Over the past year, economic uncertainty has been a constant undercurrent for many organizations. Headlines about layoffs have dominated professional networks, while ongoing tariff discussions and supply chain pressures have made operating costs unpredictable, while threatening to close off entire markets. And all this is occurring while companies weigh how to optimize (or reduce) human resource costs using AI.

In this report, we examine how these economic conditions are influencing B2B buying cycles, from the timing of seller engagement to the overall length of the cycle.

Most Buying Groups Affected

Three out of four buyers (75%) said that economic conditions (e.g., tariffs, inflation, budget tightening, etc.) affected how they approached purchases for their organization in the past year.

| Impact on Vendor Selection | Percentage of Buyers |

|---|---|

| No Impact | 25% |

| Moderate Impact | 40% |

| Significant Impact | 35% |

It’s unsurprising that financial ratifiers register the highest level of concern — 87% report that economic conditions shaped how they approached buying. While statistically higher than all others, relatively modest separation exists between Financial Ratifiers and the rest of the buying group. Ultimate decision makers (74%), influencers (76%), procurement (72%), and internal champions (74%) all report feeling the same pressure.

Financial scrutiny has become a shared operating condition, influencing how most roles approach evaluation, justification, and consensus.

| Buyer Role | Percentage of Buyers Reporting Economic Impact |

|---|---|

| Champion | 74% |

| Financial Ratifier | 87% |

| Influencer | 74% |

| Purchasing/Procurement | 72% |

| Ultimate Decision Maker | 74% |

Across solution categories, buyers of hardware and machinery are somewhat less likely to cite economic conditions as influencing their approach, yet even in these groups, well over half still acknowledge some impact.

Services buyers, however, tend to feel the impact more acutely. Nearly half (46%) describe economic conditions as having a significant influence on their approach, while in all other categories, a moderate impact is the more common of the two.

| Solution Category | Percentage of Buyers Reporting Economic Impact |

|---|---|

| Hardware | 65% |

| Machinery | 69% |

| Software | 78% |

| Services | 80% |

Not surprisingly, the effect also rose with purchase cost. Yet even among the smallest purchases (under $100,000), 64% of buyers said economic conditions influenced their approach to buying.

Conservative Shortlists and Price Caution in 2025

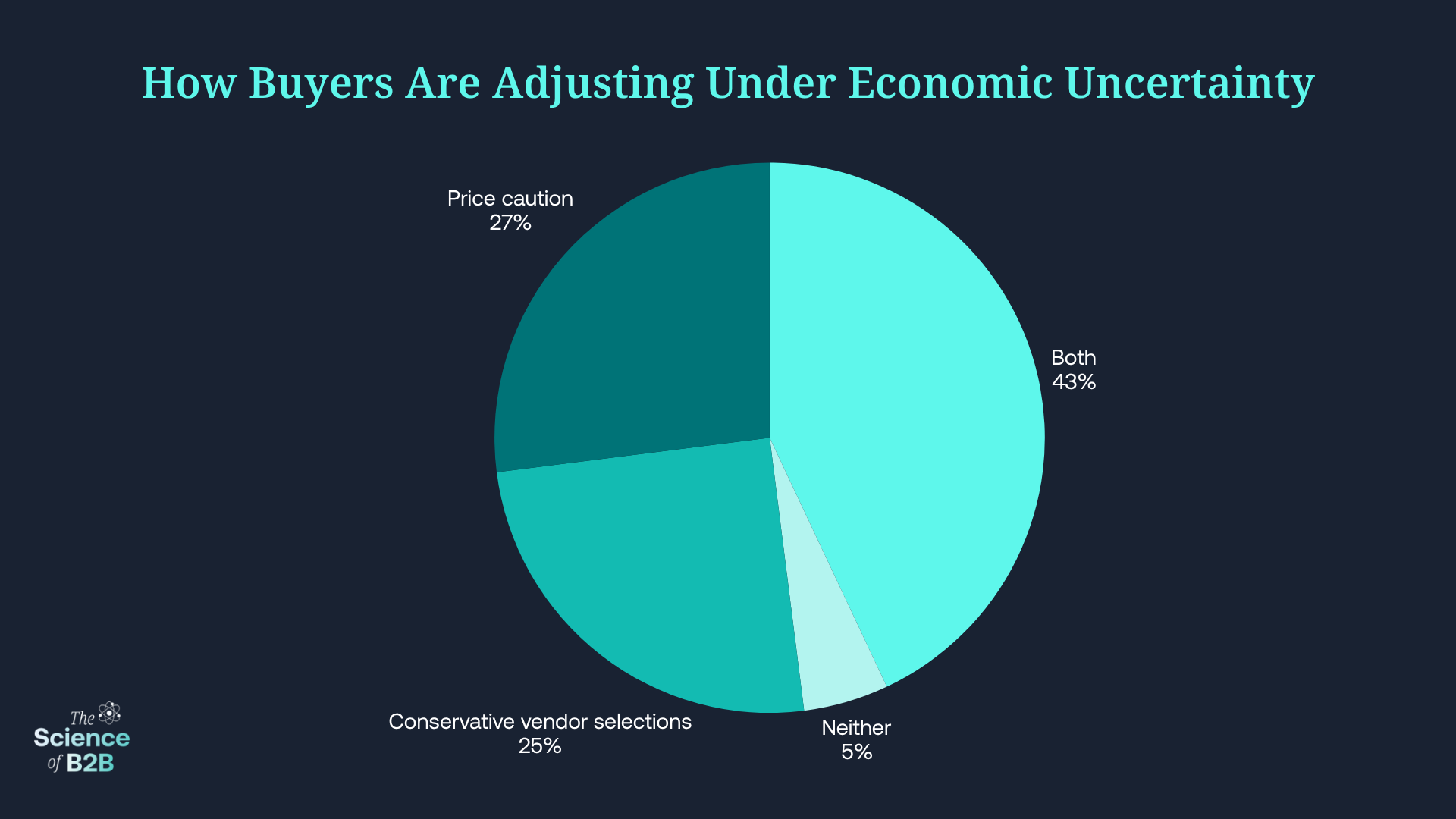

When asked how economic uncertainty affected their approach to buying, nearly all buyers said it led them to be more conservative in vendor shortlists, place greater weight on price, or both. Only 5% said neither were impacted.

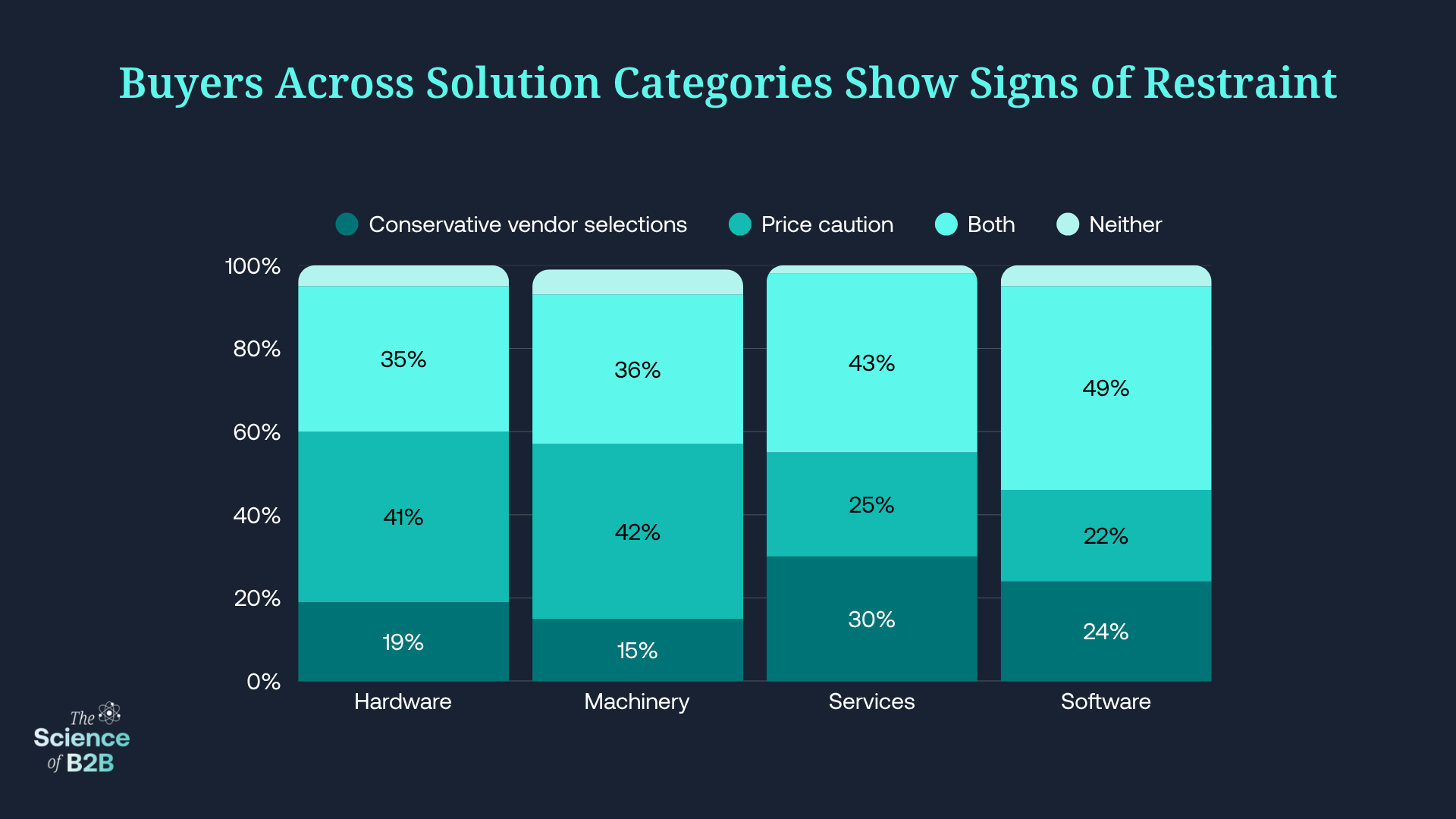

Across solution categories, services buyers show a slight tilt toward greater caution in vendor selection, but overall, most buyers display both price and vendor conservatism.

Compressed Timelines Amid Economic Pressure

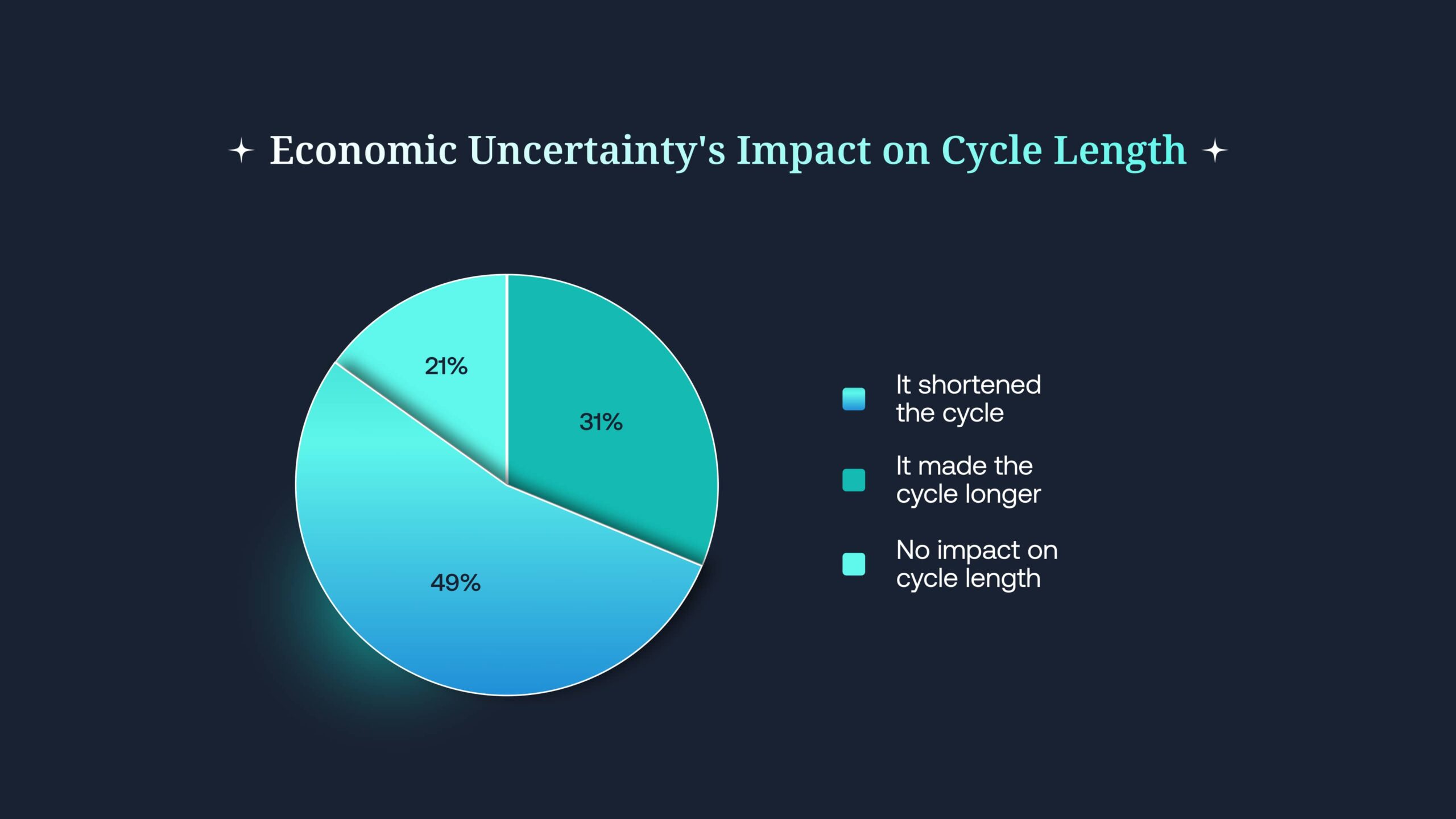

One of the most significant findings in this year’s B2B Buyer Experience Research was the acceleration of the buying process.* Buyers engaged with sellers nearly ten percentage points earlier in the journey compared to previous years. At the same time, they evaluated more vendors within the same timeframe. In past years, adding even one vendor to the shortlist above the average extended the buying cycle by roughly 2.5 months; this year, that pattern did not hold.

*Note that our study looked only at buying cycles that completed with a purchase. It is certain that a substantial number of buying processes were cancelled due to economic uncertainty and other conditions.

Buyers pointed to two main forces behind earlier seller engagement in nearly equal measure:

1) questions about AI features inside the solutions they evaluated, and

2) economic uncertainty.

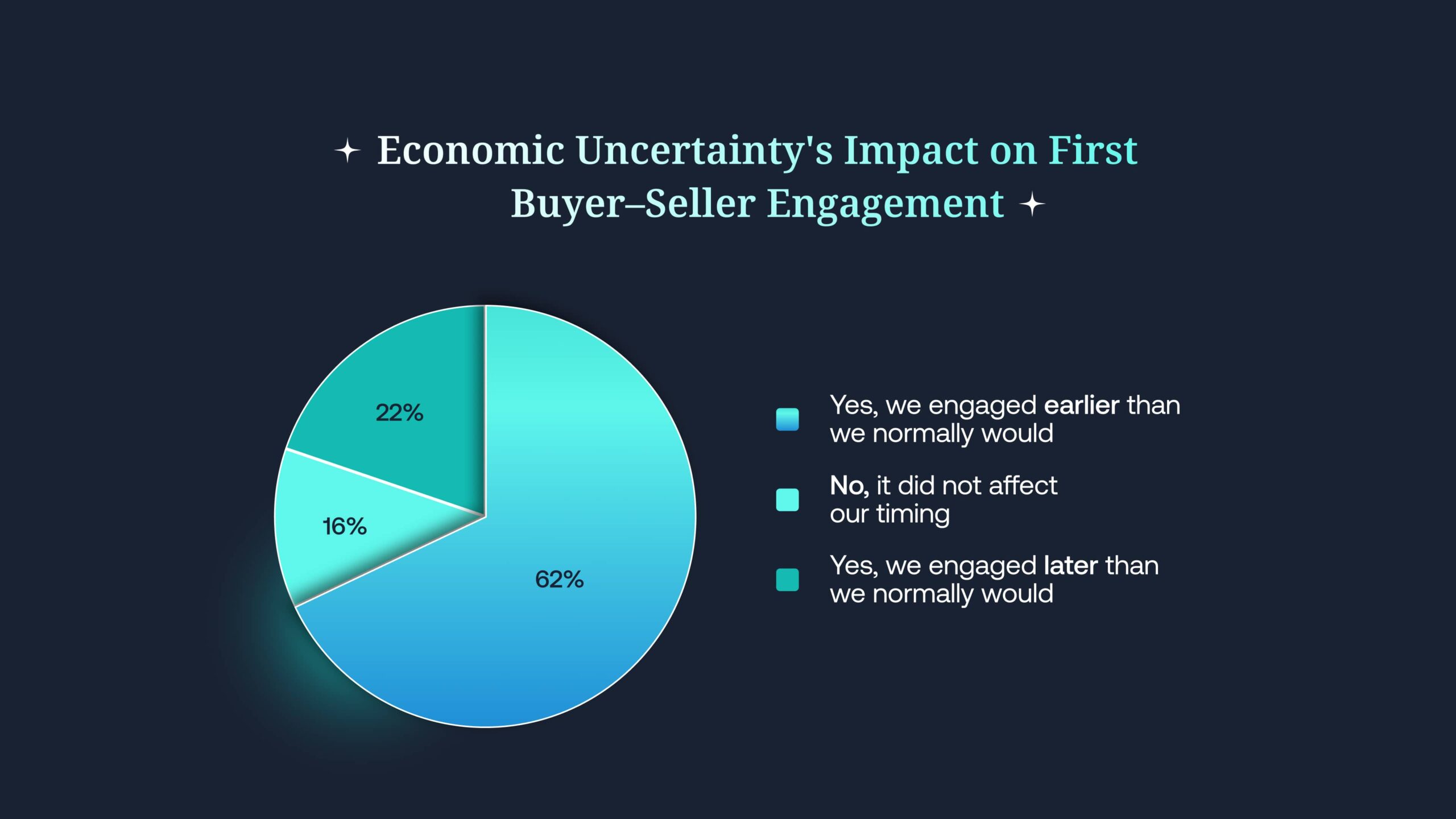

Nearly half of buyers (48.7%) said that economic conditions led directly to shorter buying cycles. Many organizations with approved budgets may have been eager to commit funds quickly, before potential pullbacks due to tariffs, cost-cutting, or other macroeconomic risks. Nearly 62% of buyers said they engaged sellers earlier because of economic uncertainty — further accelerating the buying process.

What This Means for Marketers and Sellers

Economic pressure is shaping both who makes it onto the shortlist and how quickly decisions are made. Marketers need to recognize that this caution informs the thinking of every role in the buying group. And, as our research shows, buyers nearly always purchase from vendors they already know at the start of their buying process. Brand presence and reputation must be strong enough to withstand closer scrutiny on both price and vendor reputation.

Sellers, meanwhile, are meeting buyers earlier in the journey — but in conversations that are often framed by a desire to confirm existing preferences. Success requires being prepared with compelling, value-based answers that reassure buyers under economic pressure, while marketing works to ensure the brand is seen as a low-risk, credible choice well before the purchase cycle begins.

Keep Reading

- “AI Inside” Is Catalyzing an Earlier Point of First Contact (POFC) for B2B Buyers and Sellers

- In It (Multiple Times) To Win It: Prior Evaluations Precede Most B2B Wins

- How Buyer Experience Offsets LLM-Induced Traffic Loss

- B2B Buyers Are Even Less of a Blank Slate Than We Thought

- Meet the B2B Buying Group: Who’s at the Table and What They Do

- Getting to Yes: Why Vendors Win & How Buying Groups Agree