Introduction

Research Methods

Findings

Summary of Findings

Implications

Appendix

Introduction

In the world of B2B, organizations have been successful at attracting website visitors. When compared to their B2C counterparts, B2B organizations come out on top for attracting a high volume of visitors (17% of B2B companies achieve the range of 10,001 to 100,000 unique website visitors per month compared to 15% for B2C). While equipped with bountiful website traffic, the decades-long struggle that continues today is understanding who these visitors are.

To entice web visitors to self-identify, B2B organizations gate content, requiring visitors to fill out a form that asks for their name, company, email address, and more in exchange for access to content. In the early days of B2B’s digital era, these form fills and accompanying form conversion optimization came to be the predominant buying signals and tactics marketers relied on to identify in-market buyers. However, B2B web visitors know all too well the chain of events that typically follows a form fill: a flood of emails, calls, and other attempts to contact. With these types of experiences ringing, dinging, and pinging in buyers’ ears, they’ve become increasingly reluctant to reveal themselves to sellers.

Why It’s So Important to Account for Low Form Fill Rates

B2B purchases are typically made by groups of individuals working together. In a recent survey, we asked respondents how many individuals make up the typical buying groups that purchase their solutions. Respondents reported an average of nine buying group members (see our article on buying group sizes research). Moreover, a Forrester Research B2B Buyer Study from 2021 found that buying group members report an average of 27 interactions with vendors. (Source: Forrester, retrieved July 21, 2022.) Meanwhile, Gartner reports that only 17% of B2B buying research is done on vendor websites. (Source: Gartner, retrieved July 21, 2022.) While the math is complex, the message from this is clear: B2B buying groups are large, and they do lots of digital research that providers can tap into to identify in-market buyers. Unfortunately, only a small fraction of that signal will be found on a provider’s own website, and much of it will appear as anonymous traffic.

Our research is intended to characterize the scope of this problem, and to illuminate what B2B marketers are or should be doing today to optimize pipeline production.

Research Methods

6sense Research surveyed 169 individuals in marketing organization roles within B2B provider organizations to understand how they use and perceive buying signals. Responses were collected to questions surrounding organizations’ form fill rates, the number and type of buying signals they use, how they use them, and their feelings toward their current mix of signals. The majority of individuals sampled for this study come from the Technology and Software industry (53%), but our sample also includes participants from Manufacturing (10%), Professional (11%), Business (13%), and Financial (13%) services industries.

Findings

About 3% of B2B Web Visitors Fill Out Forms

Most B2B forms block access to content. Others are required when visitors want to access a free trial or demo, or when they want to be contacted. We asked respondents to disclose their typical form fill rates. Participants reported that between 3% and 3.5% of their unique website visitors self-identify via on-site forms. That means, of course, that roughly 97% of their remaining website traffic is anonymous.

In our research, the 3% to 3.5% average form fill rate was consistent across all industries sampled. This rate was also consistent across geographic regions including North America, Latin America, EMEA, and APAC. Not only was this form fill rate consistent across regions in our response set, it is consistent with an abundance of past research and across time, as well. For example, Unbounce, a digital marketing software provider, found a roughly 3% form fill rate among their customers for the years 2020 and 2021.

Form Fill Rates are Objectively Consistent, Yet Perceived Rates Vary Across the Organization

The consistency of results across industries, geographies, and time is telling. However, there are interesting inconsistencies in how marketing practitioners report them. Respondents in demand generation roles tended to report form fill rates of approximately 1.5%, while those reporting from revenue operations roles believed this conversion to be a whopping 6% to 6.5% (see Table 1).

A similar rift was seen with respect to a respondent’s position in the corporate hierarchy, such that respondents further up the corporate ladder (e.g., C-level or SVP role) held rosier views of form fill rates than did those closer to the action.

A plausible interpretation of these observations is that those closest to the action — individual contributors and managers within functions that have daily contact with the numbers (e.g., demand generation and marketing operations) — take a more pessimistic, but likely more realistic, view of form fill rates, while those at a further remove tend to inflate the numbers.

(This difference in perspectives is substantial. In future research, we will be examining form fill rates as found within B2B marketing systems, rather than as reported by marketers.)

Table 1: Those farther from the marketing frontline believe form fill rates are better than they are.

| Function | Level in Organization | ||

|---|---|---|---|

| Revenue Ops | 6% to 6.5% | C-level/SVP | 4.2% |

| Marketing | 3.5% | Directors | 3.4% |

| Marketing Ops | 3.5% | Managers | 3.4% |

| Demand Gen | 1.5% | IC | 3.4% |

Source: 6sense

Understanding that only 3% to 3.5% of visitors fill out forms, it is clear that organizations that rely solely, or too heavily, on visitors to self-identify risk missing out on opportunities where buyers either never reach their site, or don’t fill out a form.

In this study, we asked participants to consider a list of 18 types of signals and to specify the ones that they currently use. This list, and the percentage of respondents who use them, is detailed in Table 2. For full descriptions of each signal type, please see the appendix.

Table 2: Types of Signals B2B Organizations Use Today

| Signal Type | Group or Person | Signal Source | Percent of Respondents Using |

| Ad Clicks | Anonymous / Individual person | Direct | 45% |

| Form Fill Leads | Identified / Individual person | Indirect | 42% |

| Email Clicks/Opens | Identified / Individual person | Direct | 42% |

| Marketing Qualified Leads (scored form fill leads, MQLs) | Identified / Individual person | Direct | 42% |

| Demo Requests / Downloads | Identified / Individual person | Direct | 42% |

| Live Event Registrations | Identified / Individual person | Direct | 38% |

| Social Leads | Identified / Individual person | Direct | 35% |

| “Contact me” requests | Identified / Individual person | Direct | 35% |

| Partner Referrals | Identified / Individual person | Indirect | 30% |

| Virtual Event Registrations | Identified / Individual person | Direct | 30% |

| Syndicated Content Leads | Identified / Individual person | Indirect | 28% |

| Anonymous Traffic, De-anonymized | Anonymous / Group | Direct | 26% |

| Third-Party Intent | Anonymous / Group | Indirect | 26% |

| Freemium Downloads | Identified / Individual person | Direct | 22% |

| Product Review Site leads | Identified / Individual person | Indirect | 21% |

| Demo Usage | Identified / Individual or group | Direct | 20% |

| Product Review Site Intent | Anonymous / Group | Indirect | 18% |

| Freemium Use | Identified / Individual person | Direct | 16% |

Source: 6sense

Do B2B Practitioners Rely Only on Form Fills?

The first question we wanted to address was whether organizations were taking steps to mitigate the risk of missing out on deals due to low form fill rates. The most immediate way to do this is to identify the accounts to which anonymous web visitors belong. The process of doing so, called de-anonymization, does not typically identify the source of every web visitor. However, even a small boost in understanding where web visitors are coming from could prove valuable in the face of such low form fill rates.

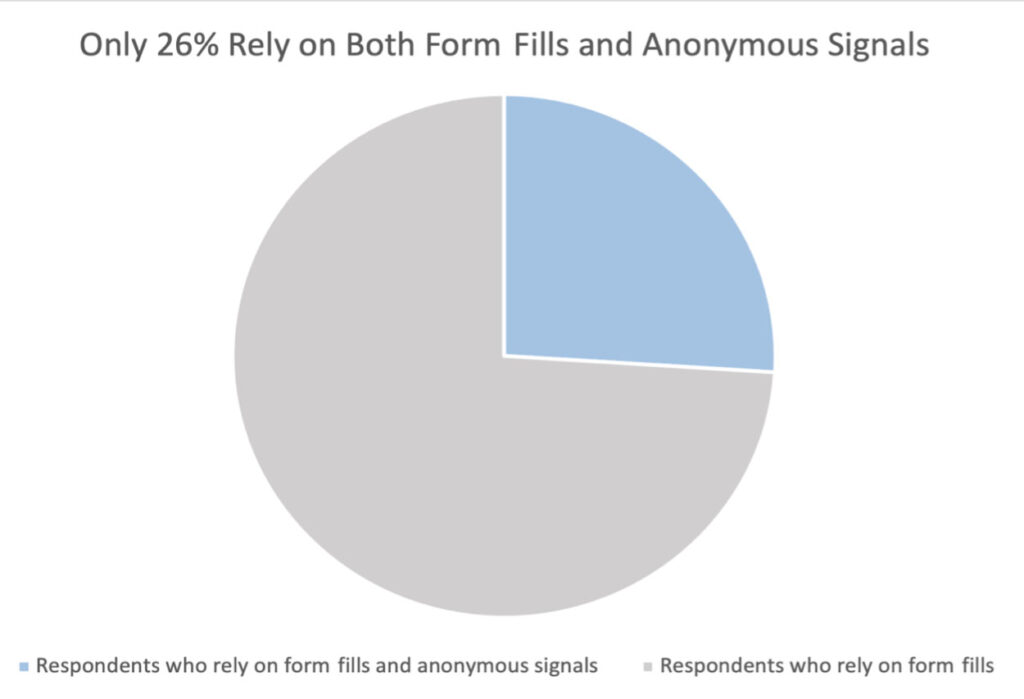

In our survey, we asked participants if they were mitigating the low form fill rates by de-anonymizing their web traffic. We found that only 26% of organizations surveyed de-anonymize non-form fill web traffic. That means the other 74% of participant organizations do not make use of the majority of activity that happens anonymously (97%) on their websites.

Chart 1: Only 26% use anonymous signals in addition to form fills.

Source: 6sense

Are Practitioners Seeing Buyers Beyond Their Own Websites?

While it is clear that most organizations are not extracting as much value from their existing web traffic as possible, it is still possible that organizations are mitigating this risk by looking for signals of buyer activity beyond their websites. The Gartner finding cited earlier showed that only 17% of B2B buyer research is conducted on vendor websites, which suggests that providers run the risk of missing out on many selling opportunities unless they pay attention to buying signals that arise outside of their own domains.

To understand how practitioners were using signals acquired from external resources, we coded the list of 18 signal types (Table 2) based on whether the signal was acquired directly through a provider’s own systems (direct signal) or whether the signal had been received and provided by an external party (indirect signal).

Encouragingly, 77% of respondents use indirect signals in addition to the direct signals they acquire through their websites. While this shows that most organizations both understand and prioritize the importance of looking beyond themselves, it still leaves almost a quarter of B2B providers without visibility into the majority of signals that might alert them to a relevant buying process. Note: 2% of participants reported using indirect signals without the aid of direct signals.

Do Organizations Notice When Buying Groups, Rather Than Individuals, Research Them?

As described above, B2B buying is largely undertaken by groups averaging nine members. Where one form fill is interpreted as a signal of interest from that prospect organization, it stands to reason that multiple form fills from the same organization should represent an especially strong signal from that organization. To understand whether B2B providers were capable of detecting this especially strong signal, we asked participants to tell us if they treated accounts with more than one form fill lead differently than accounts with only one. Here, a slim majority (61%) of participants reported that they do treat multi-lead accounts differently than single-lead accounts, thus taking advantage of this strong buying signal to prioritize prospects.

Do B2B Practitioners Use Other Group-Level Signals?

The presence of multiple leads from a single organization constitutes a signal of interest from a group. Thus, it is a group-level signal. Of the 18 signal types we asked participants about, there are three group-level signal types. To understand how such signals were being employed, 6sense Research coded the 18 signal types according to whether they were group- or individual-level signals. Results revealed that 73% of organizations that use individual-person signal types also use some sort of group-oriented signal types. Less than 4% of participants reported using only group-level signals.

Table 3. Signal Category Usage

| Identified Person | Anonymous Person | Person-Level | Group-Level | Received Directly | Acquired Externally | |

| Participants Using | 146 | 99 | 144 | 114 | 146 | 115 |

| % of Participants Using | 99% | 67% | 97% | 77% | 99% | 78% |

n = 148

Source: 6sense

Summary of Findings

Methods

- 6sense Research surveyed 169 marketers from B2B provider organizations to understand what buying signals they use today and their perceived utility of such signals.

Key Findings

- B2B organizations have an average form fill rate of 3% to 3.5%

- Form fill rates are consistent globally and across industries

- Perception of form fill rates vary across position level and function. Those in roles that are further from the action have a rosier view, while those on the front-lines have a more conservative view of form fill rates.

- 61% percent of participants treat multi-lead accounts differently than single-lead accounts

- Only 26% of organizations surveyed de-anonymize non-form fill web traffic

- While many organizations (77%) utilize signals that are both acquired directly on their site and that come from third-party domains, almost a quarter do not use a mix, using only what they acquire first-hand.

- 27% percent of organizations rely on individual-oriented signals only, even though most B2B buying purchases happen in groups.

Implications

The first disconnect found in this research lies between objective and subjective form fill rates. The evidence strongly suggests that form fill rates are in the range of 3% to 3.5% globally and across industries, yet the perception of this problem varies across organizational roles with those in higher positions believing form fill rates to be higher than they appear to be.

The most alarming discovery in our research is that 74% of organizations do not de-anonymize non-form fill web traffic. With only a paltry fraction of web visitors willing to identify themselves, this leaves these organizations at a major disadvantage and at high risk of missing potential deals. Thus, these organizations are strongly encouraged to harness the power of the 97% of anonymous web traffic by supplementing form fills with de-anonymizing signals.

Next, our research also found that almost a quarter of organizations rely solely on signals acquired directly on their own websites. This leaves those organizations vulnerable to a substantial number of missed selling opportunities. Given that Gartner suggests only 17% of prospect research is done on vendor sites, those who choose to look only within themselves miss the 83% of activity happening on third-party sites.

Organizations miss out on selling opportunities when they:

- Fail to use indirect sources of buying signals

- Fail to prioritize them effectively

- Focus too much on individual-person signals of interest, and not enough on group-level interest signals

Prioritizing accounts from which a lone individual is expressing interest at the same level as an account that has multiple individuals expressing interest will likely result in sub-optimal use of selling resources. Our study found that 27% of organizations depend exclusively on individual-person signals only. This represents a disconnect from how B2B buyers research solutions.

In all, our research found that B2B practitioners show an alarming over-reliance on form fills as the sole means of understanding which accounts are expressing interest on their own websites. In this study, that was balanced to some degree with findings that strong majorities of organizations are utilizing buying signals acquired externally. Even here, the researchers would like to see all organizations adopt more inclusive buying signal acquisition practices.

Appendix

Table Title: Signal Descriptions

| Signal Type | Description |

| Ad Clicks | Person clicks on a digital ad |

| Form Fill Leads | Web visitor fills out any web form, including chat sessions, unless specifically listed here |

| Email Clicks / Opens | Email recipient opens and/or clicks in the email |

| Marketing Qualified Leads (scored form fill leads, MQLs) | A form fill lead that has been scored and achieved threshold for passing to sellers |

| Demo Requests / Downloads | A web visitor completes a form to request a demo or to download a demo |

| Live Event Registrations | A web visitor completes a form to register for a live event |

| Social Leads | A prospect expresses interest through social media activity |

| “Contact me” Requests | A web visitor completes a form to request to be contacted |

| Partner Referrals | A partner organization refers a potential buyer |

| Virtual Event Registrations | A web visitor completes a form to register for a virtual event |

| Syndicated Content Leads | Form fill leads received from sites that host relevant gated content |

| Anonymous Traffic, De-anonymized | Web visitors whose account of origin have been determined |

| Third-Party Intent | Signals of buyer research activity acquired through linking keyword usage and digital content consumption across the internet |

| Freemium Downloads | A web visitor completes a form to download a restricted version of a solution |

| Product Review Site leads | Form fill leads acquired from websites that host product reviews |

| Demo Usage | Evidence of product usage from users of a demo version of a product |

| Product Review Site Intent | Aggregated consumption of product review site content, associated to prospect accounts |

| Freemium Use | Evidence of product usage from users of a free, restricted version of a product |

Source: 6sense