Having been privy to the lead management processes of hundreds of B2B organizations of every stripe, I would estimate that at least half have internal demand funnel (AKA waterfall) stages that combine stages of their sales process with what are really stages of the buyer journey.

The difference between those two seemingly similar constructs is vital. They are not only different, but often badly misaligned, and that misalignment is one of the most common causes of inconsistent revenue team performance.

Every B2B organization should work diligently to align their funnel to the buyer’s journey. This article will explain what each is, how they are different, why they are typically not closely aligned, and what is required to do so.

Your Funnel Is Not Their Journey

A B2B buyer’s journey is not about an individual person, but nearly always about a team of people who are working together to address a business need. Buyer journeys, therefore, are labels applied to the internal state of buying teams as they progress toward a purchase.

Typical buyer journey stages include awareness (of the business need and potential to address it), consideration (of potential solutions and solution providers), decision (selection of a provider or providers that can solve the business need) and purchase (where the deal is negotiated and consummated).

What is critical to understand about buyer journeys is that they exist independent of seller funnels. A buying organization might easily go from awareness right up to the moment of purchase without having entered into any selling organization’s funnel.

In contrast, a funnel describes a provider organization’s progress in recognizing, engaging, and converting potential buying teams. There are numerous models depicting funnels, but the best-known model is the one my colleagues and I built at SiriusDecisions, the Demand Unit Waterfall, which includes stages ranging from Target (containing good-fit prospective buyers) and Detected (where a buyer’s journey has been detected through behavioral data) down to Pipeline and Closed won (link out). Think of the funnel as describing relationship status (we are dating), whereas the journey is the internal state of the buyer (I am smitten).

Buyer Journeys and Funnels Are Misaligned

In an ideal world, B2B organizations would discover the buyer journeys their prospects are embarking on as, or even before, they occur. Doing so would allow organizations to understand and shape buyer needs and establish their brands as desirable partners.

Early detection also allows sellers to execute consistent buyer enablement and selling practices, which lead to more predictable revenue outcomes.

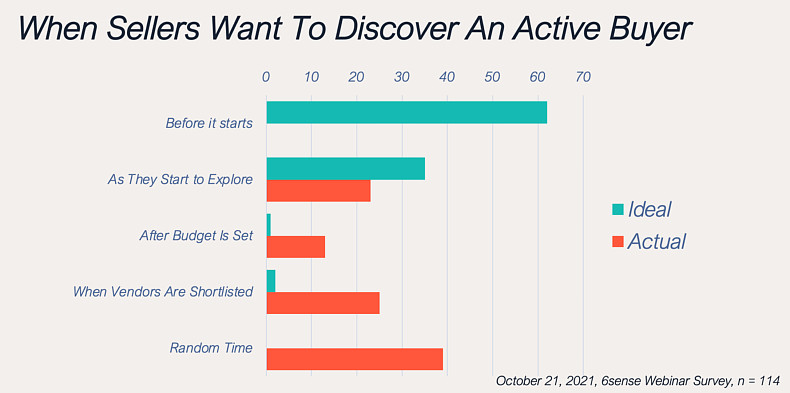

When sellers encounter buyers at random times, however, funnels are compressed into whatever time remains in that buyer’s journey. Unfortunately, as a poll I conducted during a recent webinar demonstrates (see the following chart), most B2B organizations discover buyer journeys at random points in those journeys—often when buyers have already shortlisted providers.

Although 97% of our respondents reported wanting to know about buyer journey as or before they start, none reported anticipating when buyer journeys would begin, and only 23% reported consistently discovering them as they were starting.

The Dark Funnel: Where Journeys Begin and Funnels Align

The key to aligning funnels with buyer journeys is to employ modern data science to illuminate what we at 6sense call the Dark Funnel.

Consider that unless you are the only provider of the solutions you offer and your digital properties are the only places where your category of solution is discussed, it is likely that some or even most of your potential buyers will begin their buyer journeys on influencer sites, product review sites, competitors’ sites, social media, or the myriad of other places buyers can go in the digital realm. Taken together, all those places buyers are searching for information make up the Dark Funnel.

If you are a relatively small brand, lighting up the Dark Funnel is especially important, but even the largest brands may not see potential buyers until those buyers have progressed deep into their journeys. By accessing evidence of that research activity—commonly referred to as intent data— from the Dark Funnel, sellers can begin to see virtually all relevant buyer journeys as they are beginning (see previous content contributed by 6sense on intent signals here and here).

Although most of the Dark Funnel is found on external resources, an important part of the Dark Funnel can be found much closer to home. We know that between 90-98% of traffic on B2B websites is anonymous. Unless you are identifying the source of that anonymous traffic, there’s a strong possibility that some of the buyer journeys that you would love to know about are happening right under your nose.

What’s more, your organization’s marketing activities are responsible for bringing those anonymous visitors to your site. You have already paid to engage those buyer journeys, but you must illuminate that part of the Dark Funnel to capitalize on your investment.

Rather than looking at anonymous data as a failure to convert visitors, you can work with a provider to de-anonymize that traffic and illuminate the part of the Dark Funnel that is closest to home.

Anticipating Journeys With Dark Funnel Signals

In the poll discussed above, 65% of respondents said they would prefer to know about buying processes even before they start. Though that may seem impossible, anticipating buyer journeys simply means anticipating or predicting buyer needs. Fortunately, in addition to the familiar behavioral signals just discussed, there are signals in the Dark Funnel to help you do just that.

For example, detailed technographic data can identify companies that have aging equipment and technologies that will need to be replaced. Financial performance data can identify companies that are growing and need to expand their infrastructure. Regulatory and firmographic data can identify companies that will require solutions to address pending business requirements.

Many more such signals are available to help sellers anticipate buyer needs. By acquiring and acting on those types of Dark Funnel signals, organizations can begin shaping the needs and preferences of potential buyers just as they become aware of the need to make a purchase.

In the poll discussed above, 39% of respondents said they met active buyers at random points along a buyer’s journey. When organizations discover buyer journeys only when a member of the buying team becomes a lead, or when a prospector happens to reach out to a buying team member, the results can’t be anything other than random.

Finding out about journeys at random times means that your sales cycles and funnel will be unpredictable. By tapping into the Dark Funnel, organizations can see and align their marketing and selling processes to the beginning of the buyer’s journey. By doing so, you’ll have a better chance of winning more deals, and you can bring consistency and predictability to the revenue generation process.