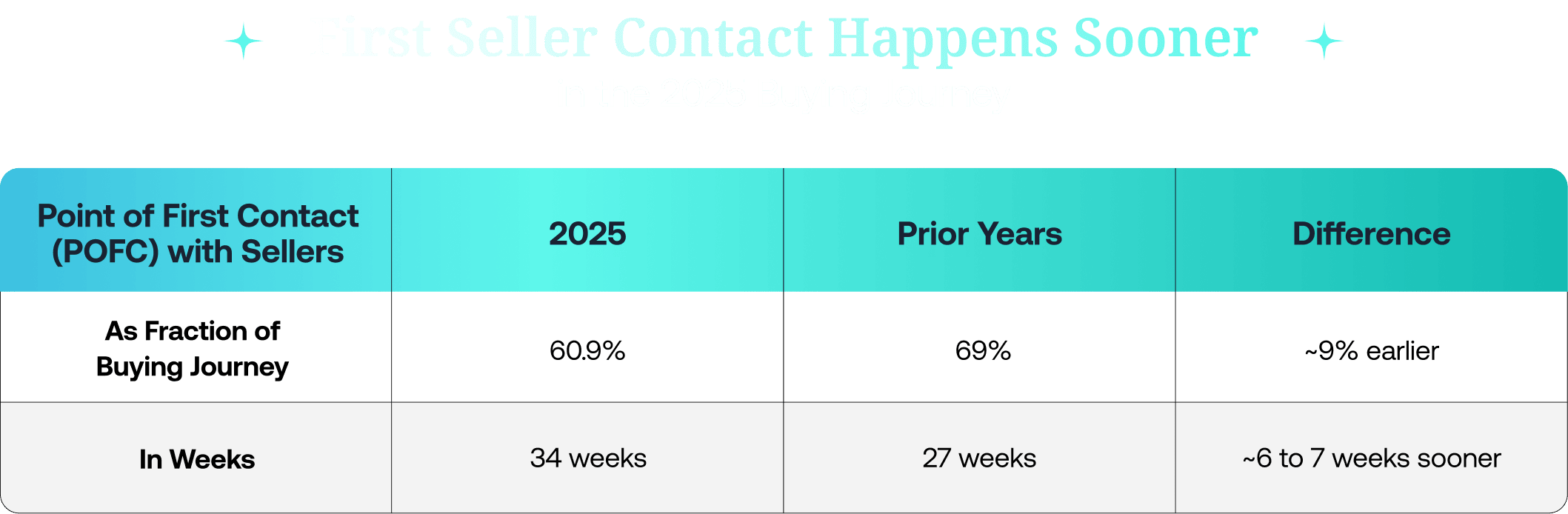

Last year, we described the 70/30 Buying Journey, which divides the buying process into two main phases: the Selection Phase and the Validation Phase. The Selection Phase, which accounts for the initial 70% of the journey, finds buyers researching, debating, and forming preliminary consensus on a preferred vendor. The Validation Phase, which follows, begins with buyers reaching out to sellers and culminates in the purchase. Notably, about 80% of the time, the favored vendor at the end of the Selection Phase is the same one buyers ultimately purchase from after the Validation Phase.

In this year’s report, we delve into how the promise of AI and the looming specter of economic uncertainty are distorting the contours of what we had termed the “70/30 Buying Journey”, while leaving its key dynamics intact.

The Promise of AI

Across boardrooms, SLT meetings, and LinkedIn feeds, AI is discussed in terms that are equal parts fear and reverence:

- Is this the birth of our dystopian — or our utopian — future?

- Will it make us all more productive, or redundant altogether?

- Are buyers already relying heavily on LLMs for their buying research?

- Will buyer agents soon be doing deals with seller AI agents, leaving revenue teams out of the picture entirely?

What we discovered in our research for the 2025 Buyer Experience Study is that AI is reshaping buying in not one, but two important ways.

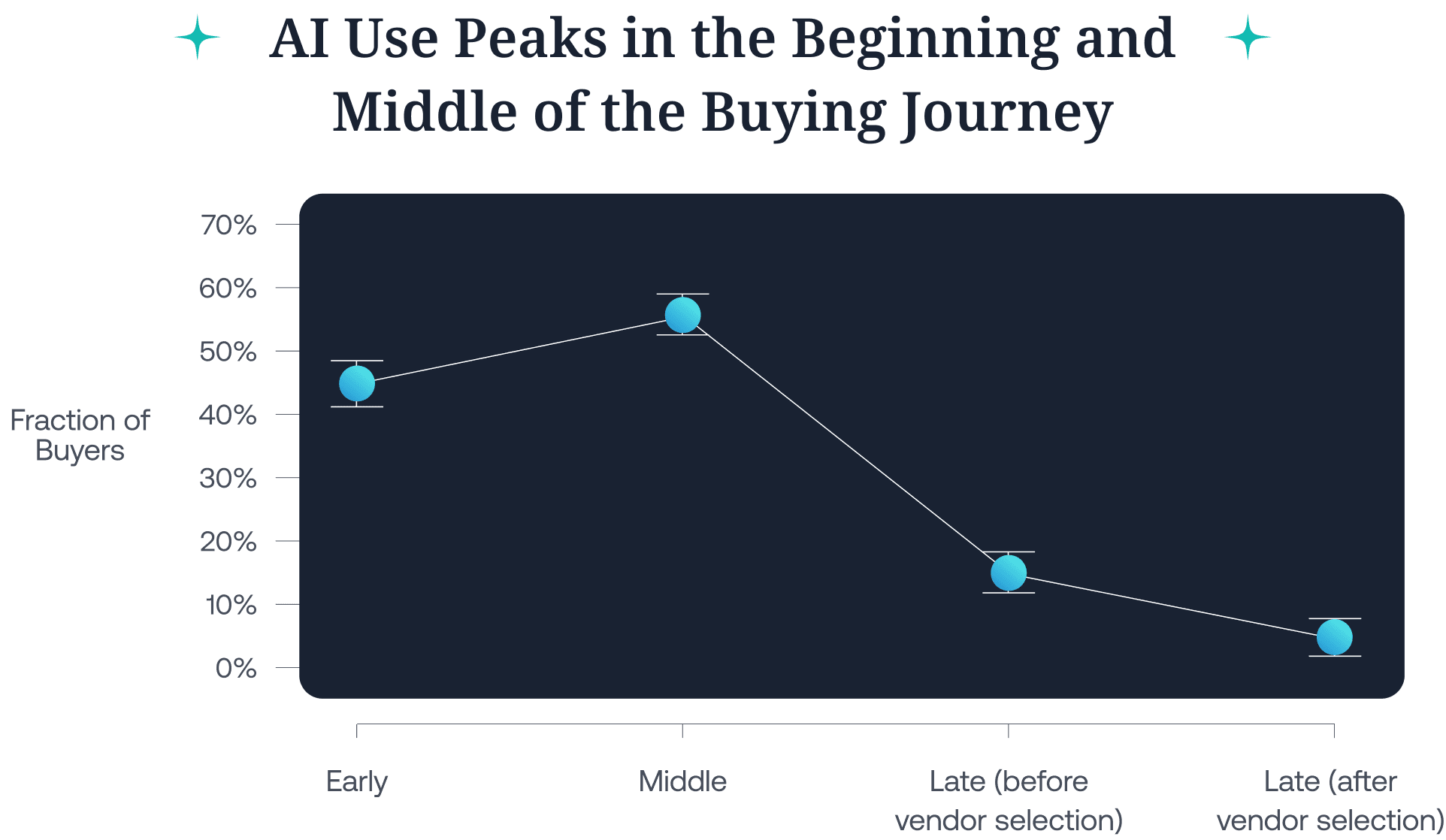

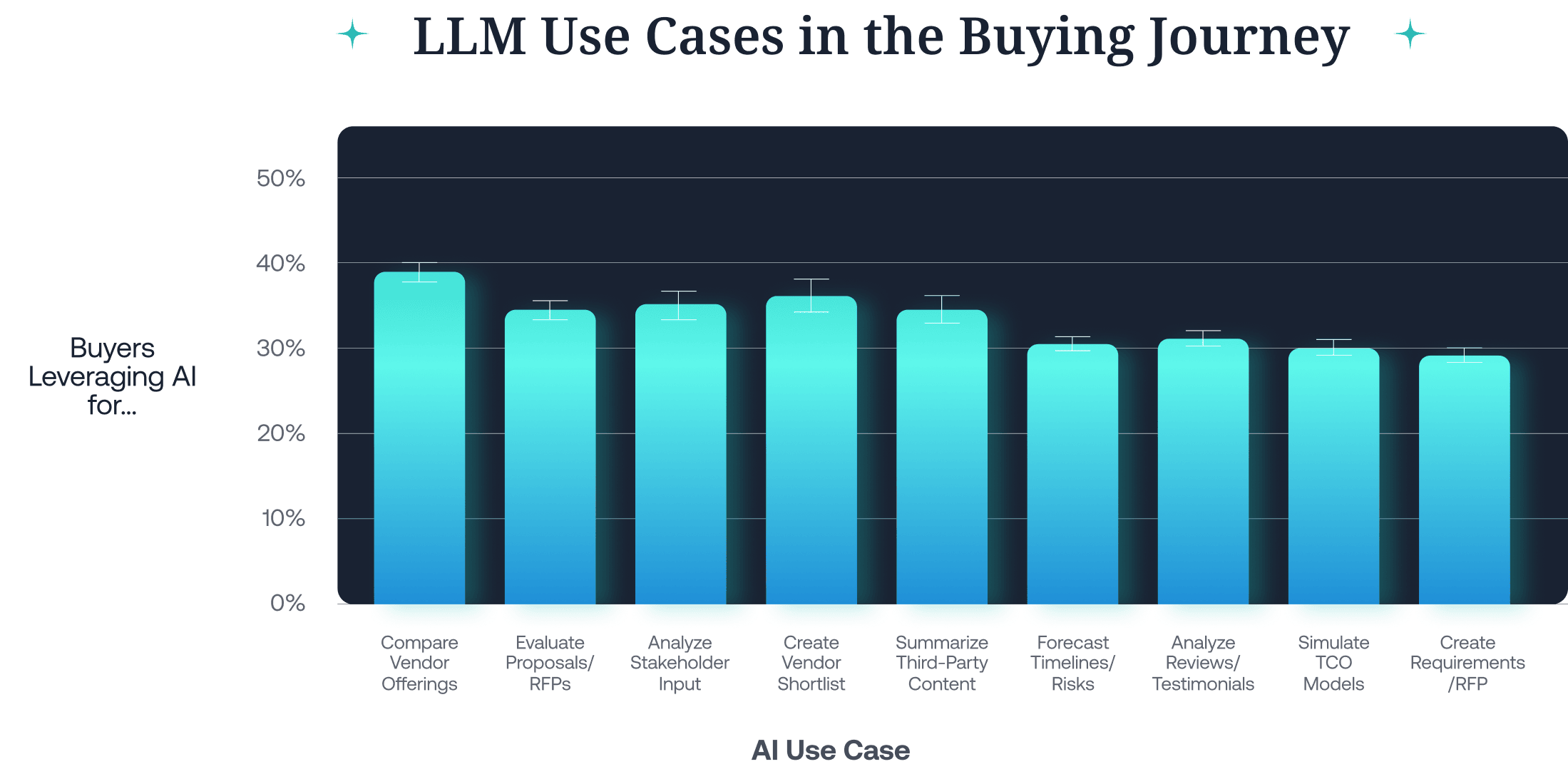

- First, there’s the use everyone’s been watching: how buyers are using AI as they research and evaluate solutions. Our report describes in detail how buyers are utilizing AI in their shopping.

- But the second — and currently more important — shift is that AI has become a core element of nearly every solution companies are acquiring, and buyers have to account for that in their evaluations.

In our earlier Buyer Experience Reports, we have emphasized how the buying journey has been abstracted from the sales cycle. Results from two years of research and just over 5,000 participants across three major global markets have shown us that:

Buyers are deeply experienced in the solution categories that impact their roles.

&

They are able to execute two-thirds of their buying journeys — including choosing winning vendors — before engaging with sellers.

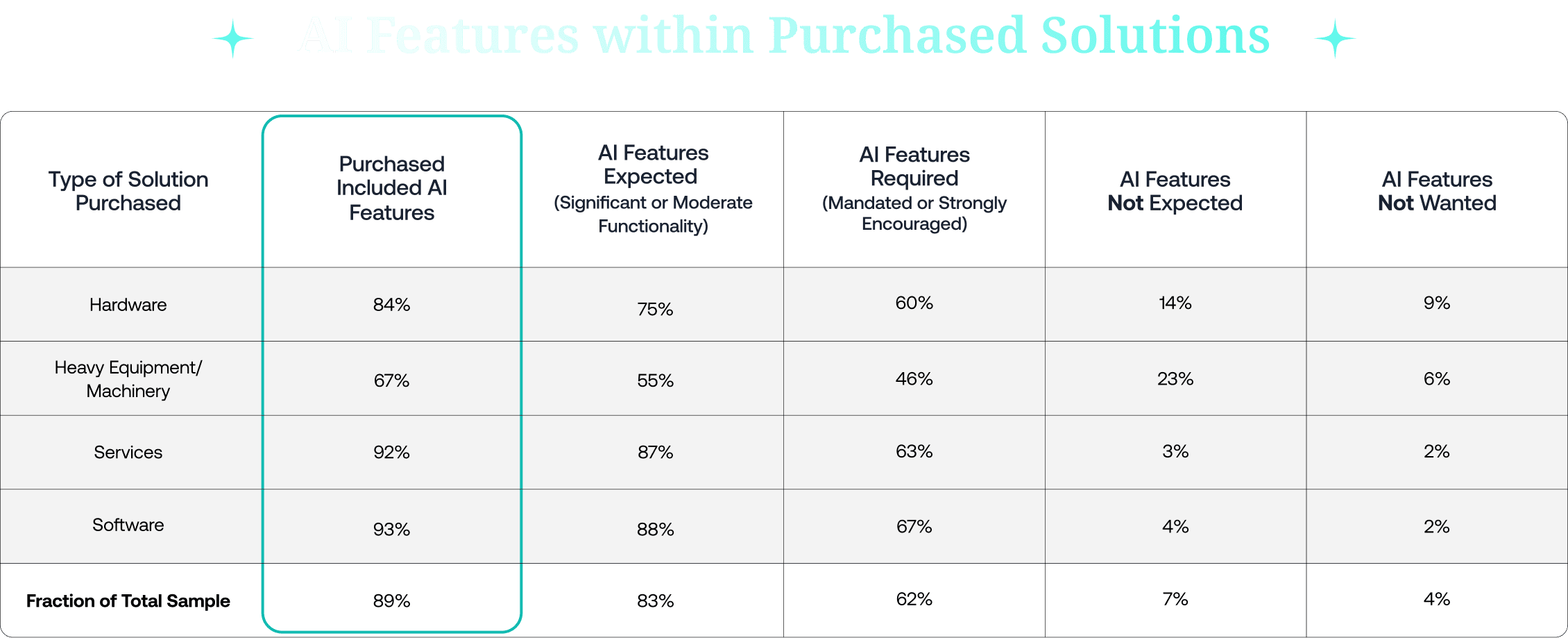

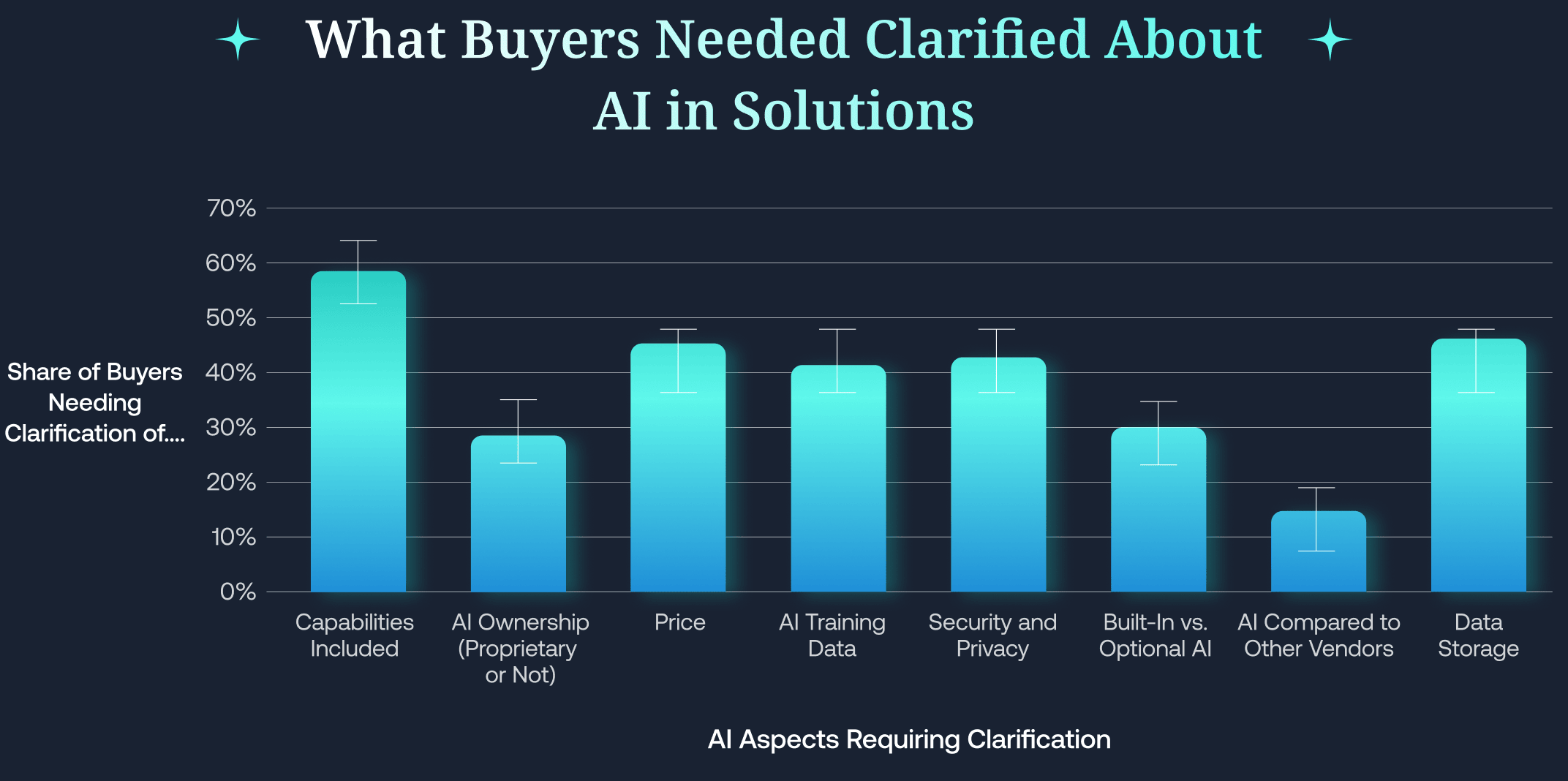

However, buyers of nearly every B2B solution now have to understand whether AI is embedded in those solutions, and, if so, what it is doing. They need to know how AI is changing a vendor’s capabilities, pricing models, implementation timelines, and data security.

Simply put: a buyer’s due diligence now includes answering vital questions about how AI is being implemented in solutions they buy, whether technology or services, and even physical goods.

Buyers’ experience in a given category is of little use in this new terrain, and the information they need is not readily available on vendor websites. Later in this report, we discuss how this is warping buying processes.

The Specter of

Economic Uncertainty

Alongside the rise of GenAI, persistent macroeconomic uncertainty continues to keep many organizations in a defensive crouch — slowing hiring, tightening budgets, and raising the bar for new investments.

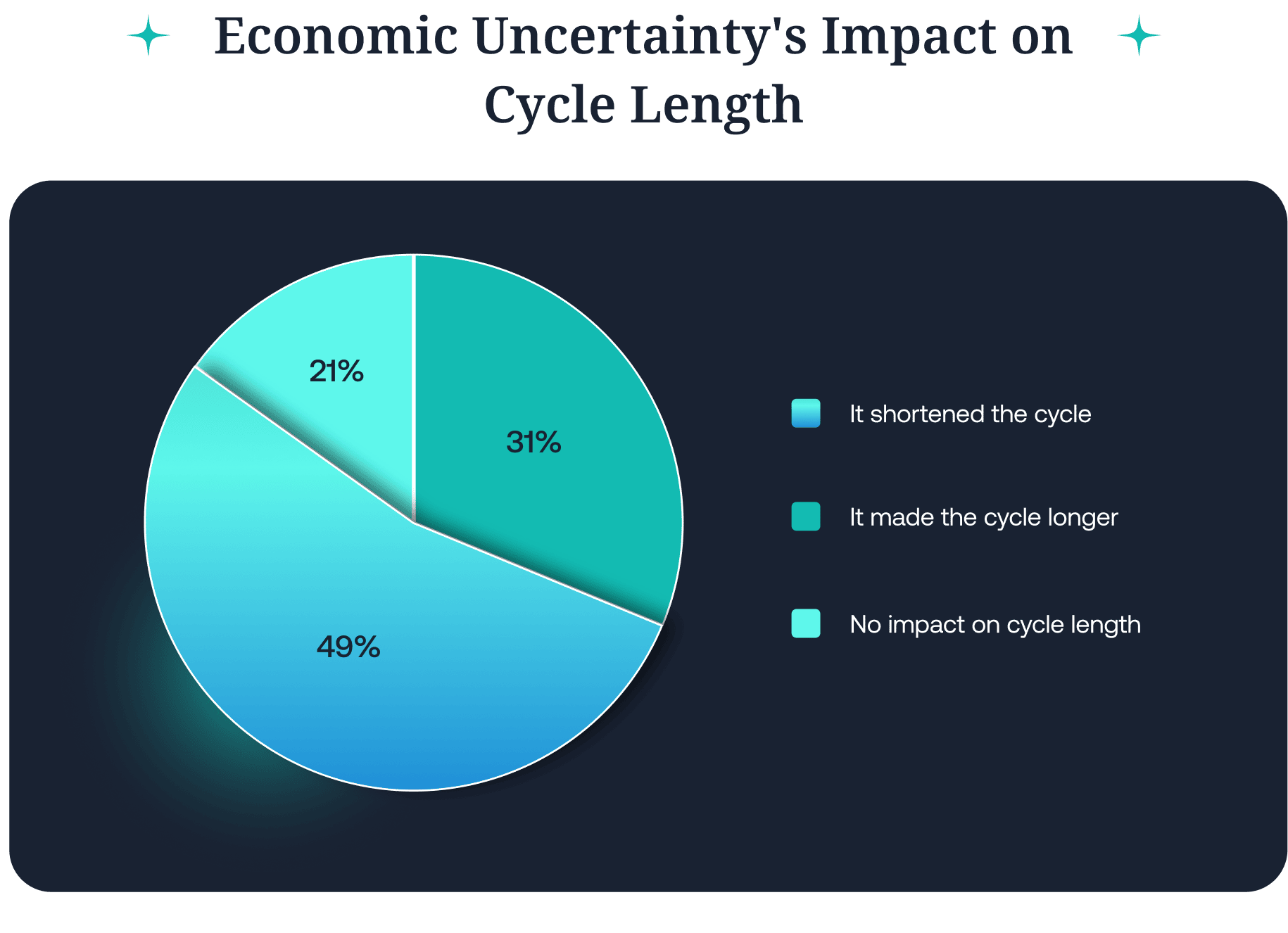

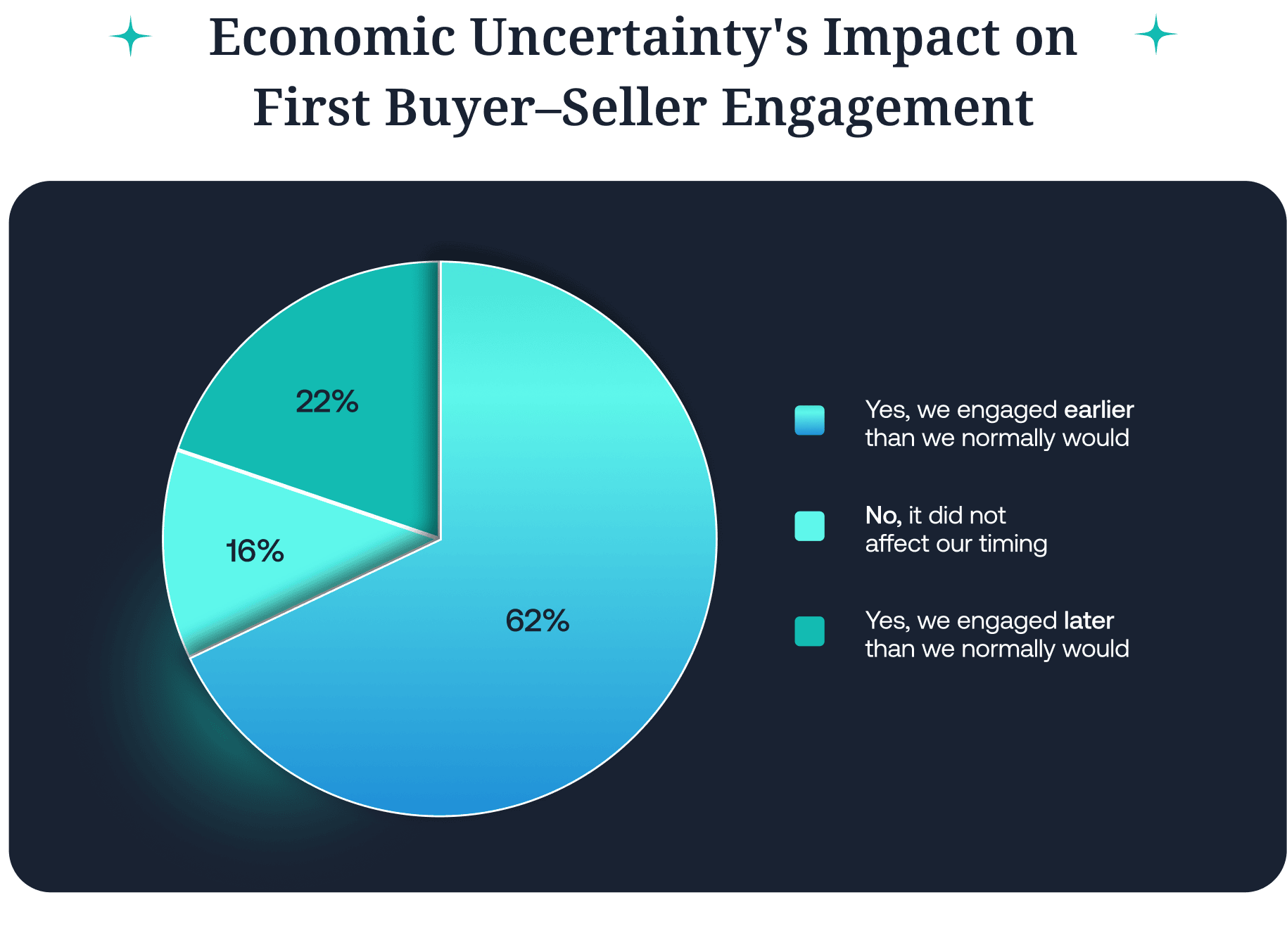

Our interest, naturally, is to understand whether buyers are pulling back with caution and skepticism – or, conversely, moving quickly to spend before budgets tighten further.

Our 2025 Buyer Experience Report answers these questions.

What you will read in this report is that buyers are still in control, still human, and surprisingly consistent in how they move through the buying process — even as the world around them transforms.

However, transform it has, and buyer behavior reflects that, distorting a key aspect of the buying journey we have been reporting on for two years.