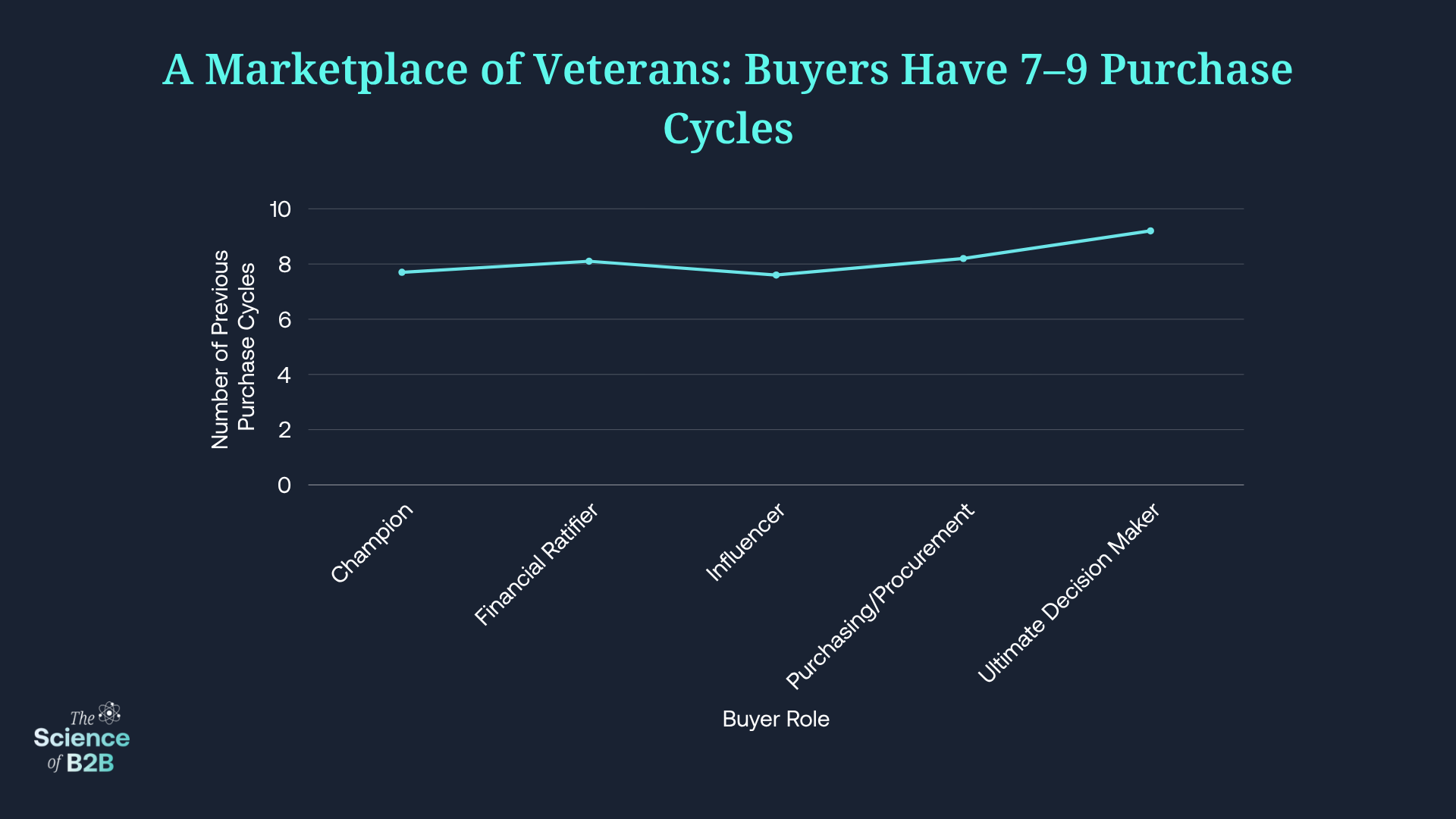

B2B buyers are anything but new to buying. On average, in categories that are important to their jobs buyers have been through eight to nine formal evaluations in their careers. Not all of those evaluation cycles led to a purchase — many did not. But even journeys that end without a purchase leave a mark on buyers.

Across our research, 85% of buyers report having prior experience with the vendor they ultimately selected. In this year’s study, we asked for greater clarity on the type of prior experience buyers have with the winner. Crucially, that experience largely comes from prior evaluations, not mere brand familiarity.

If you’ve just won a deal, it is likely that members of the buying group had already evaluated your solutions and in many cases, not purchased from you in the past. The buyers in our study have said that getting into the evaluation set today — even if the outcome is “not this time” — is a necessary step on the way to future wins. The sections that follow quantify that effect.

Prior Experience Fills the Shortlist

Prior experience does more than decide the winner; it determines much of where buyers begin their process.

Almost all buyers (97%) know at least one vendor on the shortlist. And by the time that shortlist is filled, the average buying group member says they know 75% of vendors on it — up from 69% last year. With the typical buying group evaluating five (5.1) vendors, that leaves roughly just one spot open for a vendor the buying group has not had prior experience with. Most competitors — nearly four out of five — are named to the shortlist on day one of the buying journey.

In other words, there is little room for “discovery” when buying groups decide to go into market for a solution. In reality, what many think of as the stage when buyers are “researching their options” is more accurately a period of deliberation to build consensus that begins almost immediately. In the early days of a buying journey, most buying group members are not going internet and LLM searches to discover which vendors they should evaluate. They enter the process knowing their options well, having had prior experience with most of them, and placing (or exclude) them with confidence from the start.

Buying groups may be looking to identify a final vendor to fill out the list, but, in practice, prior experience functions as a baseline requirement for getting on the shortlist.

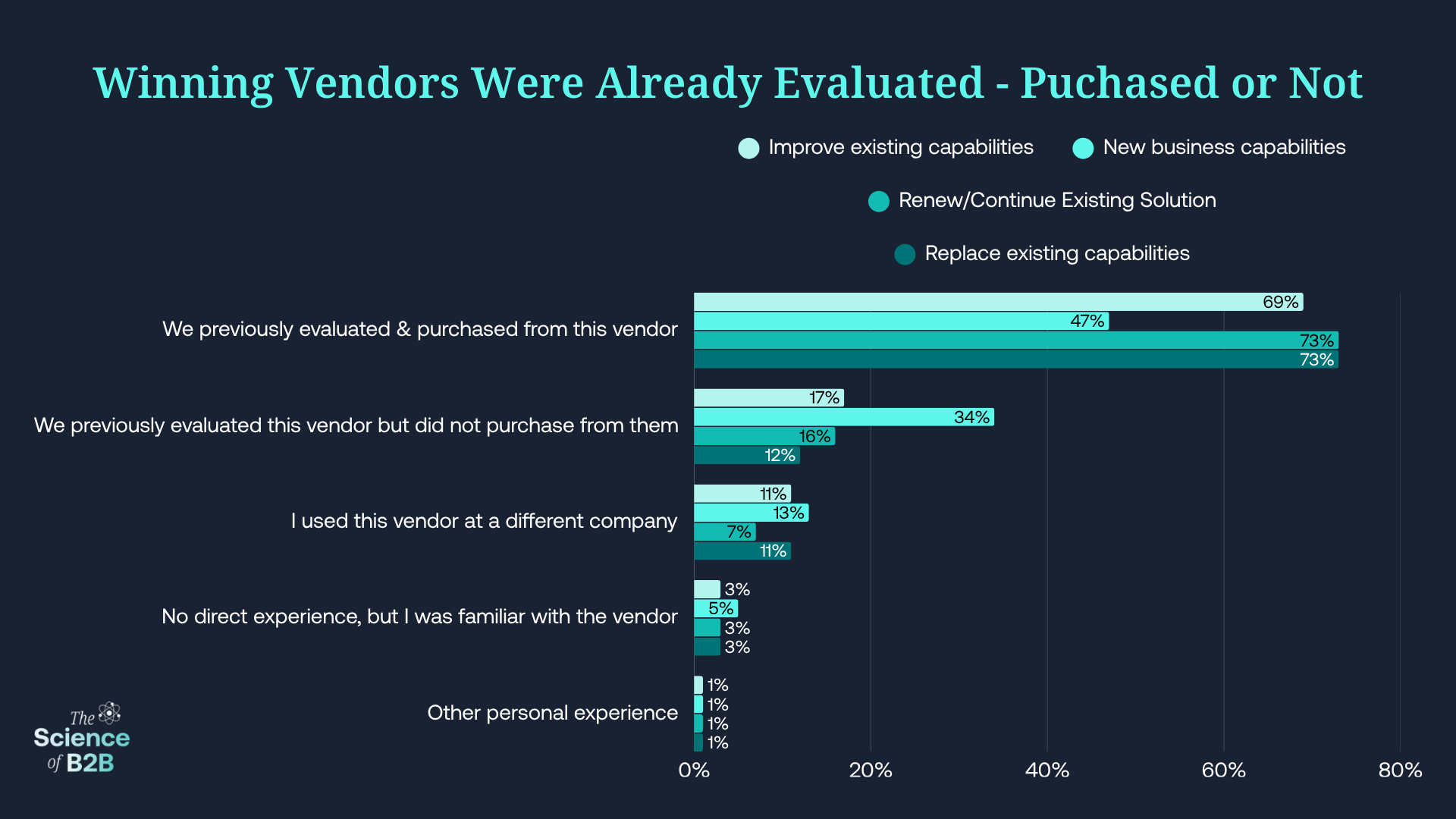

| Type of Capability Purchased | % of Deals Where the Winner Had Been Previously Evaluated |

|---|---|

| Improve existing capabilities | 86% |

| New business capabilities | 81% |

| Renew/Continue Existing Solution | 89% |

| Replace existing capabilities | 85% |

Prior Evaluation Outranks Brand Familiarity

As we’ve just seen, securing a place on the shortlist typically requires prior experience with the buyer. For the eventual winner, that experience overwhelmingly comes from a formal evaluation, whether the purchase involves net-new capabilities, a renewal, or upgrades.

| Type of Prior Experience With the Winning Vendor | % of Respondents |

|---|---|

| We previously evaluated & purchased from this vendor | 64% |

| We previously evaluated this vendor but did not purchase from them | 21% |

| I used this vendor at a different company | 11% |

| No direct experience, but I was familiar with the vendor | 3% |

| Other personal experience | 1% |

For purchases that involve an improvement, renewal, or replacement, buyers had both evaluated and purchased from the winning vendor roughly 7 out of 10 times. But when the purchase introduces a net-new capability — whether technology, a service, or piece of equipment the business has not purchased before — that likelihood falls to 47%. However, even for net-new capabilities, prior evaluation still does most of the work: 34% of winners in this category come from vendors that were evaluated before but not selected. Those earlier “no” decisions leave behind a residue of familiarity: due-diligence records, internal champions, and an informed view of fit — assets that compress risk and cycle time when the need becomes arises again.

Brand familiarity without direct experience accounts for only a minute (3%) share of buyer experience across all types of purchases.

For a deeper discussion of the kinds of prior experience buyers have had, please see our deep dive report, Getting to Yes: Why Vendors Win & How Buying Groups Agree.

Relationships Forged in Prior Evaluations Carry Forward

Not only do buyers stick with brands they’ve evaluated before, but they also carry forward the relationships they forged in earlier cycles. Across purchase types, 75% of buying group members enter the process with at least one seller they already know. The truly “cold” case, where no one knows any seller, happens in only about a quarter of buying journeys. These ties likely make it easier to restart due diligence – whether the vendor previously won or lost.

Aborted Evaluation Cycles: Buyers’ Hidden Experience

In B2B, aborted evaluation cycles occur frequently. The numbers from our April, 2025 study of 6sense customers and their ideal customer profile (ICP) accounts suggest that for every buying group that reaches the point in their buying journey where they engage sellers, there are four to five or more buying groups that spend multiple months and even quarters conducting evaluations, then abort the process before engaging with sellers. The reasons for this are all too familiar: budgets are cut, leadership changes, priorities shift.

But during these partial evaluations, buyers are engaging with content and being targeted with nurture campaigns and BDR/SDR calls; they’re attending webinars, and they’re talking to peers and colleagues. In SaaS, where companies retain 80% or more of their existing customers at contract renewal time, it may appear that buyers often do not evaluate alternatives. However, the research suggests that even buyers that renew without formal, competitive evaluations engage in some due diligence research activity prior to a decision to renew.

Not Just Your Primary Buyer Persona Targets

Owing to resource constraints, most marketing teams focus their time, attention and resources on primary buyer personas — the champion and ultimate decision-maker roles in a buying process. However, our data strongly suggest that every member of the buying group is an experienced buyer in the category. In fact, while the Ultimate Decision-maker is the most experience member of the buying group, with over 9 prior evaluation cycles, the Financial Ratifier and Purchasing roles reported more than 8 prior evaluation cycles. These roles may not be involved in the day-to-day operation of the business functions making the purchases, but they do become involved in virtually every major purchase other business functions make. The least experienced members of the team are the Champion and Influencer roles, with just under 8 cycles each.

What This Means for Marketers and Sellers

It is clear that buying group members maintain mental rosters of vendors in the categories in which they typically become involved. Shortlists are built from the collective prior experience and memories of these buying group members, and winners in a current cycle are usually vendors that have already cleared a formal evaluation with one or more buying group members.

This casts the job of the revenue team, and marketing in particular, in a different light than previously. Within established solution categories, marketing tactics rarely need to introduce the brand and solutions to individuals who enter the process as blank slates. Instead, it may be more important to clear away old brand residue from buyers’ memories, introducing how the brand and solutions have changed for the better — or even carried through favorable traits.

Three years of our research have shown that buyers spend most of the buying journey (60%+) in internal discussions and gathering input from their networks of peers and advisers. Ninety-four percent of buying groups align on a preferred vendor before direct engagement occurs, and that preferred vendor walks away with the contract 77% of the time. This tells us that content and experiences intended to sway buyer preference should be made as accessible and frictionless as possible.

When familiarity has not been earned through a prior evaluation, providing avenues for easy evaluation are critical. Provide self-serve demos, freemium or time-boxed trials that reflect real workloads, and on-demand access to the materials that accelerate scrutiny. Even more, establish avenues through which future buyers can grow familiar with and receive value from your brand.

Your brand and core value proposition should also be made equally accessible. Keep core content ungated and, unless you are in a new category, entering new markets, or are a new brand, write for buyers who already know you. Meet buyers where their last cycle ended rather than treating them as first-time discoverers. Traditional discovery and introductory content still has a place, but it serves a minority of potential buyers, most of whom arrive familiar with your offerings.

For sales, treat a loss as a milestone on the way to a win. The objective after “not this time” is to leave behind a complete file and durable relationships: named champions, mapped stakeholders, notes on fit and objections, agreed inspection points to re-open the file, and a clear path to reconsideration when conditions change.

Losing the Battle, Winning Future Wars

A fascinating finding from this year’s research is that 42% of participants said that their preferred vendor changed during the sales process. However, more than half of those still wound up purchasing from the vendor that was in the top spot prior to sales involvement. After having spent an average of six months arriving at consensus, most buying groups do not want to re-litigate the issue, and will stick with the Selection Phase winner, even if they come to like another vendor more during the Validation Phase. Buyers frequently develop a preference for a vendor during the Validation Phase, but do not act on that change of heart.

Deal forensics including customer interviews can uncover how often this happens — in both directions. Customer success teams will be more successful if they are aware that a recently won customer may have developed a preference for a competitor’s approach. At the same time, understanding that an account has developed a preference for your solution, even while buying another, should lead sellers to maintain the relationships post-lost sale, in preparation for the next cycle.

For important segments and accounts, organizations should also begin to think of their sellers as brand assets, who are creating memories in the minds of buyers, and to whom buyers will look in future buying journeys — even before they talk to them.

Keep Reading

- “AI Inside” Is Catalyzing an Earlier Point of First Contact (POFC) for B2B Buyers and Sellers

- How Buyer Experience Offsets LLM-Induced Traffic Loss

- B2B Buyers Are Even Less of a Blank Slate Than We Thought

- Meet the B2B Buying Group: Who’s at the Table and What They Do

- Getting to Yes: Why Vendors Win & How Buying Groups Agree

- B2B Buying Under Economic Pressure in 2025